Tip Income and Taxes

This guide has been updated for OBBBA

People in a number of professions, including wait staff, bartenders, and hairdressers, receive tip income over the course of any given tax year. The IRS has specific rules for when tips need to be reported on federal income tax returns.

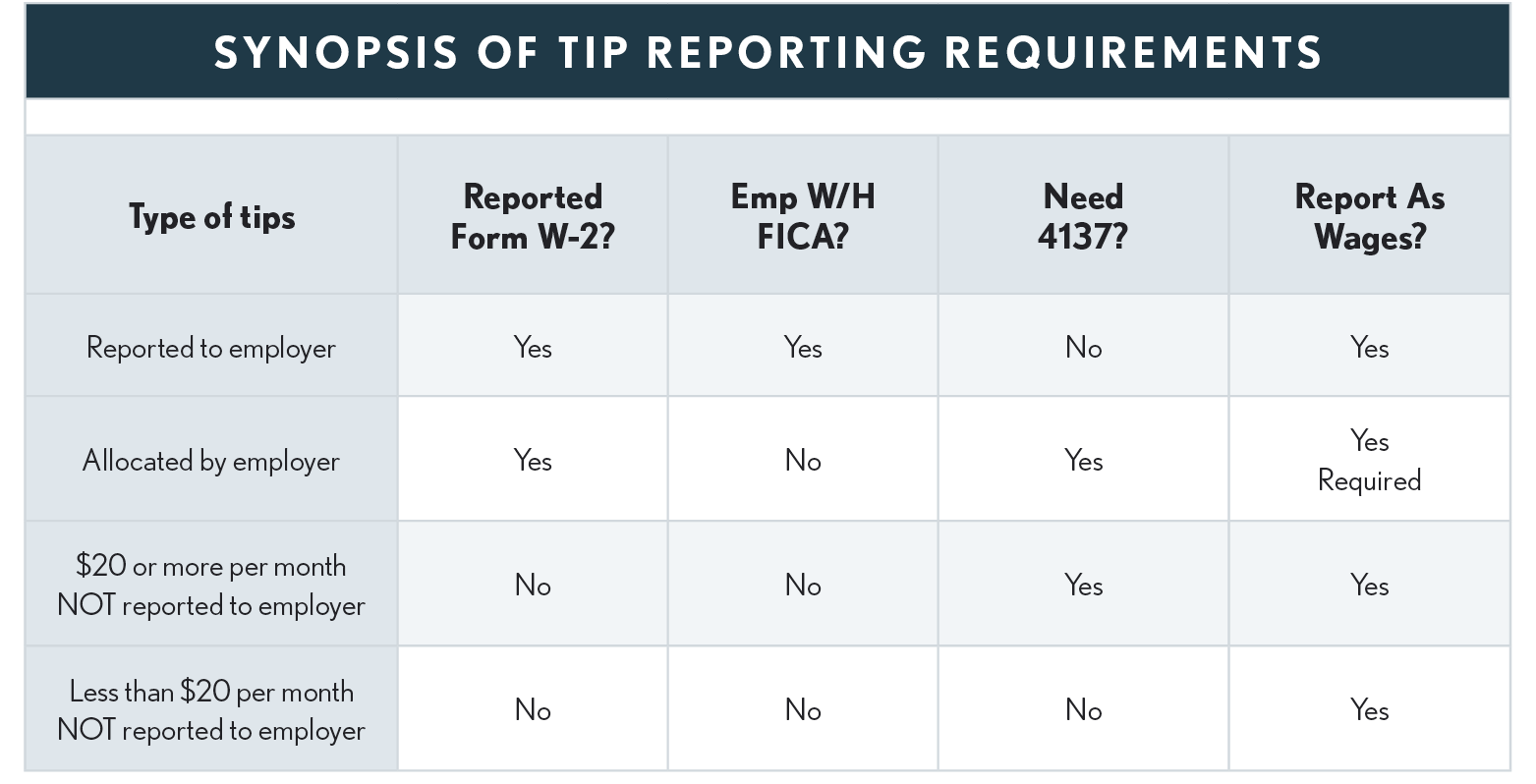

Above, you'll find a helpful synopsis of tip reporting requirements. Below, you'll find information about IRS forms that you may need to submit if you receive tips as part of your job.

Related IRS Publications and Forms

• Form 3800 – General Business Credit

• Form 4070A - Employee’s Daily Record of Tips (in Pub 1244)

• Form 4070 – Employee’s Report of Tips to Employer (Pub 1244)

• Form 4137 – SS and Medicare Tax on Tips

• Form 8027 – Annual Informational Return

• Form 8846 – Credit for Employer SS & Medicare Taxes Paid

• Pub 1244 – Employee’s Daily Record of Tips

• Pub 5080 - Form 4137 Compliance Program FAQs

California Differences

California conforms to federal tip rules but does not have a credit like the Sec 45B credit for employers and as of publication date has not conformed to the OBBBA tip income exclusion.