Social Security Benefits Limits on Earnings After Retirement (Excess Earnings)

There are limits to how much a taxpayer can earn each year after they begin receiving Social Security benefits without impacting those benefits.

If a worker, spouse, divorced spouse, or minor child works after Social Security benefits start, special rules apply as to the amount of money that can be earned without impacting benefits. The following types of income will reduce the amount of a Social Security check if they exceed the limits:

-

Gross wages,

-

Net earnings from self-employment,

-

Some government pensions,

-

Insurance renewals, sales commissions, royalties and severance pay.

In the case of items (3) and (4), complicated rules apply. Call the Social Security Administration for additional information. The following types of income are not considered when computing the limitation:

Rental

income (1) Inheritances

Pension

income (4) Court

case settlements

Interest

& dividends (2) Worker's

compensation

Unemployment compensation Lottery/contest winnings

Sick pay (after 6 months of retirement) Tips less than $20 per month

Reimbursement

for moving (3) Reimbursement

for travel (3)

Jury

duty pay Delayed

payment from self-employment (5)

(1) If not in the real estate business. (2)

If not in the broker business. (3) Income not counted by the IRS. (4)

Some government pensions can reduce the amount of Social Security benefits. (5)

SE income paid in a year after the year of entitlement to Social Security that

is attributable to services performed prior to the first month of entitlement

to SS.

