Excludable Employee Fringe Benefits

Certain employee fringe benefits, such as group life insurance, are excluded from taxable income. Find full details about IRS rules regarding employee benefits in this guide.

Group Term Life Insurance

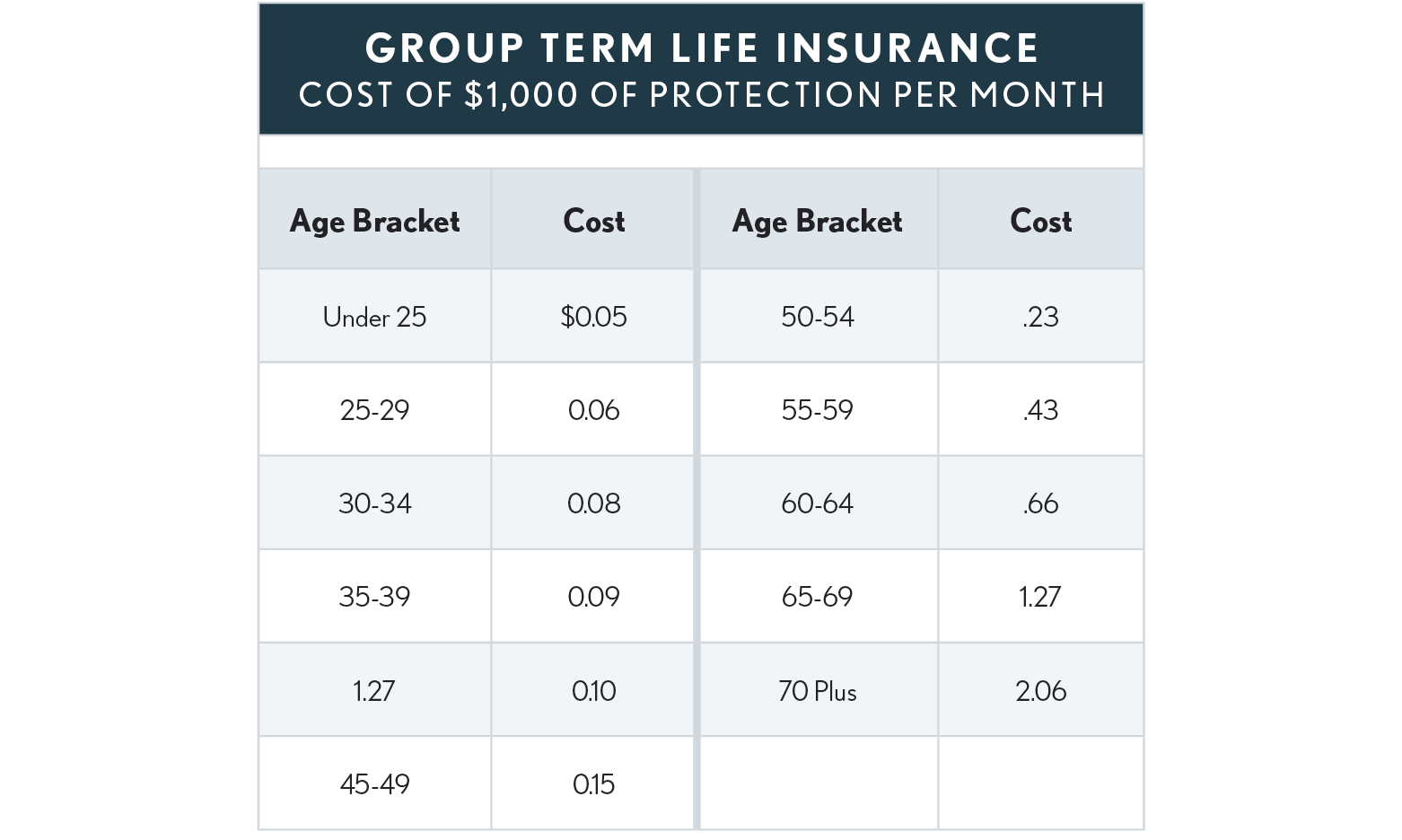

The first $50,000 of group term life insurance (GTLI) coverage provided by an employer is excluded from taxable income. The employer-paid cost of group term coverage in excess of $50,000 is taxable income to the taxpayer even if they never receive it (i.e., it is “phantom income”). If two or more employers provide GTLI coverage totaling more than $50,000, the wages reported on the W-2 forms will not be correct, and the taxable amount of GTLI coverage must be recalculated (see table below). Subtract any amount reported as Code C in Box 12 of the W-2 forms from the recalculated amount of GTLI cost, and then add the result to wages reported on the return.

