Disallowances of Business Interest

This is awareness only since it applies to very high-income individuals only.

Regardless of business form, the interest expense is limited to the sum of:

-

The taxpayer's business interest income for the tax year;

-

30% of the taxpayer's adjusted taxable income (ATI) for the tax year; plus

-

The taxpayer's floor plan financing interest (certain interest paid by vehicle dealers) for the tax year.

Small Business Exemption

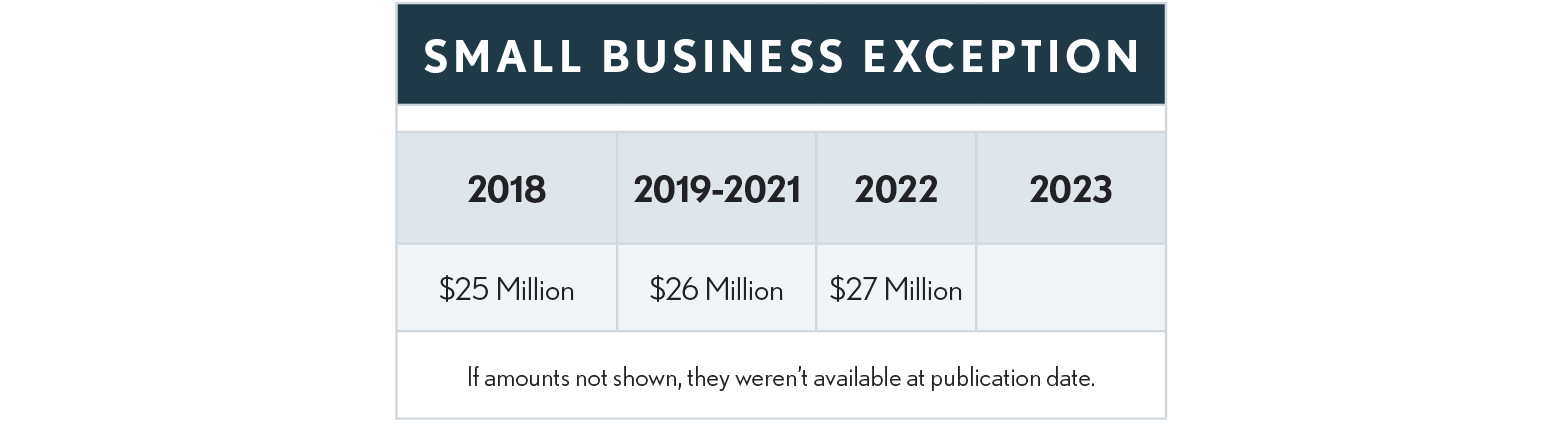

An exemption from the business interest limitation rules applies to taxpayers (other than tax shelters) with average gross receipts for the three prior years of $25 million or less. This amount is inflation-adjusted for years after 2018 (see table below).

Rental Real Estate Activities

A rental real estate activity is not subject to the limitation on business interest unless the rental real estate activity is a trade or business. Watch out Real Estate Professionals!

Real Property Trades or Businesses Election

A real property trade or business can elect out of the interest limitation by using the alternative depreciation system (ADS).