Unemployment Taxation

When a worker receives unemployment benefits from the federal government, he or she is subject to taxation. Below, you'll find important details about taxes on unemployment income.

For the last 40+ years unemployment benefits have been federally taxable to some extent, most recently being fully taxable for federal purposes – except for tax year 2020.

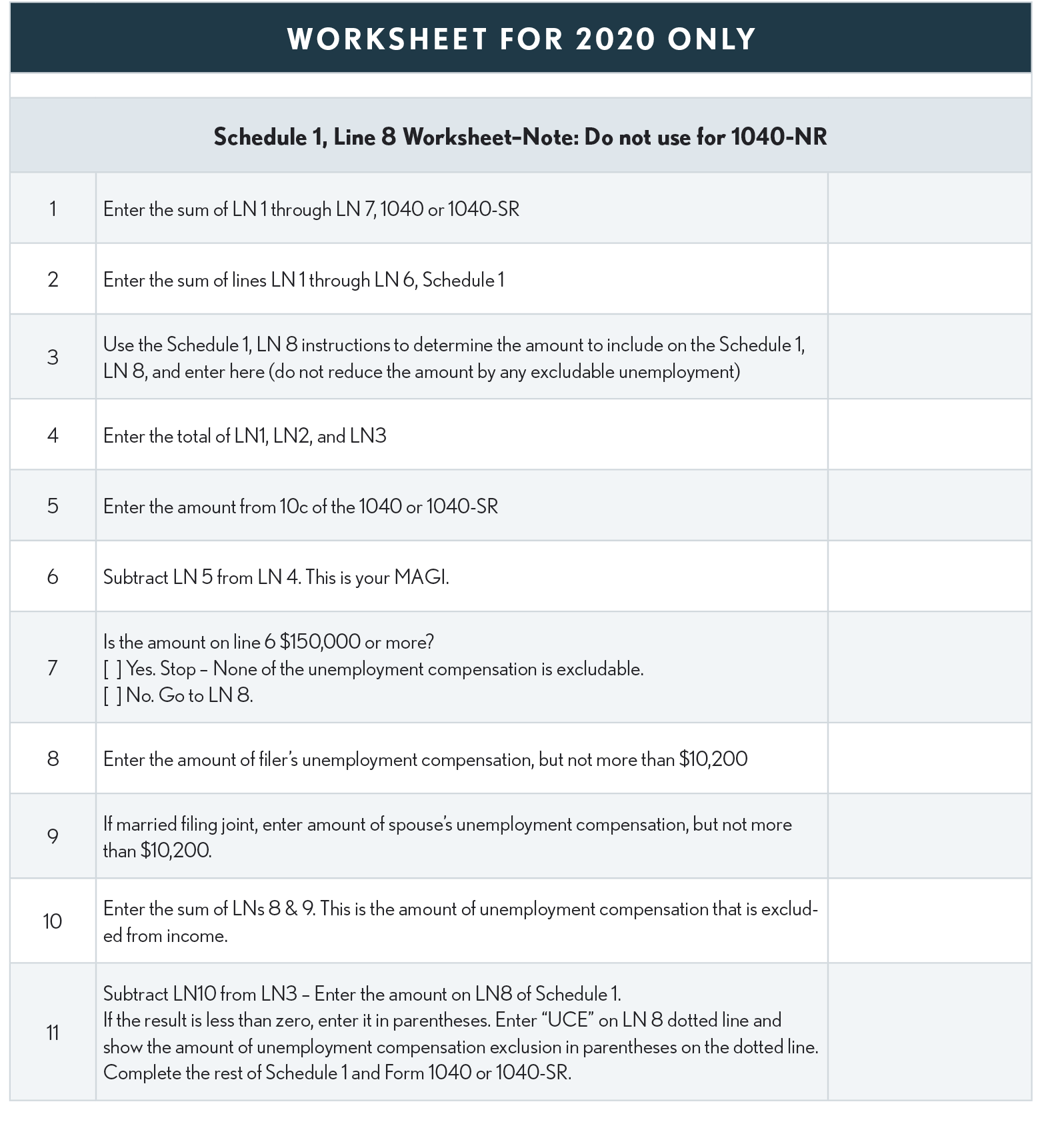

The American Rescue Plan Act (ARPA) included a provision allowing up to $10,200 of unemployment compensation received by everyone in 2020 to be excluded from income if the taxpayer’s MAGI was less than $150,000 (no distinction of the amount by filing status). None of the unemployment compensation was included in determining the MAGI.