Strategy - Group Life Policy – The first $50,000 of group term life insurance coverage provided by an employer is a tax-free fringe benefit that does not add anything to the employee’s overall tax bill. But the cost of employer-paid group term coverage more than $50,000 is treated as taxable income and added to theW-2. What’s worse, the cost of that insurance coverage is based on an IRS table that is frequently higher than the employer is paying for the insurance, which creates phantom income.

For older employees, the after-tax cost of the additional coverage frequently exceeds the cost for an individual term policy. It may be appropriate for certain employees to only utilize the first $50,000 in coverage and acquire an individual policy for any additional needed coverage.

IRS Regulation §1.79-3(d)(2) provides the table shown above to be used for figuring the cost of group term life insurance. These amounts have been in effect since July 1, 1999.

Generally, if the group-term life insurance plan favors key employees as to participation or benefits, the employer must include the entire cost of the insurance in the key employees' wages. (IRS Pub 15-B, 2025)

Exclusion for Qualified Employee Discounts

The amount of an employee discount on qualified property or services provided by an employer is excludable from the employee's income. The exclusion is limited to: (1) for property, the employer's gross profit percentage, and (2) for services, 20% of the price at which the employer sells the services to non-employee customers. Qualified property or services are property or services offered for sale to non-employee customers in the ordinary course of a line of business of the employer. For the exclusion to apply, the employee must provide substantial services in the line of business of the employer in which the employer offers the property or services in question to non-employee customers. The exclusion does not apply to highly compensated employees if the qualified employee discounts are available on a discriminatory basis.

