California Paid Family Leave Insurance

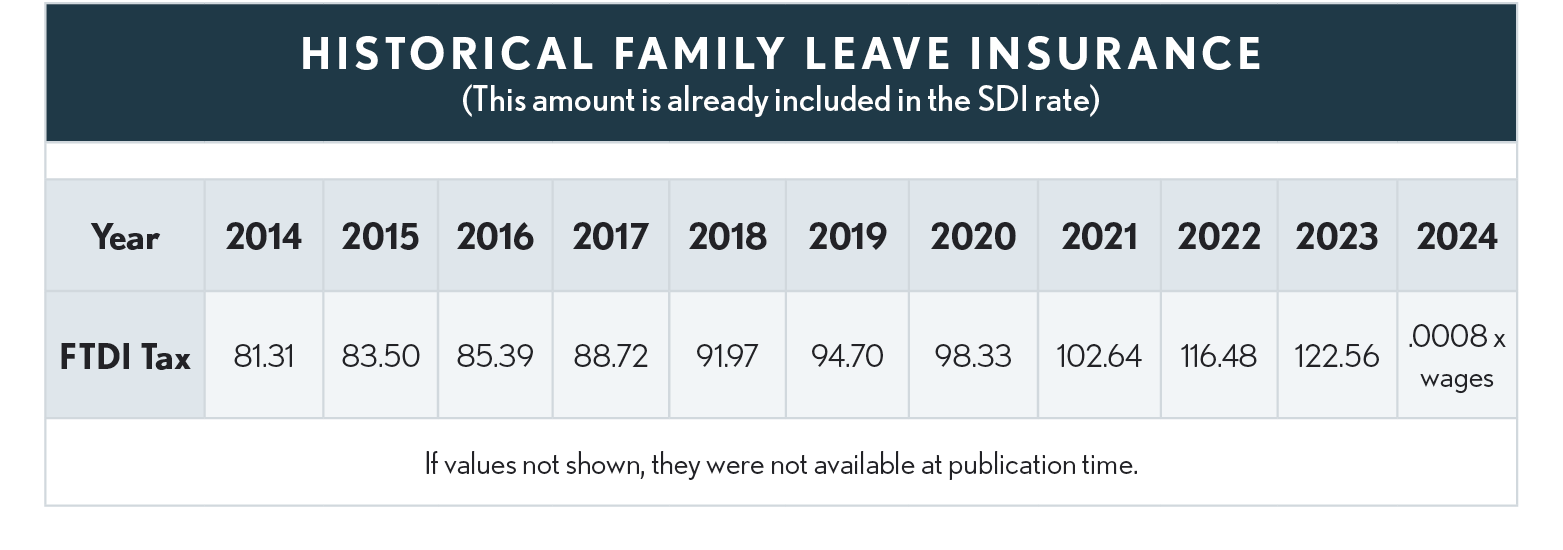

California provides paid family leave insurance (PFL) benefits to eligible individuals who are unable to work because they are caring for a seriously ill or injured family member, or bonding with a minor child within one year of the birth or placement of the child in connection with foster care or adoption. Payments under this plan are reported on Form 1099G, Certain Government Payments. The program is funded by increasing the SDI contribution rate by 0.08 percent (which is included in, not additional to, the annual SDI tax rate). The following table shows the amount a taxpayer can pay into that program based upon the maximum earnings for years 2014 – 2023. Starting with 2024, the cap on maximum earnings subject to SDI tax is removed.

Amounts shown are 0.08% of the max SDI earnings for the year – For 2023: 153,164 x .0008=122.56

In CCA 200630017 the IRS held that amounts withheld from an employee’s payroll under the PFL program were deductible as taxes (under Sec 164). In that same PLR the IRS held that the PFL payments were includable income as Sec 85 unemployment insurance but the provisions of Regulation 1.85-1(b)(1)(iii) apply to those who do not itemize their deductions. Thus, where taxpayers were unable to deduct the family temporary disability insurance (FTDI) contributions as an itemized deduction, they established a basis and subsequent FTDI income can be reduced by the accumulated basis.

Example: Marcia went on paid family leave on Jan 1, 2024, to care for an injured son and collected $1,560 of PFL income. Assuming Marcia has worked continuously only since 2017 and has paid the maximum SDI in all of those years, she would have had $715.40 (the total of the amounts in the chart above for years 2017 through 2023) withheld. Assuming she did not itemize in all of those years, she established a basis of $715. Therefore only $845 of the $1,560 paid during the leave period would be taxable on her federal return.

-

Other Issues: Taxpayers who itemized but received only partial benefit because of the tax benefit rule would seemingly be able to include in their basis the amount from which they received no benefit. Also those subject to the AMT (taxes are not deductible under AMT) received no benefit from the tax deduction, so it would seem that the nobenefit portion would also add to basis. This can become quite complicated.