Differential Pay Not Subject to FICA Tax

When an employer provides differential pay to a member of the United States military, that money is not subject to FICA taxes. Learn more about this federal policy below.

Revenue Ruling 2009-11 (IRB 2009-18) provides that differential pay employers pay to their employees who leave their jobs to go on active military duty is subject to income tax withholding but is not subject to Federal Insurance Contributions Act (“FICA”) or Federal Unemployment Tax Act (“FUTA”) taxes. Additionally, the ruling provides that employers may use the aggregate procedure or optional flat rate withholding to calculate the amount of income taxes required to be withheld on these payments, and that these payments must be reported on Form W-2.

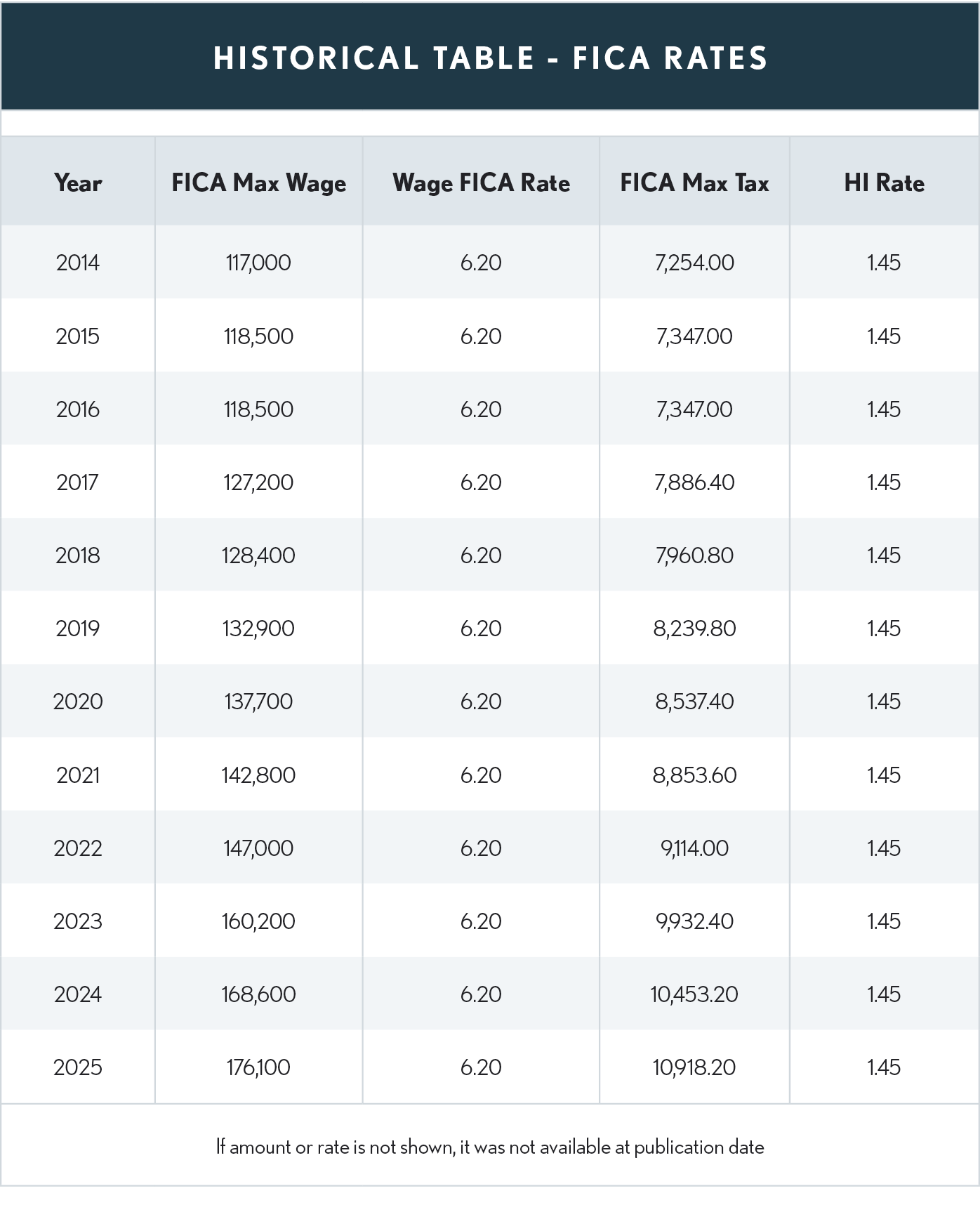

FICA Rates for other years are available at: https://www.ssa.gov/oact/progdata/taxRates.html