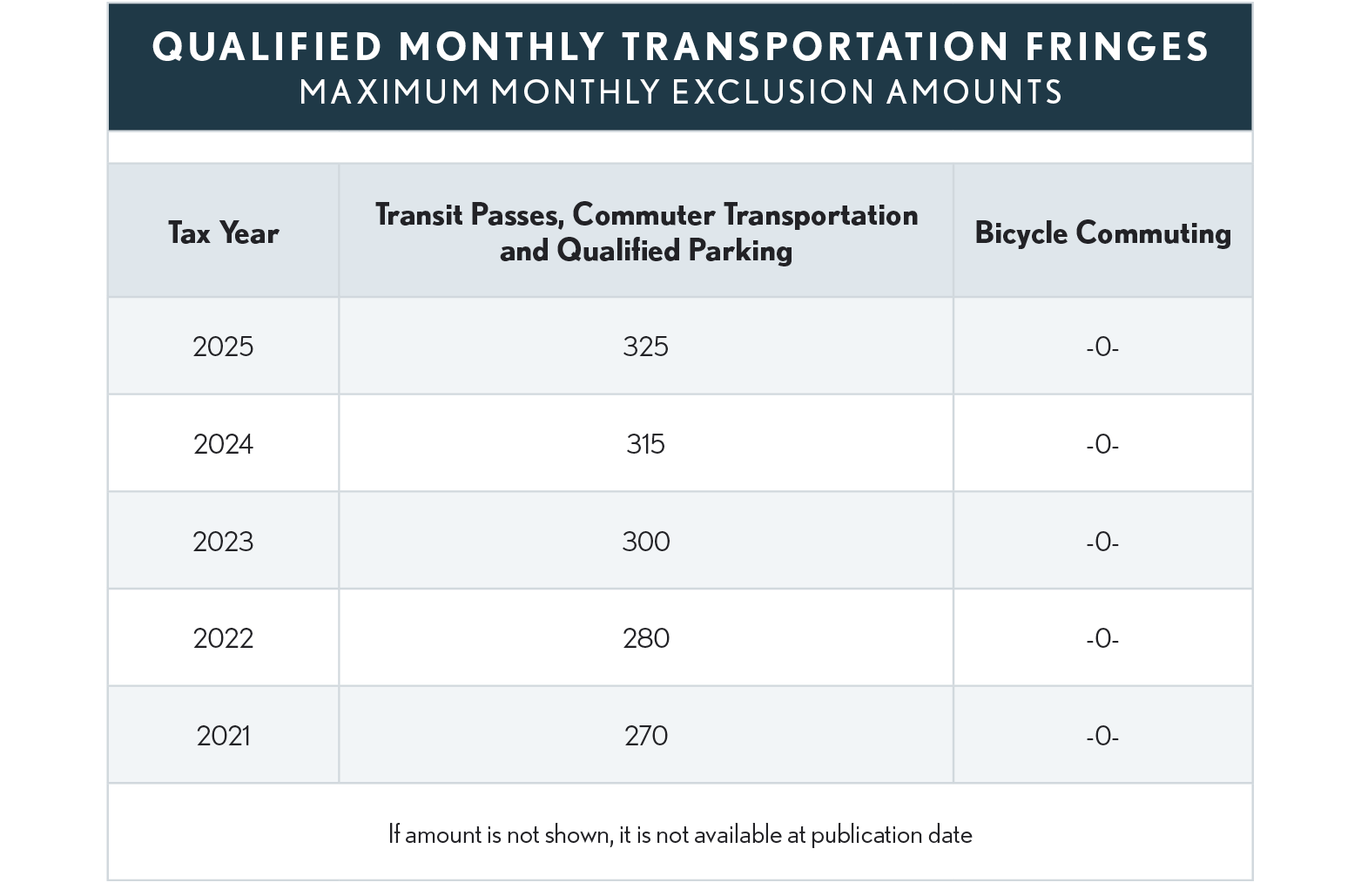

Qualified transportation fringe exclusion - The amount an employee receives, as a fringe benefit must be included in income, based on its fair market value. But any fringe benefit that qualifies as a “qualified transportation fringe” is excluded from income up to the amount of the dollar limitation.

The amount of “qualified transportation fringe” that may be excluded is subject to certain dollar limitations. The amount of the limit depends on the type of benefits provided. The maximum amount of the monthly exclusion, adjusted for changes in the cost of living is shown in the adjacent table. Qualified transportation fringe exclusions include transit passes and transportation in a commuter highway vehicle (van pool), if in connection with travel between the employee's residence and place of employment.

A commuter highway vehicle has a seating capacity of 6 adults (excluding the driver) for which 80% of the mileage must be reasonably expected to be for employee commuting and to be for trips where the vehicle is half full (excluding the driver).

TCJA made the following changes for years after 2017, which the OBBBA of 2025 made permanent.

-

Bicycle commuting expense reimbursement is no longer treated as a nontaxable fringe benefit.

-

Parking and mass transit reimbursement, up to the amount shown in the table above, is excluded by employees.

-

After 2017 employers can no longer deduct the amounts reimbursed for parking or mass transit., No deduction is permitted for reimbursing the employee for commuting expenses, except as necessary for ensuring the safety of an employee.

Value of Clothing NOT Exempt From Taxation Under De Minimis Fringe Benefit Rule

The IRS had previously issued a private letter ruling (PLR 201005014) that allowed employees to exclude the value of employer-provided clothing and related accessories from their taxable income as a de minimis fringe benefit. However, the IRS subsequently determined that based on the variations related to the acquisition and distribution of the clothing and other items that it could not conclude that the items were eligible to be de minimis fringe benefits. Therefore, the IRS revoked that exemption in PLR 201135022 (but did not make the revocation retroactive).

