Reduced Home Sale Gain Exclusion

In specific cases, the IRS requires taxpayers to take a reduced home sale gain exclusion. Discover situations in which this might happen as you continue reading.

The reduced exclusion applies to any sale or exchange if a taxpayer doesn’t meet the ownership, use or once-every-two-years requirements due to a change in the place of employment, health or (to the extent provided in regs) unforeseen circumstances. The reduced exclusion applies if any of the following are true:

-

Taxpayer did not meet the ownership and use tests for a home sold due to a change in health, place of employment or unforeseen circumstances (as defined in regulations), or

-

Exclusion would have been disallowed because taxpayer sold more than one home during the two-year period, except if the taxpayer sold the home due to a change in health, place of employment or regulations-defined unforeseen circumstances.

Change in Employment

Is a change in the location of the employment (including self-employment) of a qualified individual (taxpayer, spouse, co-owner of the residence, or a person whose principal place of abode is in the same household as the taxpayer). This condition is treated as met (a safe harbor) if: (1) the new place of employment is at least 50 miles farther from the residence sold or exchanged than was the former place of employment (for the unemployed, 50 miles between the new place of employment and the residence sold or exchanged); and (2) the change in place of employment occurs during the period of the taxpayer's ownership and use of the home as his principal residence. (Reg. § 1.121-3(c))

The Health Condition

is met if the primary reason for the sale is: (1) To obtain, provide, or facilitate the diagnosis, cure, mitigation, or treatment of disease, illness, or injury of a qualified individual, or (2) To obtain or provide medical or personal care for a qualified individual suffering from a disease, illness, or injury.

A qualified individual is:

-

The taxpayer,

-

The taxpayer’s spouse,

-

Co-owner of the residence,

-

A person whose principal place of abode is in the same household as the taxpayer,

-

Family members (son/daughter and descendants; stepson/stepdaughter; brother/sister/stepbrother/step-sister; father/mother and ancestors; stepfather/stepmother; son/daughter of sister/brother; sister/brother of father/mother; son-/daughter-in law, father-/mother-in law, brother-/sister-in law) of any individual in the four bullets above, even if they aren't the taxpayer’s dependents, or

-

Descendants of the taxpayer's grandparent (e.g., first cousins).

A sale or exchange doesn't qualify for the health condition if it is merely beneficial to the general health or well-being of the individual. The health condition is treated as met if a doctor recommends a change of residence for the health reasons listed above in (1) and (2). (Reg. § 1.121-3(d))

Strategies

The definition of a “qualified individual” opens some interesting possibilities and, although we cannot cover all of them, the following are some examples:

-

Incapacitated Parent – Suppose an elderly parent for health reasons can no longer care for themselves., A child, or other qualified relative, could sell their home and use the partial exclusion to relocate closer to an elderly parent or vice versa.

-

Joint Owners – Suppose two unrelated individuals buy a home together., Things don’t work out and one loses a job, etc., while the other relocates and changes jobs (meeting the 50-mile requirement)., Because the co-owner is a qualified individual, the owner that did not relocate can still utilize the partial exclusion.

Unforeseen Circumstances

The regulations for partial home sale exclusions are quite liberal. Some taxpayers who are unaware of the unforeseen circumstances reduced exclusion provisions may have unnecessarily paid taxes on gain when they sold their homes. Taxpayers who would otherwise qualify under this section to exclude gain from a sale or exchange on or after May 7, 1997, may elect to apply all the provisions of this section for any years for which the statute of limitations has not expired.

Foreclosure & Unforeseen Circumstances

Loss of a home due to foreclosure or voluntary reconveyance would be unforeseen circumstances

-

In general - A sale or exchange is by reason of unforeseen circumstances if the primary reason for the sale or exchange is the occurrence of an event that the taxpayer could not reasonably have anticipated before purchasing and occupying the residence.

If the taxpayer qualifies for a safe harbor described in this section, the taxpayer's primary reason is deemed to be a change in place of employment, health, or unforeseen circumstances. If the taxpayer does not qualify for a safe harbor, factors that may be relevant in determining the taxpayer's primary reason for the sale or exchange include (but are not limited to) the extent to which:

o The sale or exchange and the circumstances giving rise to the sale or exchange are proximate in time;

o The suitability of the property as the taxpayer's principal residence materially changes;

o The taxpayer uses the property as the taxpayer's residence during the period of the taxpayer's ownership of the property;

o The circumstances giving rise to the sale or exchange are not reasonably foreseeable when the taxpayer begins using the property as the taxpayer's principal residence; and

o The circumstances giving rise to the sale or exchange occur during the period of the taxpayer's ownership and use of the property as the taxpayer's principal residence.

