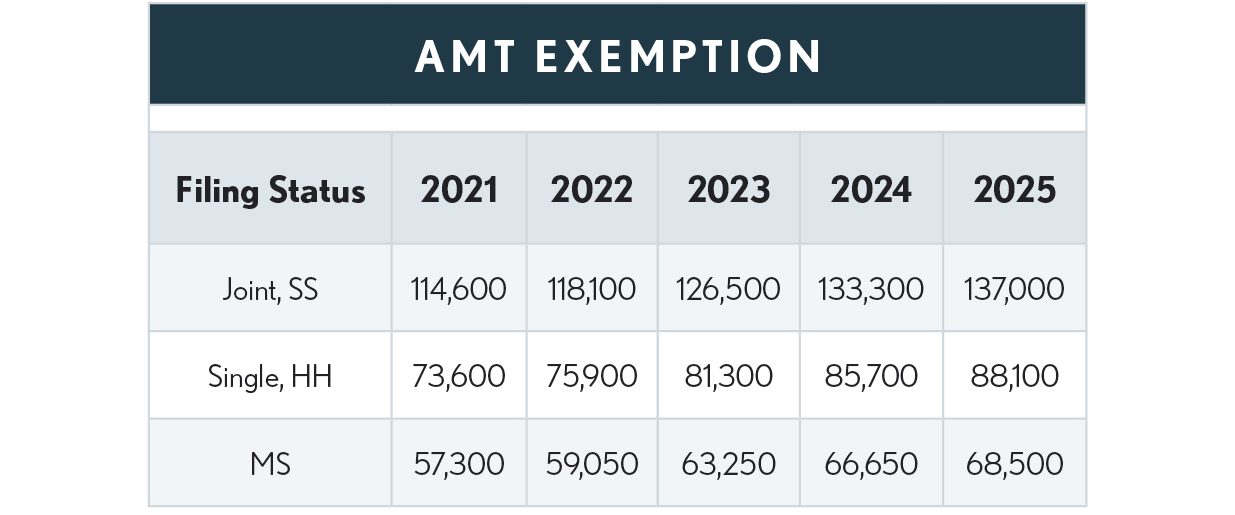

AMT Exemption and Phase Out

AMT Exemptions

For regular tax before 2018 and after 2025, a personal exemption deduction is allowed for the taxpayer, spouse and each claimed dependent. For the AMT, taxpayers are allowed a single exemption (see table) based upon the taxpayer’s filing status. In both cases, the exemptions are phased-out for higher-income taxpayers. However, for tax years 2018 through 2025, the regular tax exemption deduction is $0 and thus for regular tax purposes there is no phase-out of the exemption allowance.

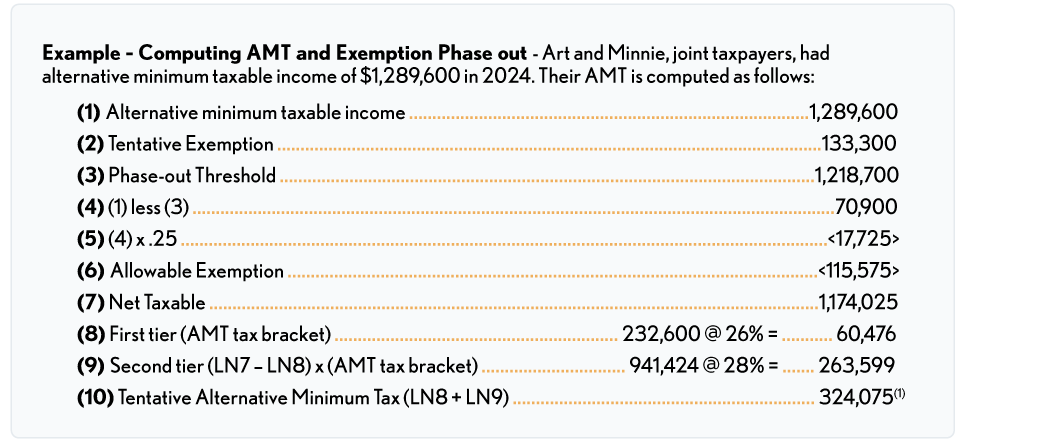

AMT Exemption Phase Out

(1) Rather than computing the Regular tax and the Alternative Tax and using the larger of the two, the Form 6251 instead computes a tentative AMT and then treats any amount by which the tentative AMT exceeds the regular tax as the AMT (an add-on tax to the regular tax). Although this method calls attention to the additional tax created by the AMT, it tends to add to taxpayer confusion in understanding how the AMT is derived.

Non-Refundable Personal Credits

Effective for tax years beginning after 2011, the American Taxpayer Relief Act permanently allows an individual to offset his entire regular tax liability and AMT liability by the non-refundable personal credits.