Understanding the IRS Schedule D Computation

The Schedule D has become one of the most complicated calculations on a tax return.

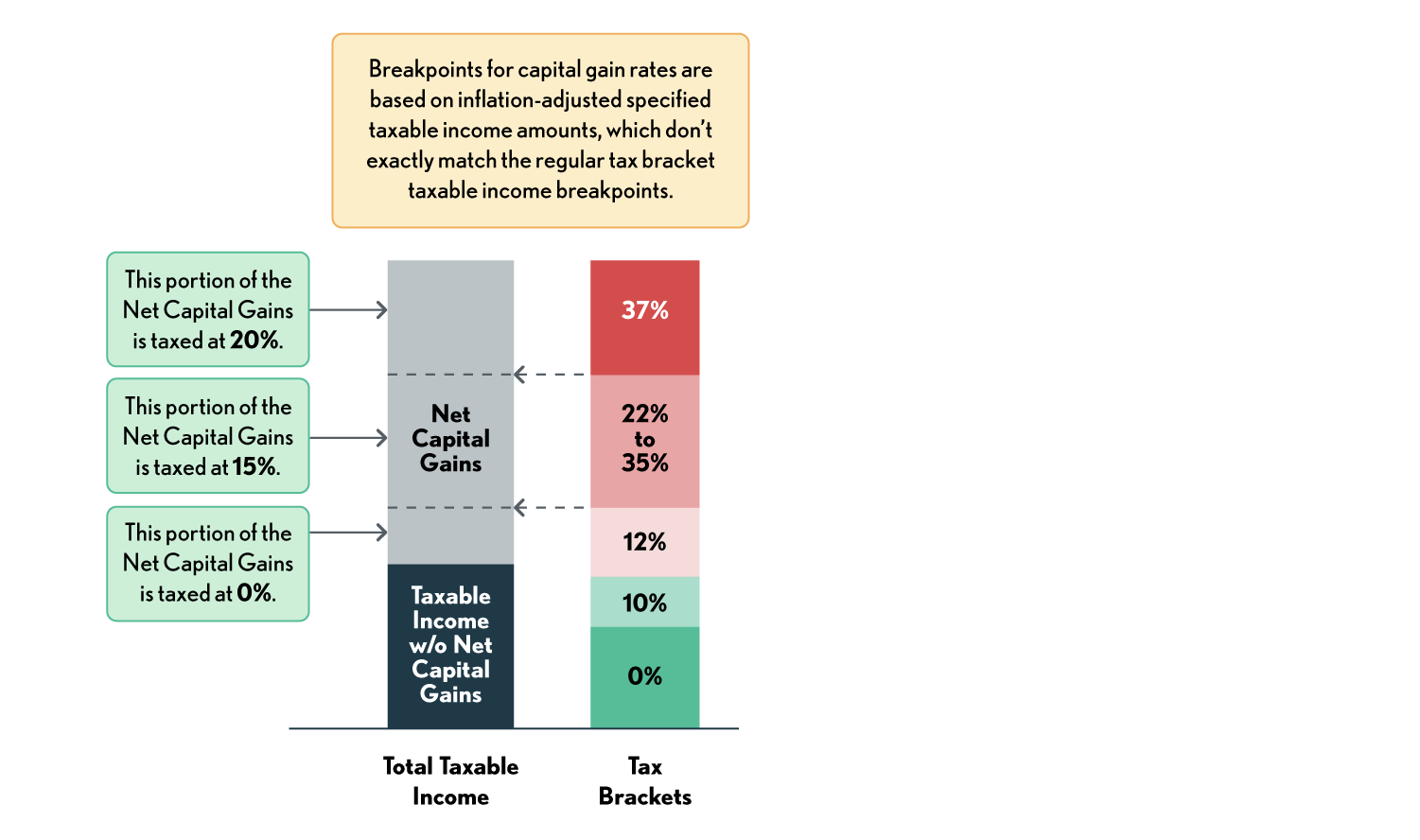

Although the IRS publishes lengthy worksheets, and computerized tax programs transparently make the calculations (if data has been entered correctly), tax practitioners need to have an understanding of how the tax is determined (computed) on the Schedule D. Adjacent is a graphic 3-step illustration of the Schedule D tax computation.

Determine NET CAPITAL GAINS.

(+) Qualified Dividends

(-) Dividends Elected to be Treated as Investment Income (for Form 4952 limitation) (not exceeding the qualified dividends)

(+) Net Long-Term Gains

(-) 25% and 28% Gains (not exceeding the long-term gains)

_________________________________________________________________

NET CAPITAL GAINS

Net capital gains are taxed in the sequence shown in the illustration to the right. Where there are unrecaptured Sec 1250 gains taxed at 25%, or long-term collectibles and qualified small business stock gain taxed at 28%, the computation can become very complicated and the Schedule D and associated worksheets must be used to determine the tax.