Residence Used Partially For Business (Mixed-Use Property)

Certain IRS home sale gain exclusion rules apply to any residential property that is used partially for business. If you plan to sell a mixed-use property, the following information will apply to you.

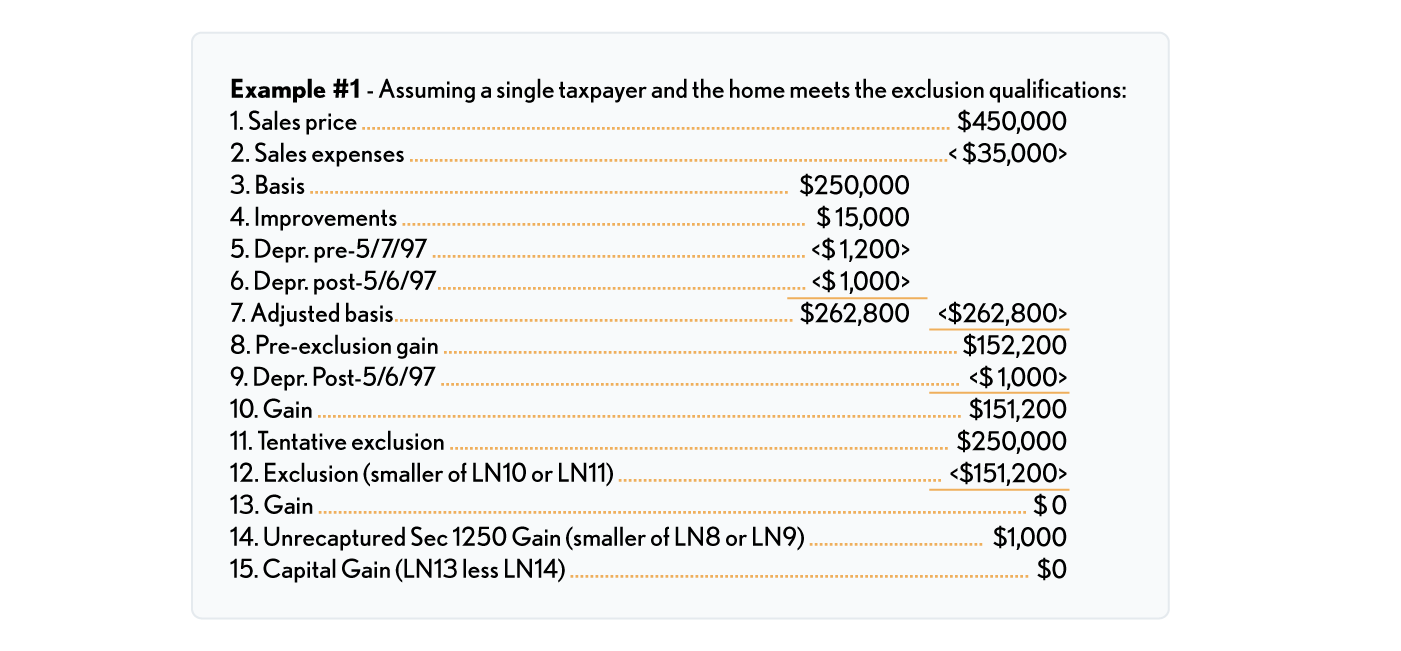

The final regulations provide that no allocation of gain is required if both the residential and nonresidential portions of the property are within the same dwelling unit; gain to the extent of any post-May 6, '97, depreciation adjustments isn't excludible. However, gain is allocated if the portion of the home used for business is separate from the dwelling unit and the separate structure fails the residential qualification tests. (Reg. § 1.121-1(e)(1))

No allocation of gain is required if both the residential and nonresidential portions of the property are within the same dwelling unit. The gain from the sale is treated as if the entire home qualified for the home gain exclusion except that any gain to the extent of any post-May 6, '97 depreciation adjustments isn't excludible. Any depreciation taken, including post-May 6, '97 depreciation, adjusts the basis of the home.