Basic Standard Deduction (Child/Dependent)

-

The basic standard deduction for a child, or any individual, who is or could be claimed as a dependent by another taxpayer, is limited to the greater of the following two amounts but not to exceed the regular standard deduction for the year ($14,600 for 2024; $15,000 for 2025).

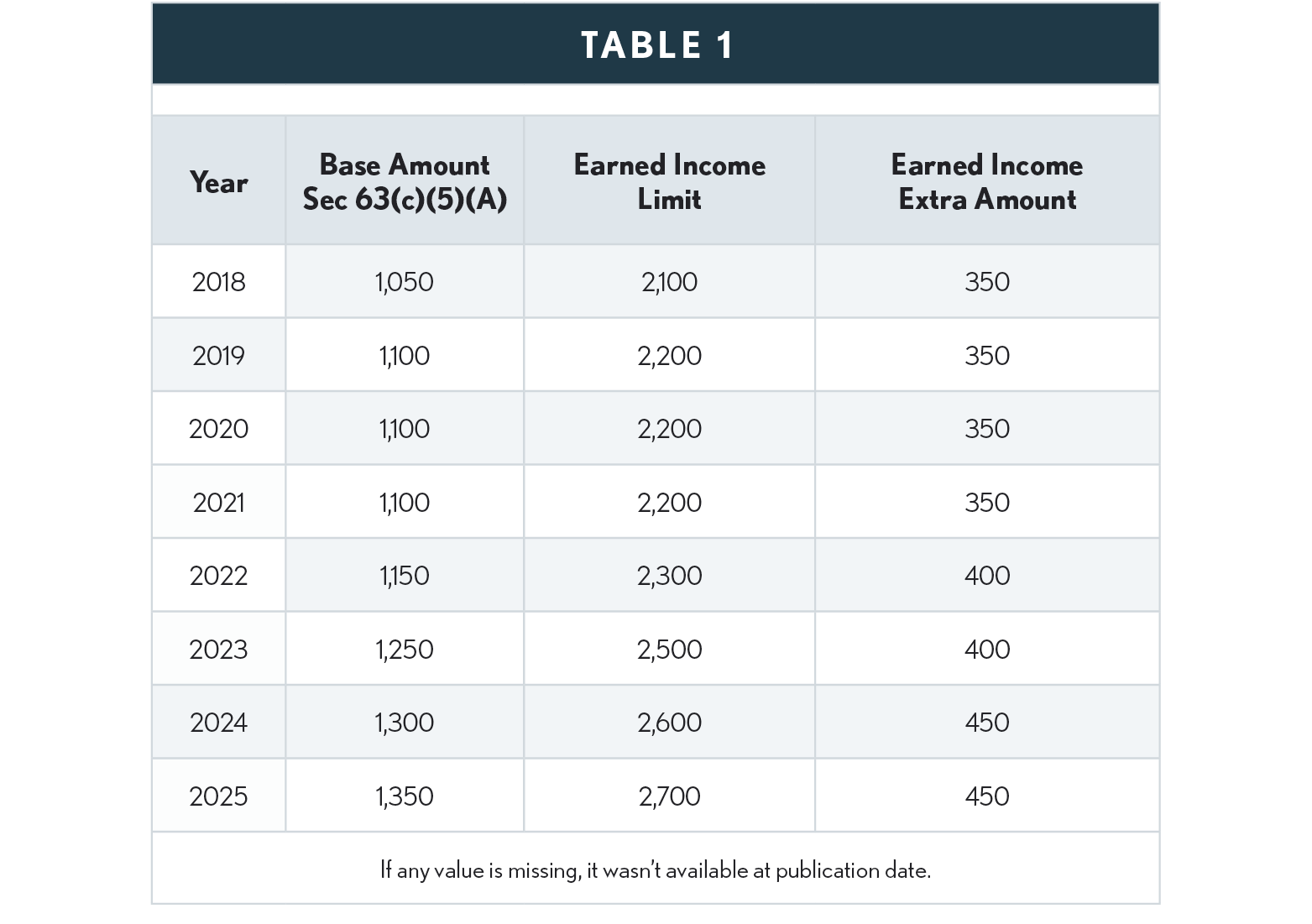

o The “base amount” which is $1,350 for 2025 (up from $1,300 for 2024), or

o The dependent’s earned income plus the “extra” amount of $450 for 2025 (same as 2024).

-

If neither parent is alive on the last day of the year, the child’s tax is at his/her own rate.

-

If the child is married and files joint, child is taxed at his/her own rate.,

Note: Both the “base” and “extra” amounts are inflation-adjusted – see table below. Ignore the “earned income limit” column in the table for this calculation.