California Differences - AMT

With all the changes brought about by TCJA and the increases in the federal AMT exemption amounts, combined with substantially higher income levels at which the exemption phases out, it is more likely taxpayers will incur a state AMT before incurring it on their federal return, which is the opposite of the situation before 2018. California’s AMT calculation, done on Schedule P (540), is similar to the federal computation, with generally the same categories of adjustments and preferences, but often using different amounts that result from the frequent lack of conformity between federal and California law. Refer to the instructions to Schedule P for details about these differences. The California AMT Tax rate for individuals has been 7% since 2011.

AMTI Exclusion

The most significant difference between the federal and California AMT calculation—and a reason fewer taxpayer have been subject to California AMT—is that for California purposes a “qualified taxpayer” must exclude income, positive or negative adjustments, and preference items attributable to any trade or business when figuring AMTI.

Qualified Taxpayer

A “qualified taxpayer” is an owner of a trade or business with aggregate gross receipts, less returns and allowances, for the year of less than $1 million from all of the taxpayer’s trades or businesses. If the taxpayer’s ownership interest for any business is less than 100%, such as a partnership, then only the taxpayer’s proportionate share of gross receipts for that business are included for the $1 million test. The threshold is not based on filing status, so it does not become $2 million for married taxpayers filing jointly.

If a qualified taxpayer’s net trade or business income is a loss, the amount of the exclusion is zero.