Excess Earnings Reduction Amount

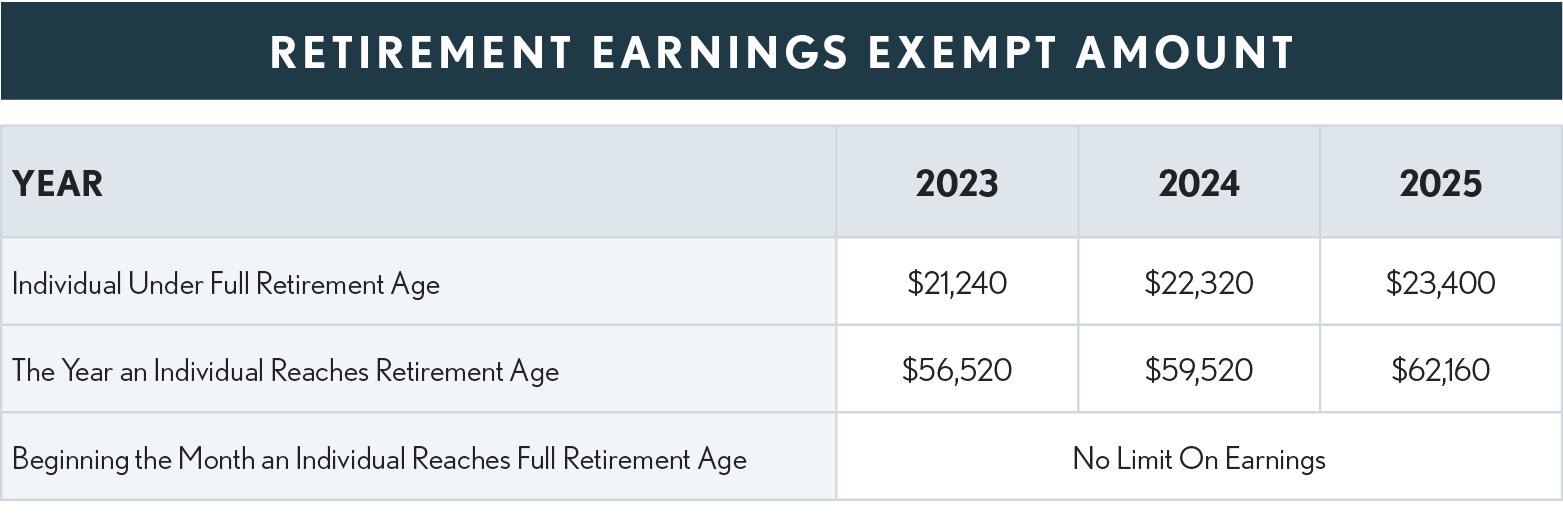

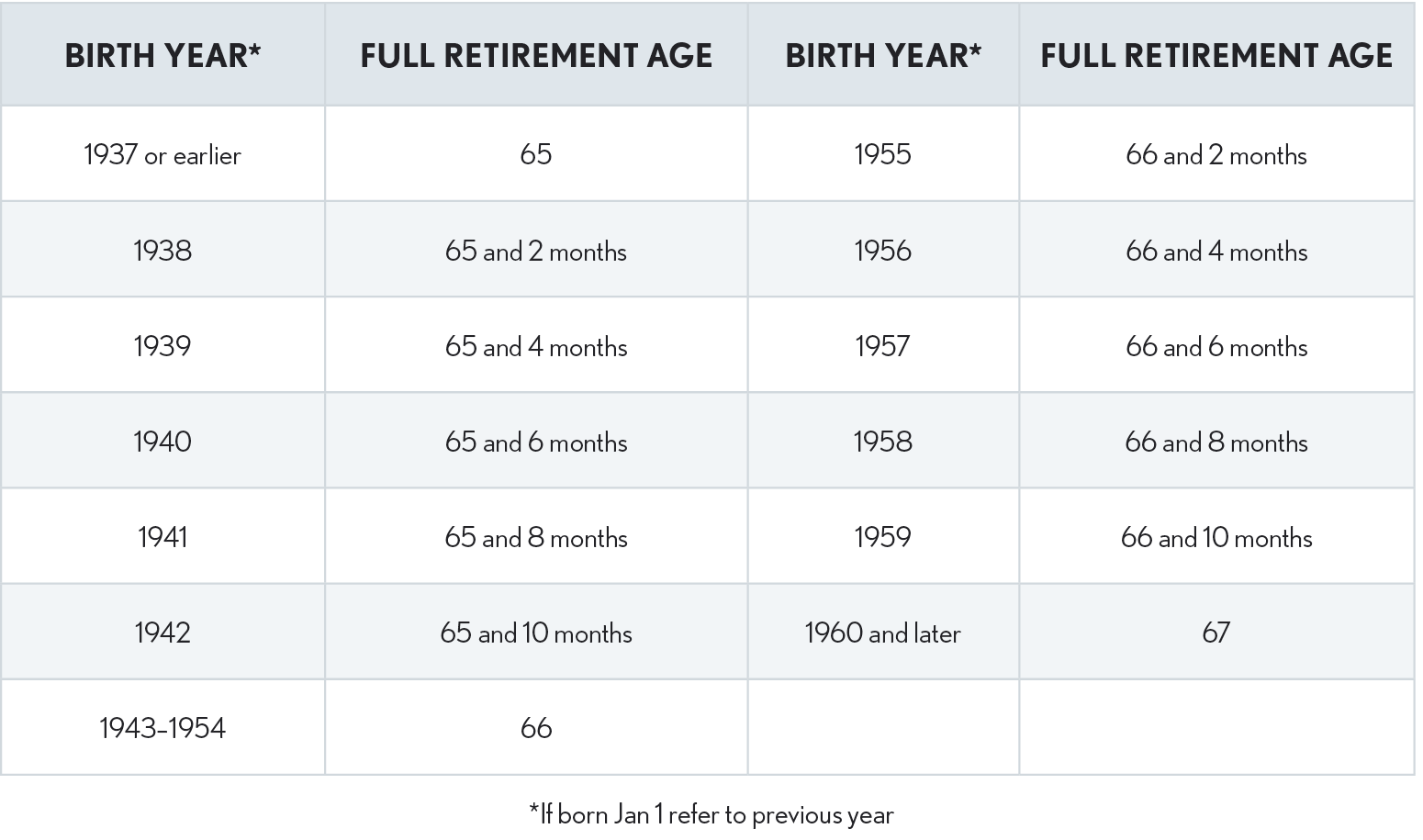

An individual can get Social Security retirement benefits and work at the same time. However, if the retiree is younger than full retirement age and makes more than the yearly earnings limit, the benefits will be reduced $1 for every $2 of earnings exceeding the annual limit. The annual limit for 2023 is $21,240. Starting with the month the individual reaches full retirement age, the benefits will no longer be reduced.

In the year the individual reaches full retirement age the benefits will be reduced $1 for every $3 of earnings exceeding $56,520 in 2023. The earnings for this limit only include earnings prior to the month the individual reached full retirement age.

Mid-Year Retirement

Some people who retire in mid-year have already earned more than their yearly earnings limit. That is why the Social Security Administration has a special rule that applies to earnings for one year, usually the first year of retirement. The special rule allows the Social Security Administration to pay a full Social Security check for any whole month they consider an individual retired, regardless of yearly earnings. If the individual will:

-

Be under full retirement age for all of 2023, they are considered retired in any month that their earnings are $1,770 (2023) or less and they did not perform substantial services in self- employment. The amount for 2024 is $1,860.

-

Reach full retirement age in 2023, they are considered retired in any month that their earnings are $4,710 (2023) or less and they did not perform substantial services in self-employment. “Substantial services in self-employment" means the individual devoted more than 45 hours a month to the business or between 15 and 45 hours to a business in a highly skilled occupation. The amount for 2024 is $4,960.

Full Retirement Age or Over

The excess earnings limitation does not apply to individuals who have reached full retirement age or over beginning the month that full retirement age is attained.

Quarter of Coverage (QC)

Is the basic unit for determining whether a worker is insured under the Social Security program. No matter how high the earnings may be, an individual cannot earn more than 4 QC's in one year. For a self-employed individual, in 2023, if net earnings are $6,560 (up from $6,040 in 2022) or more, the yearly maximum of 4 credits is earned (1 credit for each $1,640 of earnings in 2023). If the SE individual’s net earnings are less than $6,560 (up from $6,040 in 2022), credit may still be earned by using the optional method (see SSA Publication 05-10022).