Methods of Computing SE Tax

There are three methods a taxpayer may use to figure net SE earnings and SE tax: (a) the regular method; (b) the farm optional method; (c) the nonfarm optional method. All methods use Schedule SE for the computation. A taxpayer must have $433.13 or more of net SE earnings (before reduction by the 7.65% deduction) to be subject to the tax (.9235 x $433.13 = $400). No Schedule SE is required if net SE income is below the $433.13 amount (unless (b) or (c) above applies).

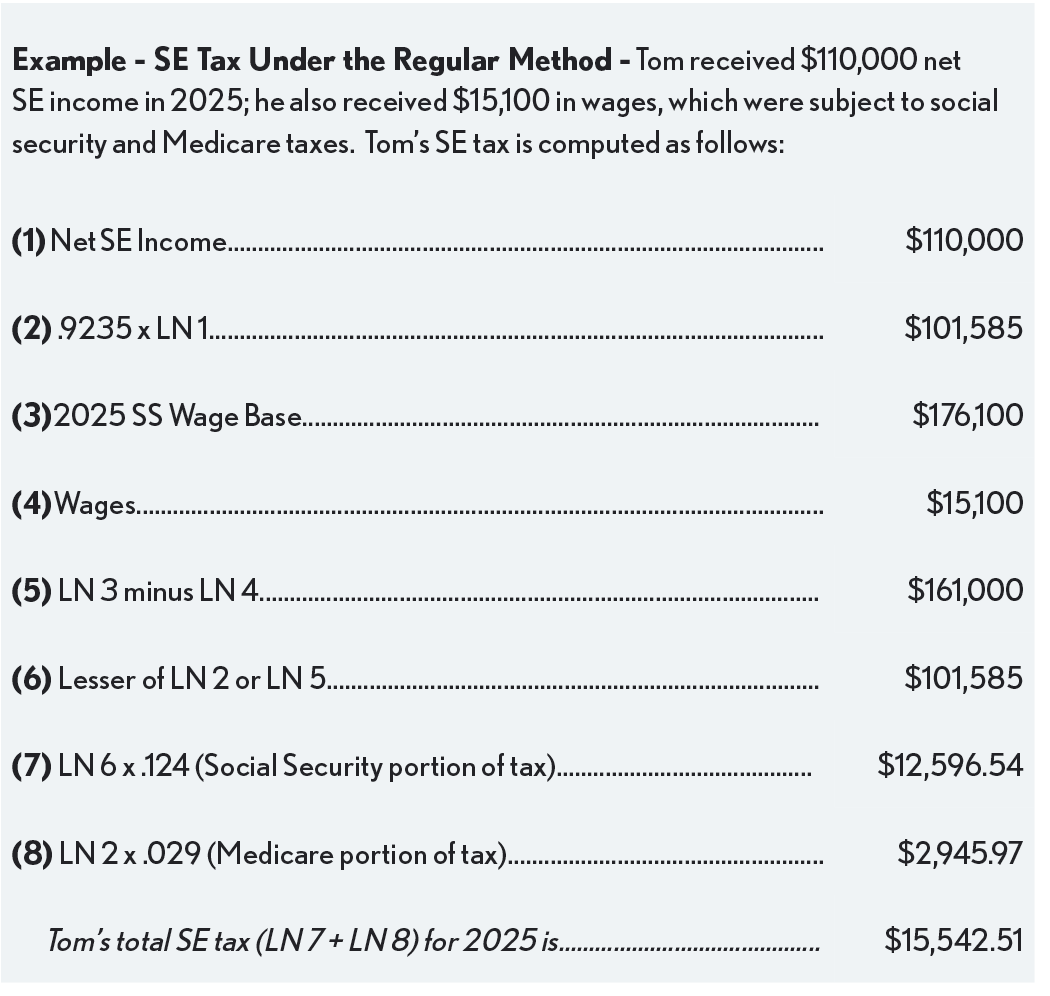

The Regular Method

For 2020 and subsequent years, the choice of using a short method instead of the long method was eliminated. Thus, Sch. SE, Part I is used by all individuals computing their SE tax under the regular method. This includes:

-

Individuals whose total wages and tips subject to social security tax plus net SE earnings are more than "maximum subject to tax for the year”.