State Tax Issues

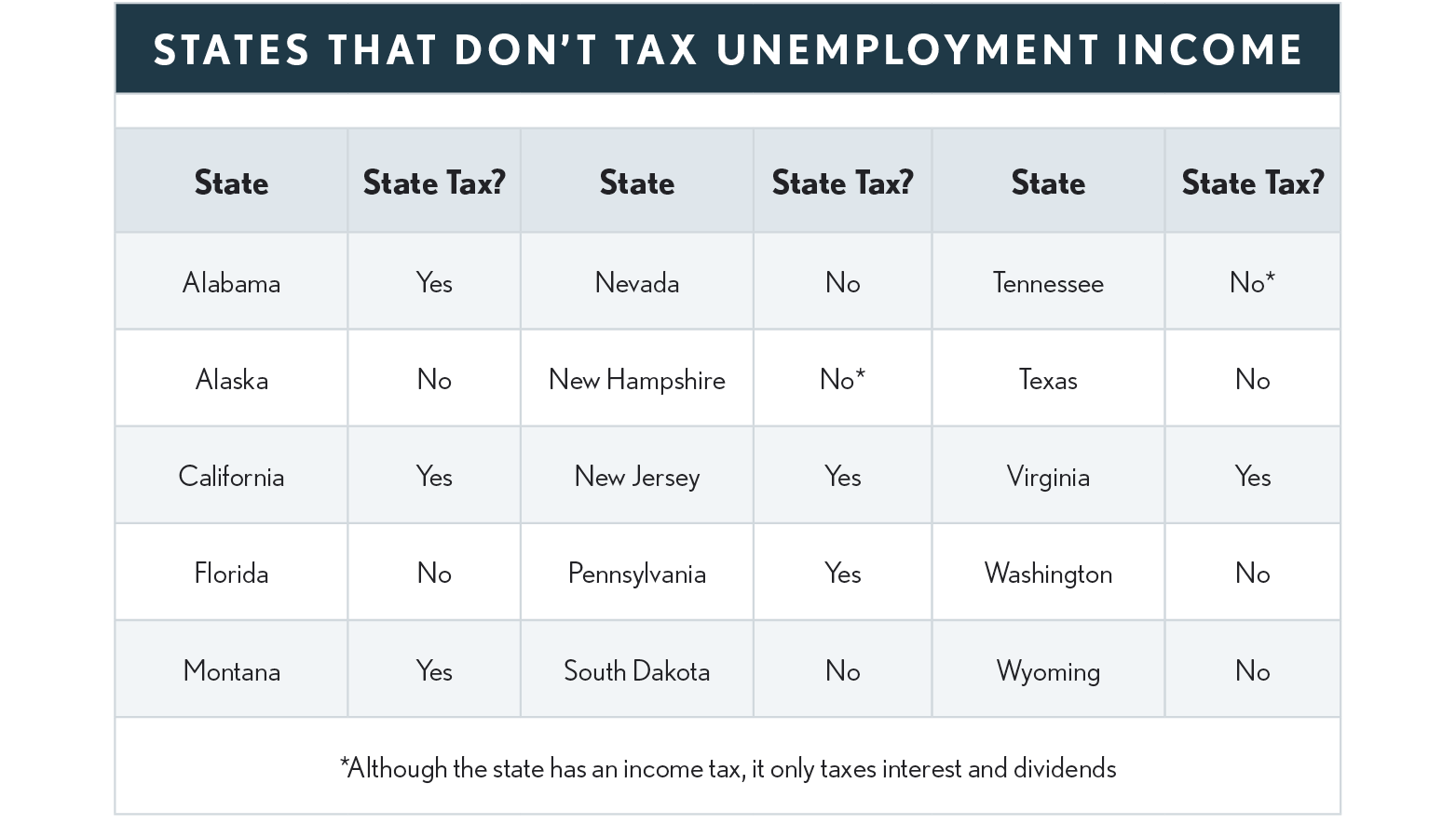

There are several states where unemployment benefits are not taxable. Of those, seven states do not have a state income tax, so obviously, unemployment benefits are not taxable in those states. The following table summarizes the states that do not tax unemployment income. If “yes” is in the “State Tax?” box, the state does have an income tax but doesn’t tax unemployment benefits. States that don’t have an income tax are identified by “no” in the State Tax? box.

Two states exempt 50% of the unemployment income amounts above $12,000 (single taxpayer) or $18,000 (married taxpayers). They are Indiana and Wisconsin. Montana is only exempt through 2023. The remaining states fully tax unemployment benefits.

A Word Of Caution: One online source for this information that appears to be comprehensive is Taxes on Unemployment Benefits: A State-by-State Guide | Kiplinger – however, we have not verified the accuracy of this list. For any state you should check the state’s tax department website for confirming information and forms instructions.