Trade or Business Aggregation – Sec 199A Deduction

Aggregating (grouping) trades or businesses offers taxpayers a means of combining their trades or businesses for purposes of applying the W-2 wage and UBIA of qualified property limitations and potentially maximizing the deduction under Section 199A. If such aggregation were not permitted, taxpayers could be forced to incur costs to restructure their business activities solely for tax purposes. In addition, business and non-tax law requirements may not permit many taxpayers to restructure their operations. The IRS feels Sec 469 passive activity grouping is inappropriate relative to the 199A deduction, and therefore provides a separate form of grouping for 199A purposes, that permits the aggregation of separate trades or businesses, provided certain requirements are satisfied.

These grouping rules can become quite complicated because they may be made at the business entity level as well as the individual level. For purposes of this material, although we do include the rules applicable to entity aggregation, we will generally limit the discussion to aggregations at the individual level.

Who Should Consider Aggregation?

Taxpayers whose taxable income exceeds the 199A deduction phaseout thresholds and who must rely on the wage limitation in order to qualify their QTB (not SSTB) for a deduction. Taxpayers with taxable income below the phaseout threshold amount do not benefit from aggregation. Aggregation is optional.

Before getting into an illustration, remember the 199A deduction figured at entity level is the lesser of:

-

20% of QBI (net of the Form 1040 adjustments for 50% of SE tax, retirement plan contributions and SE health insurance premiums), or

-

The wage limitation.

The wage limitation is the greater of:

-

50% of the W-2 wages paid by the business or

-

25% of the W-2 wages paid by the business plus 2.5% of the unadjusted basis of the business’s qualified property (abbreviated UBIA).

Illustrations

The illustrations below assume the taxpayer’s taxable income is such that the wage limitation will apply in all cases. It also assumes that none of the businesses are SSTBs, which cannot be included in an aggregation. The 199A deduction determined in the illustrations is the amount determined before the final limitation that caps the combined 199A deductions from all sources to 20% of the taxpayer’s taxable income before the 199A deduction and net of any capital gains.