-

Ministers, members of religious orders, and Christian Science practitioners, who, by IRS consent, pay no SE tax on earnings from these sources but who owe SE tax on earnings from other sources.

-

Employees receiving wages reported on Form W-2 of $108.28 (.9235 x $108.28 = $100) or more while working for a church electing out of social security taxes.

-

Taxpayers with tip income subject to social security and Medicare tax that wasn’t reported to their employers (the social security tax on this is computed on Form 4137).

Those who use one of the optional methods to figure SE tax use Part II, on page 2 of the form (page 1 for years 2021 and 2022).

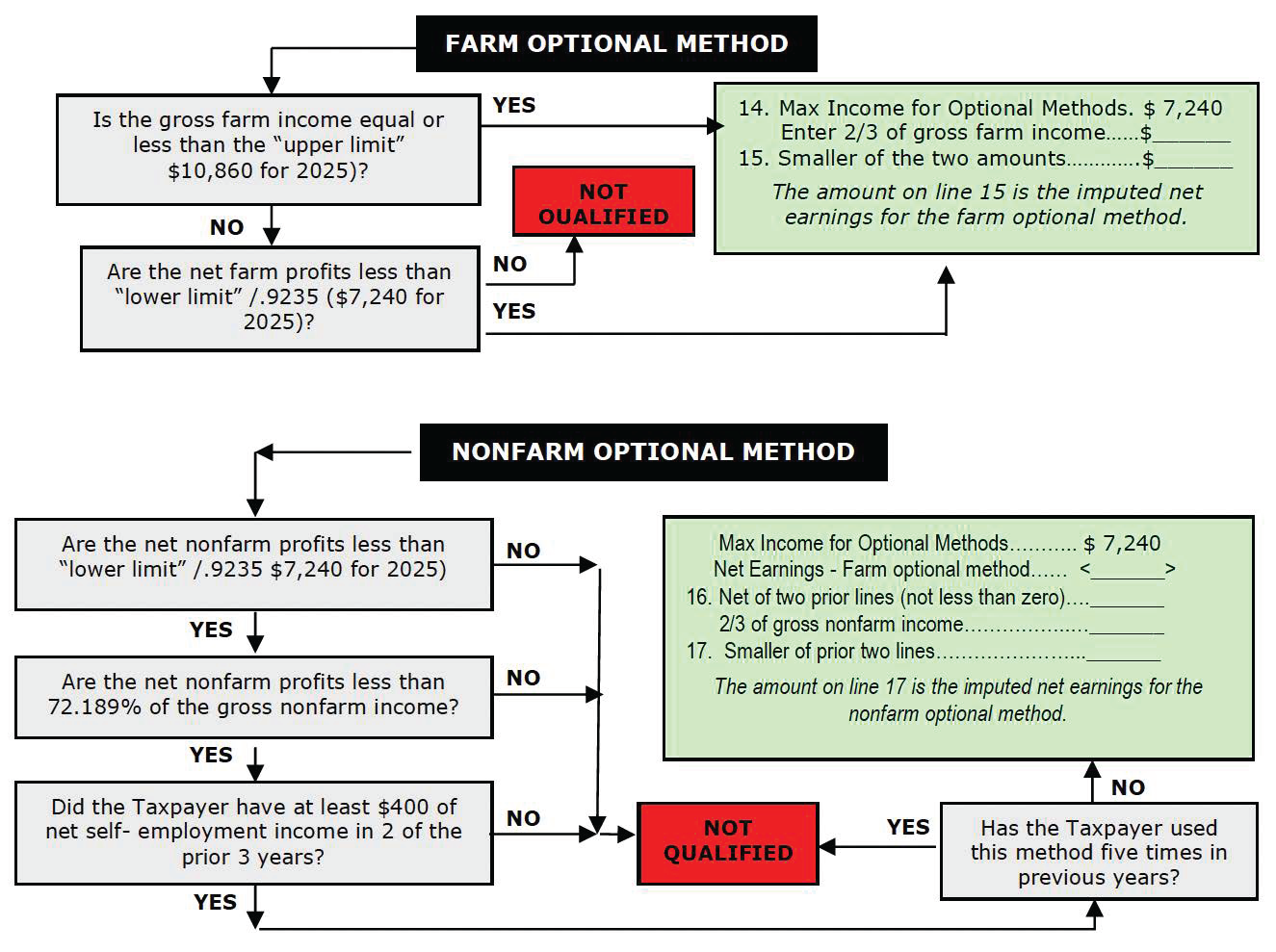

Farm and Non-Farm Optional Methods

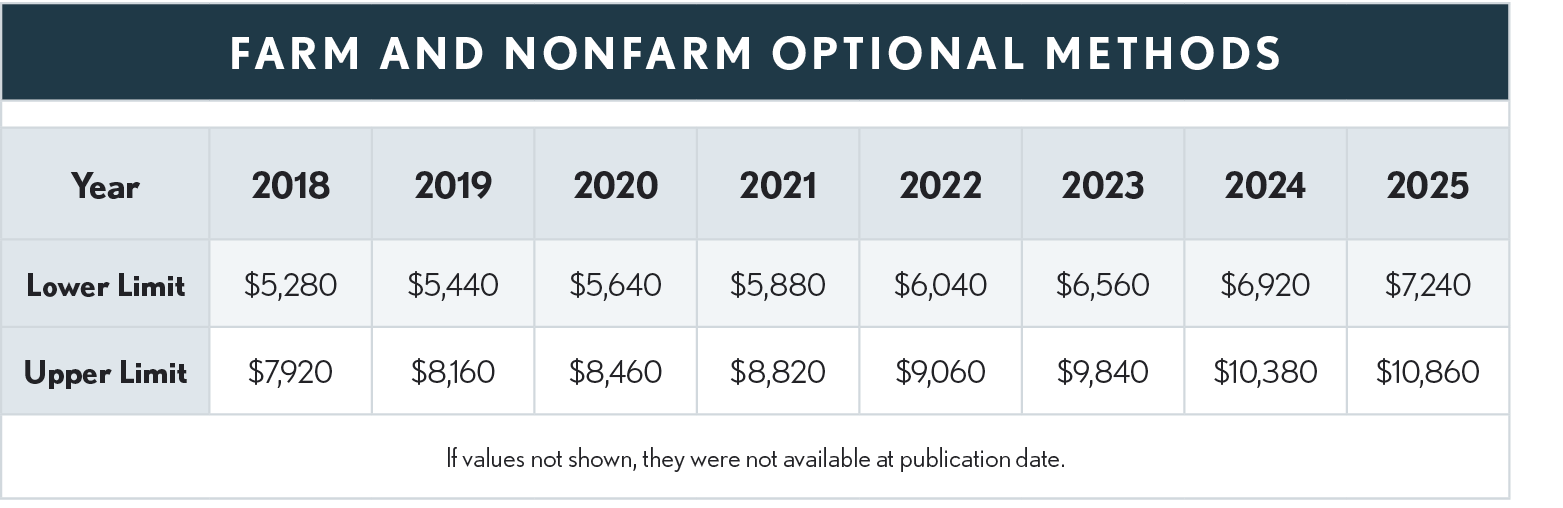

Use of these methods allows a taxpayer to continue SE tax coverage even in years when profits are small (or even when there is a loss). A taxpayer who uses one of the optional methods for figuring SE tax also uses the resulting imputed income when calculating the credit for child and dependent care expenses and the earned income tax credit. The “lower limit” and the “upper limit” for the optional methods are shown below:

Note: The lower limit is determined by multiplying the minimum earnings for a quarter’s Social Security coverage by four. Thus, for example, for 2025 the lower limit is $7,240 ($1,810 x 4). The upper limit is determined by multiplying the lower limit by 1.5 resulting in an upper limit for 2025 of $10,860 ($7,240 x 1.5).

The following flow charts detail the qualifications for each method and the computations for both.The two optional methods can be applied in unison.