Portability of Unused Estate Tax Exclusion

The executor of a deceased spouse’s estate may transfer any unused exclusion to the surviving spouse for estates of decedents dying after December 31, 2010. A Form 706 (Estate Tax Return) must be timely filed to obtain the portability. (Code Sec. 2010(c)(2))

Example - Husband dies in 2014, having made taxable transfers of $3 million and having no taxable estate. His unused exclusion amount in 2014 was $2.34 Million (2014 exclusion amount of $5.34 million - $3 million). An election was made on his estate tax return to permit Wife to use his deceased spousal unused exclusion amount. Wife made no taxable gifts in his year of death or later years and has had no other husbands. Wife's applicable exclusion amount for 2022 is $14.4 million (her $12.06million basic exclusion amount plus the $2.34 million deceased spousal unused exclusion amount from Husband), which she may use for lifetime gifts or for transfers at death. (Committee Report)

-

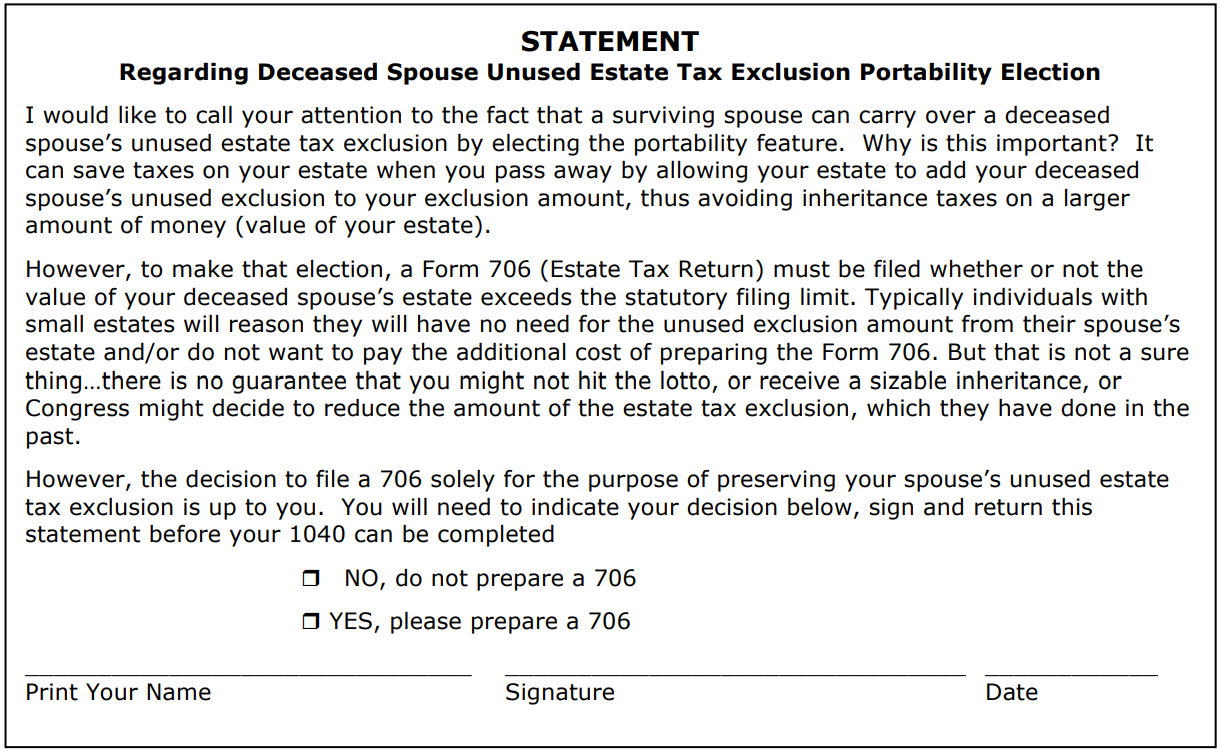

Typically, individuals with small estates will reason they will have no need for the unused amount from their spouse’s estate and/or do not want to pay the additional cost of preparing a Form 706. But that is not a sure thing…there is no guarantee that they might not hit the lotto, receive a sizable inheritance, or Congress might decide to reduce the estate tax exclusion. You as a practitioner must bring this issue to the attention of the executor and surviving spouse, and if they refuse to file a Form 706, have them sign a statement to that effect. Don’t put yourself in jeopardy with the beneficiaries for the tax on the unused exclusion.

Caution

President Biden’s Build Back Better Act included a proposed reduction in the estate tax exclusion, so it is on Congress’ radar, and the issue could be revived.