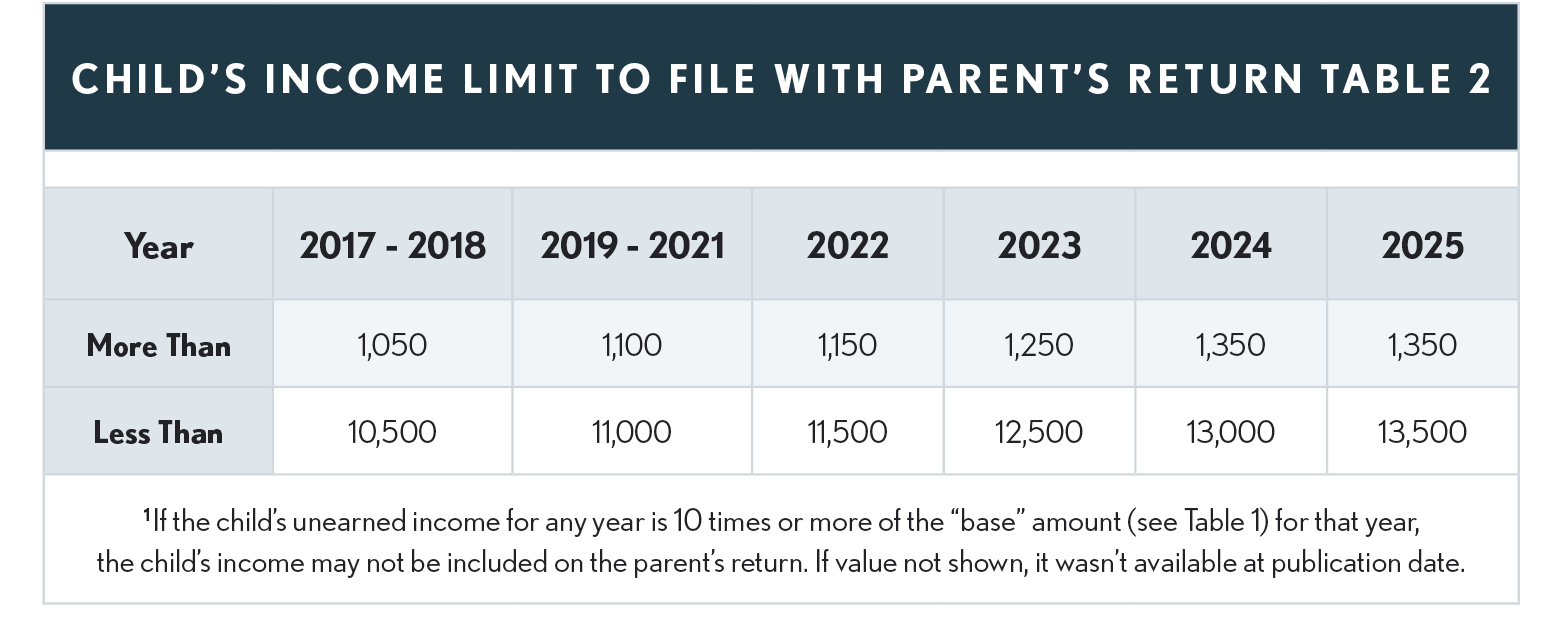

Parent's Election to Report Child's Interest and Dividends

Parents may elect to include their child's interest and dividend income (including capital gain distributions) on their own tax return instead of the child filing a return of his/her own. If the child has other types of income, either earned or unearned, this election cannot be made. This provision was unchanged by the TCJA.

Caution

This is an irrevocable election (Reg Sec. 301.9100-8(a)(4)(i)) and the child is treated as having no gross income and the child’s income becomes the parent’s income.