Health FSA Limit

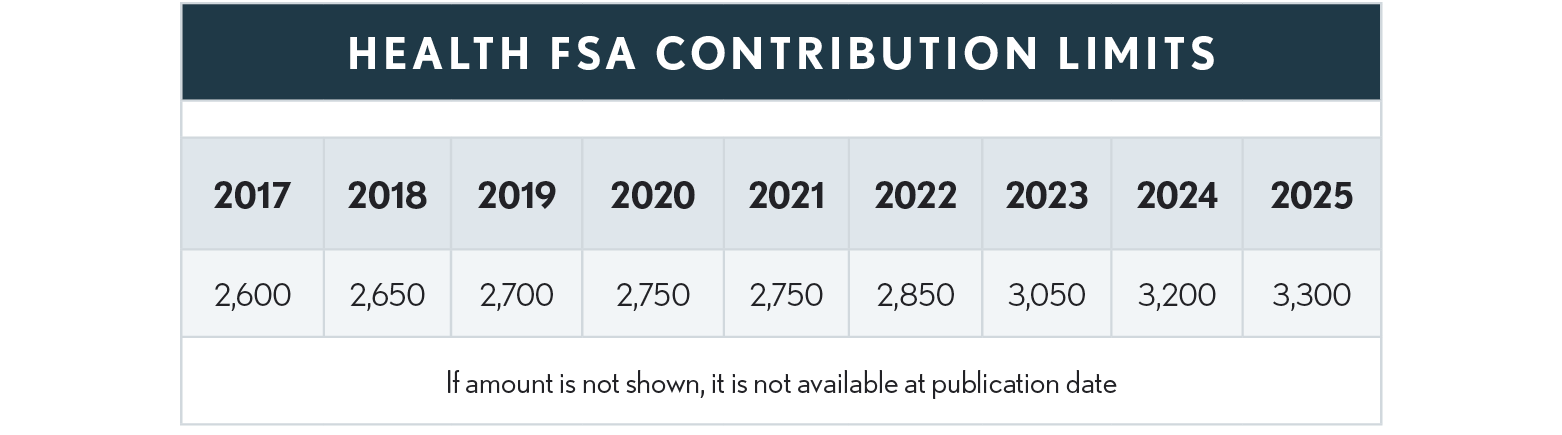

Health FSAs are benefit plans established by employers to reimburse employees for health care expenses, such as deductibles and co-payments, and are usually funded by employees through salary reduction agreements. Sometimes employers may contribute as well. Qualifying contributions to and withdrawals from FSAs are tax-exempt.

For a health FSA to be a qualified benefit under a cafeteria plan, the maximum salary reduction contribution an employee may make cannot exceed $2,500, indexed for cost-of-living adjustments as shown in the table below. The health FSA cap doesn't limit the amount permitted under other employer-provided coverage, such as an FSA for dependent care assistance (Notice 2012-40).

Pet Insurance

Pet insurance is on a growing list of benefits that employers may consider offering to make their overall benefit packages more enticing to existing and prospective employees. However, cost of insurance for a pet does NOT currently qualify as an ERISA excludable benefit.

Work-Life Referral (WLR) Services

Also known as caregiver or caretaker navigation services, are employer-funded fringe benefits designed to assist employees in managing personal, work, or family challenges. These services are typically part of an Employee Assistance Program (EAP) or bundled with other employer-provided services. WLR programs may be available to a significant portion of an employer’s workforce but are typically used infrequently. Employees generally access these services when facing specific challenges that the programs are designed to address.

WLR services provide employees with consultations that help them identify, contact, and negotiate with various life-management resources. These consultations are informational and referral-based, meaning they guide employees to appropriate service providers rather than directly offering those services. Employers often contract third-party providers to deliver WLR services. Examples of WLR services include:

-

Education and Care Providers: Helping employees find suitable education, child care, and medical service providers.

-

Government Benefits: Assisting in navigating eligibility for government benefits, including Veterans Administration benefits.

-

Paid Leave Programs: Evaluating and using paid leave programs offered by employers or state/local governments.

-

Home Services: Locating professionals for home adaptations for family members with special care needs.

-

Medical System Navigation: Helping employees navigate private insurance, public programs, and medical travel benefits.

-

Financial Planning: Connecting employees with local retirement and financial planning professionals.

-

Administrative Assistance: Helping employees complete paperwork and basic administrative tasks to direct employees to the necessary life-management resources.

Under certain circumstances, the value of WLR services can be excluded from an employee's gross income and employment taxes as a de minimis fringe benefit. This means that if the value of the benefit is minimal and infrequently provided, it may not be considered taxable income.