California Local Income Tax

If you receive a W-2 from an employer based in the State of California, there are specific pieces of information you should be aware of.

On Form W-2 from a California employer, an amount in the local income tax box normally reflects the amount of state disability insurance (SDI) withheld from wages. However, instead of SDI, certain voluntary plan disability insurance (VPDI) may be withheld if an employer elected to carry its own voluntary plan. Such a plan must be approved by the state of California and a portion of the premiums must be sent to the state.

Federal Deductibility

For federal purposes, a taxpayer’s SDI payments are treated for Schedule A as state income taxes paid. However, contributions to VPDI are not deductible as such (Rev Rul 81-194, 1981-2 CB 54).

California Excess Withholding Credit - Years Before 2024

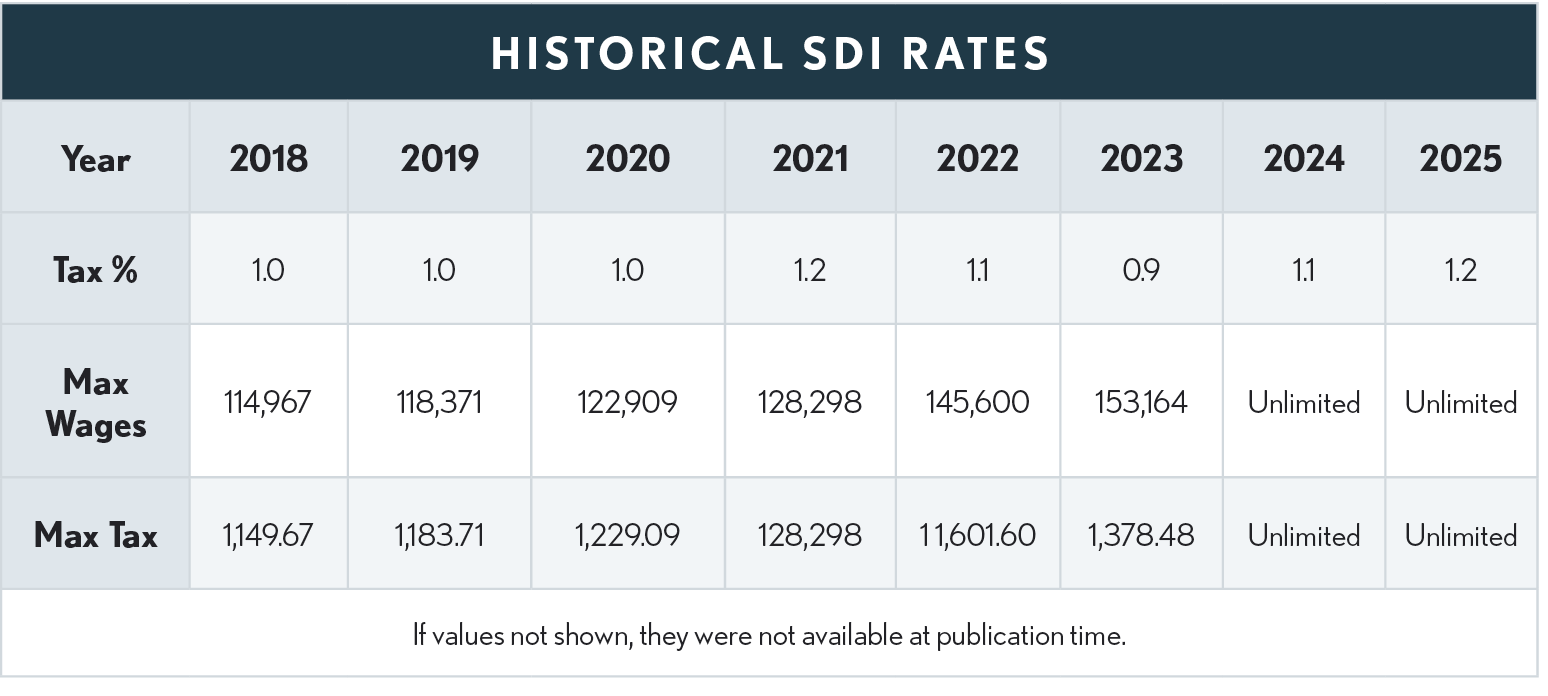

If a taxpayer pays more than the annual maximum into the disability insurance fund, the employee may take a credit on the state return for the excess amount which was withheld. According to the FTB, SDI (or VPDI) amounts withheld must be combined; then subtract the maximum contributions due for the tax year. The balance is a refundable credit. Remember that the credit may be claimed only if taxpayers had excess withholding because they had two or more employers who each withheld SDI or VPDI. For the purpose of claiming the credit, payments to both SDI and VPDI will count.

Under SB 951, enacted in 2022 and effective January 1, 2024, the wage cap applicable to SDI tax is removed, resulting in SDI tax on all taxable wages.

2023 Example : Martin Lewis has two employers for 2023: One withholds $910 of SDI and the other withholds $885 of VPDI. On Martin’s Schedule A he includes $910 of SDI as part of his state income tax deduction. The total of the SDI and the VPDI is $1,795. The maximum for 2023 is $1,378.48, giving Martin a $416.52 overpayment credit on his CA return.

-