Self-Certifying a Late 60-Day Rollover

A recipient of a retirement plan or IRA distribution who inadvertently misses the 60-day time limit for properly rolling the amount into another retirement plan or IRA may make a written certification to a plan administrator or an IRA trustee that a contribution satisfies the conditions listed below, and therefore, will be eligible for a waiver of the 60-day rule.

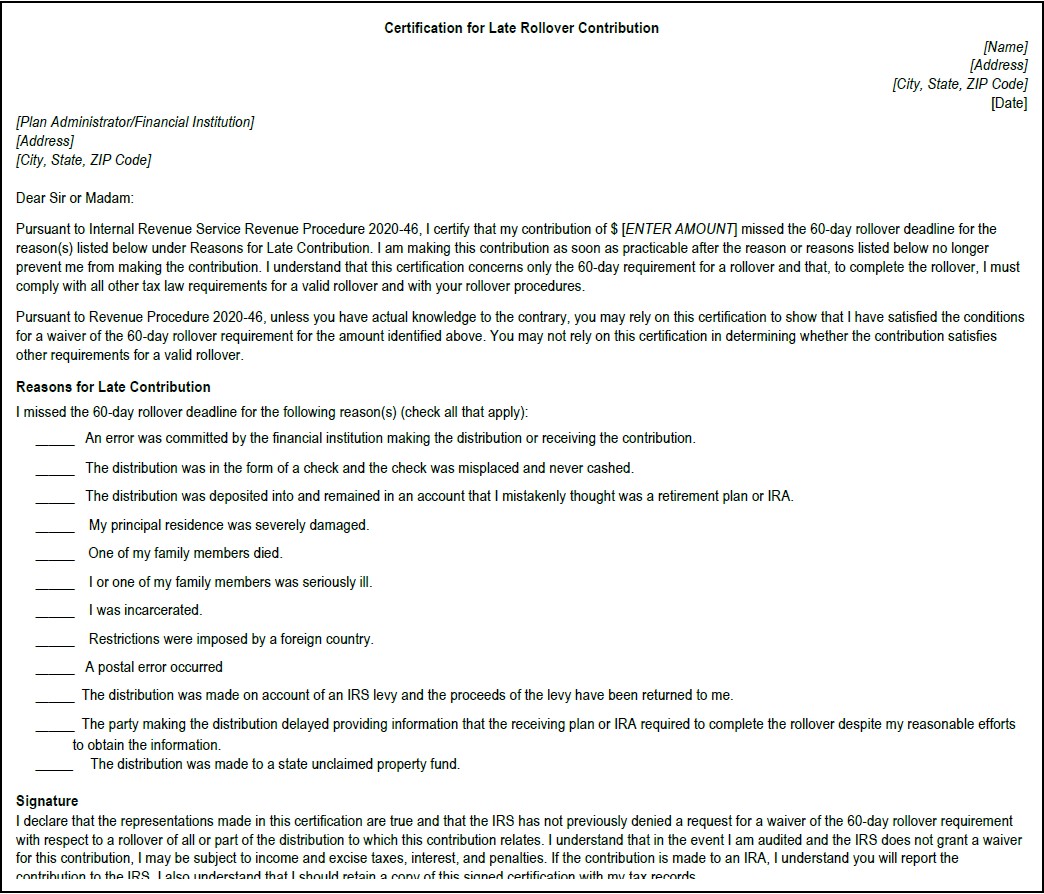

Taxpayers may make the certification (subject to verification on audit) by using the model IRS letter (illustrated below) on a word-for-word basis or by using a letter that is substantially similar in all material respects. A copy of the certification should be kept in the taxpayer’s files and be available if requested on audit. (Rev. Proc. 2020-46, modifying and superseding Rev Proc 2016-47) Use of the self-certification method by eligible taxpayers will generally eliminate the need for an expensive private letter ruling to request a waiver.

Conditions For Self-Certification - No Prior Denial by the IRS

The IRS must not have previously denied a waiver request with respect to a rollover of all or part of the distribution to which the contribution relates.

Reason For Missing 60-Day Deadline

The taxpayer must have missed the 60-day deadline because of the taxpayer’s inability to complete a rollover due to one or more of the following reasons:

-

an error was committed by the financial institution receiving the contribution or making the distribution to which the contribution relates;

-

the distribution, having been made in the form of a check, was misplaced, and never cashed;

-

the distribution was deposited into and remained in an account that the taxpayer mistakenly thought was an eligible retirement plan;

-

the taxpayer’s principal residence was severely damaged;

-

a member of the taxpayer’s family died;

-

the taxpayer or a member of the taxpayer’s family was seriously ill;

-

the taxpayer was incarcerated;

-

restrictions were imposed by a foreign country;

-

a postal error occurred;

-

the distribution was made on account of a levy under § 6331 and the proceeds of the levy have been returned to the taxpayer;

-

the party making the distribution to which the rollover relates delayed providing information that the receiving plan or IRA required to complete the rollover despite the taxpayer’s reasonable efforts to obtain the information; or

-

a distribution was made to a state unclaimed property fund (added by Rev Proc 2020-46).

Up to 30 Days Allowed to Make the Contribution

The contribution must be made to the plan or IRA as soon as practicable after the reason or reasons listed above no longer prevent the taxpayer from making the contribution. This requirement is deemed to be satisfied if the contribution is made within 30 days after the reason or reasons no longer prevent the taxpayer from making the contribution.