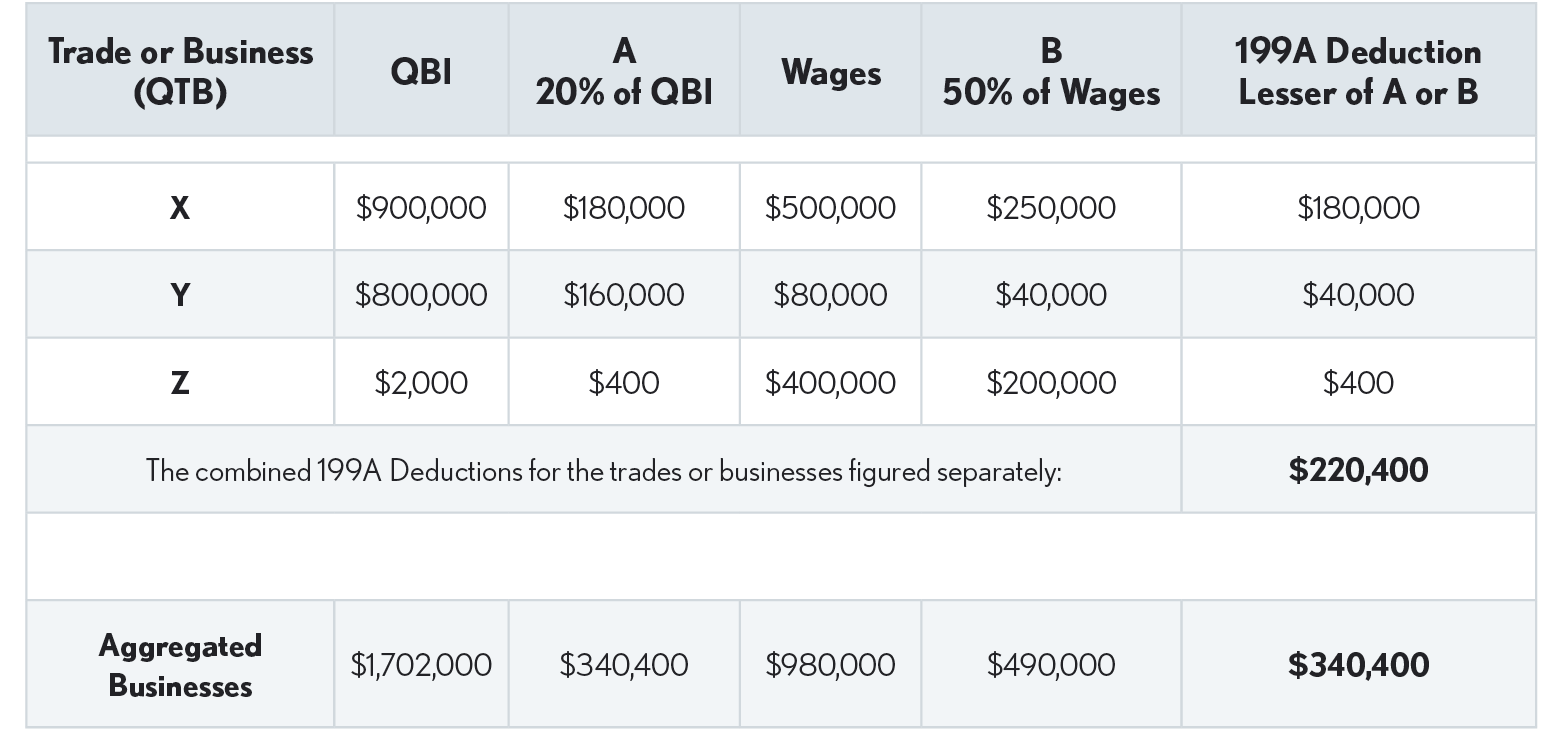

Illustration #1 - To simplify the comparison, this illustration assumes the QTBs only have wages and no UBIA. The outcome is that aggregating these three QTBs results in a substantial increase in the 199A deduction.

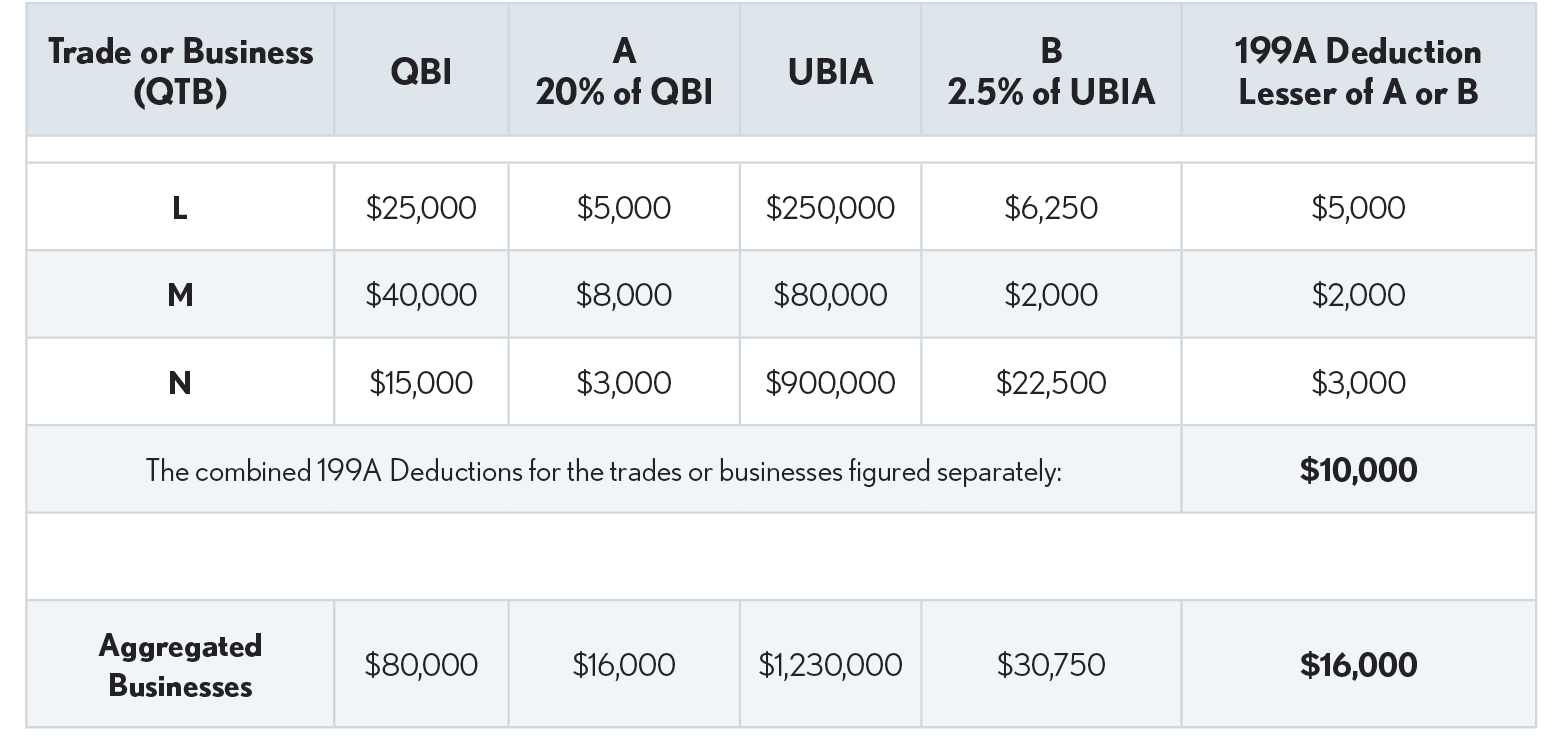

Illustration #2 - This illustration assumes the QTBs only have UBIA and no wages. The results show that aggregating these three QTBs provides the taxpayer a substantial increase in the 199A deduction.

QBI Losses

When making the aggregation analysis remember that losses from any QTB or SSTB entity proportionally reduce the QBI of the taxpayer’s other entities. So, an aggregation excluding an entity with a loss does not overcome the reduction of QBI for the profitable entities.