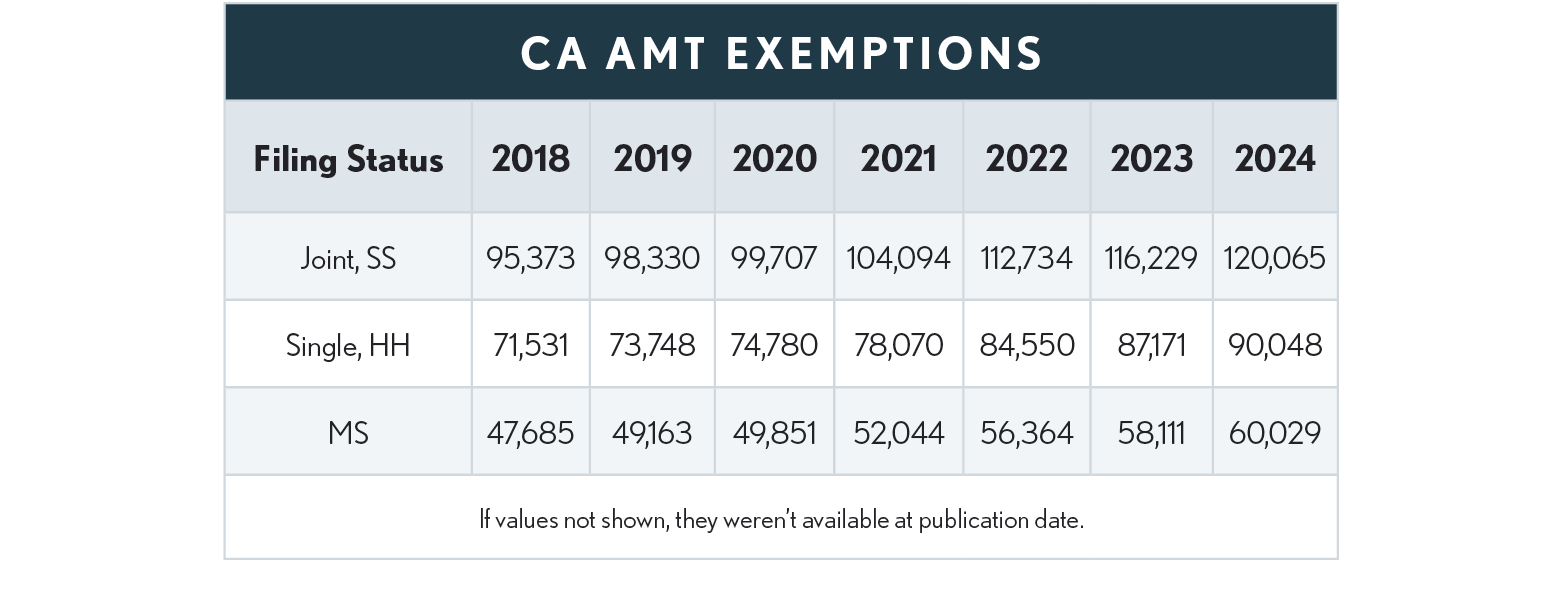

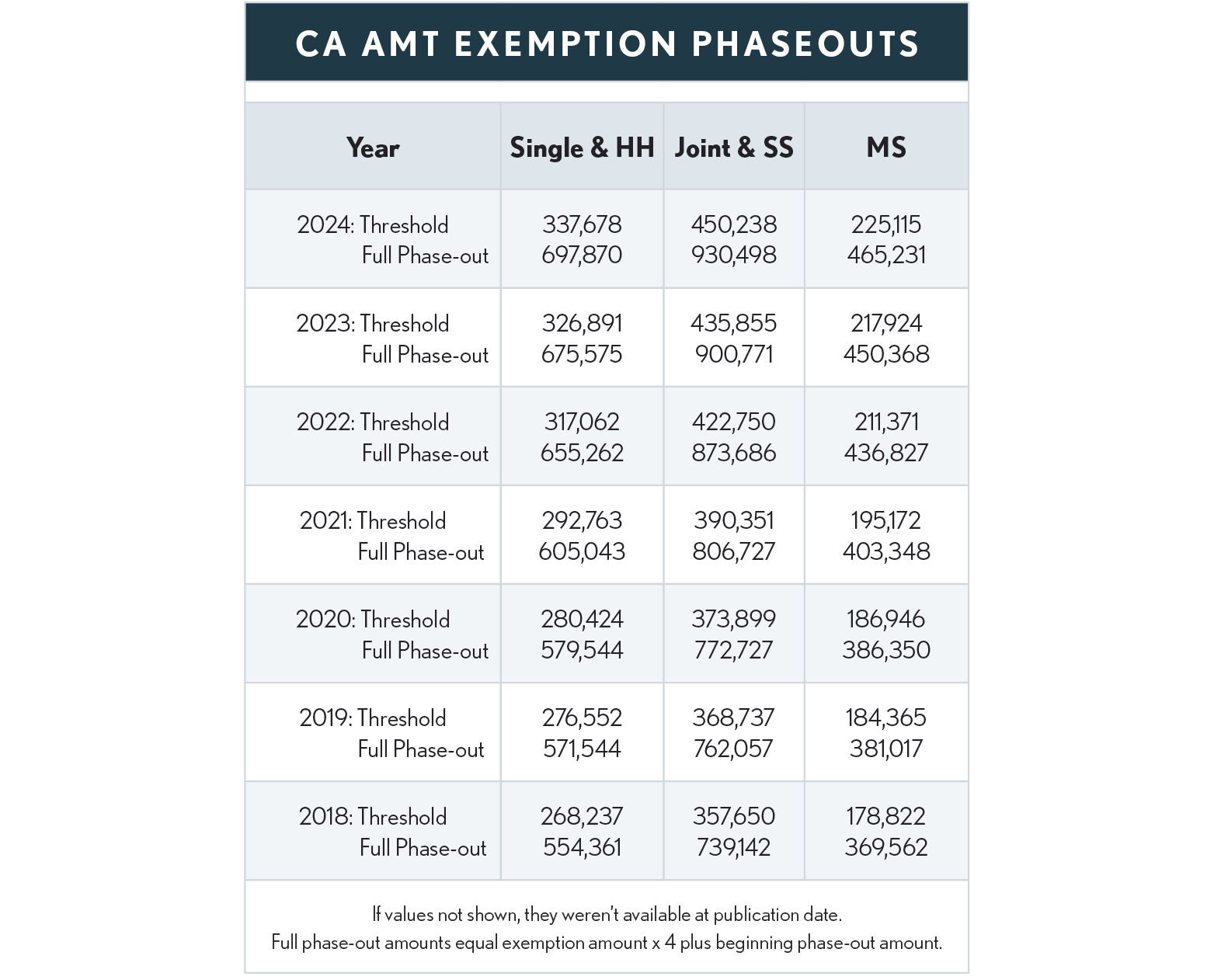

AMT Exemptions and Phaseout

The California AMT exemption and the AMTI at which the exemption begins to phase out is adjusted annually for inflation. The adjacent tables show the exemption amounts and the phaseout start and end points for the current and prior several years.