• Specific safe harbor events - The primary reason for the sale or exchange is deemed to be unforeseen circumstances if any of the events specified below occur during the period of the taxpayer's ownership and use of the residence as the taxpayer's principal residence. (Reg. § 1.121-3(e)(2))

-

Involuntary conversion of the residence; Reg. § 1.121-3(e)(2)(i)

-

A natural or manmade disaster or act of war or terrorism resulting in a casualty to the residence; Reg. §1.121-3(e)(2)(ii)

-

Death of a qualified individual; Reg. 1.121-3(e)(2)(iii)(A)

-

A qualified individual's cessation of employment making him eligible for unemployment compensation; Reg. §1.121-3(e)(2)(iii)(B)

-

A qualified individual's change in employment or self-employment status that results in the taxpayer's inability to pay housing costs and reasonable basic living expenses for the taxpayer's household – but not for maintenance of an affluent or luxurious standard of living; Reg.§ 1.121-3(e)(2)(iii)(C)

-

A qualified individual's divorce or legal separation under a decree of divorce or separate maintenance; Reg.§ 1.121-3(e)(2)(iii)(D) and,

-

Multiple births resulting from the same pregnancy of a qualified individual. Reg. §1.121-3(e)(2)(iii)(E)

A qualified individual is defined the same way as for the change-in-employment condition. IRS may designate other events or situations as unforeseen circumstances.

-

Sale to Facilitate Adoption - The IRS has concluded that the sale of a home and rental of a larger one to facilitate an adoption was an “unforeseen circumstance” for purposes of the reduced home sale exclusion rule.(PLR 200613009)

-

Home Sale to Accommodate Pregnant Joint Owner - Two unmarried taxpayers jointly purchased a home and used it as their principal residence. Approximately seven months after buying the home, the female partner became pregnant. The mother to be and the father of the expected child were no longer in a relationship and plan to sell the home and find separate residences because the home isn't large enough to accommodate two adults and a child and neither one of them can afford to make the monthly mortgage payments on the home alone., The private ruling concludes that the sale qualified as an unforeseen circumstance. (PLR 200652041)

-

Big Family Qualified for Reduced Maximum Exclusion - IRS has privately ruled that a taxpayer's second marriage and resulting large combined new family were unforeseen circumstances under the home sale exclusion rules. As a result, he qualified for a reduced maximum exclusion for gain on the sale of a home he had owned and used as a principal residence for less than 2 of the preceding 5 years. (PLR 200725018)

-

Birth of Second Child Qualified for Reduced Maximum Exclusion – In a private letter ruling, the IRS allowed a married couple to use the reduced maximum gain exclusion when they sold their home after the birth of their second child. When they purchased the 2-bedroom condo, the couple had only one child. The child’s bedroom was also used as the husband’s home office and a guest room. After having a second child, the taxpayers moved out of the condo and sold it., The IRS approved the reduced maximum exclusion on the basis of unforeseen circumstances and that the suitability of the residence changed significantly with the arrival of the second child. (PLR 201628002)

Caution: Other taxpayers shouldn't assume that the decision to sell a home to facilitate an adoption or expansion of the family automatically qualifies as an unforeseen circumstance. Under Reg. § 1.121-3(e)(3), unforeseen circumstances include events determined by IRS to be unforeseen to the extent provided in published guidance of general applicability. A ruling directed to a specific taxpayer (i.e., a private letter ruling) does not establish a generally applicable safe harbor.

Specific Examples

“ Example (2) - H works as a teacher and W works as a pilot. In 2021, H and W buy a house that they use as their principal residence. Later that year, W is furloughed from her job for six months. H and W are unable to pay their mortgage during the period W is furloughed. H and W sell their house in 2022. The sale is within the safe harbor of item (5), above, and H and W are entitled to claim a reduced maximum exclusion. ”

-

“ Example (3) - In 2021, H and W buy a two-bedroom condominium that they use as their principal residence. In 2022, W gives birth to twins and H and W sell their condominium and buy a four- bedroom house. The sale is within the safe harbor of item (7), above, and H and W are entitled to claim a reduced maximum exclusion. ”

-

“ Example (4) - B buys a condominium in 2021 and uses it as his principal residence. B's monthly condominium fee is $X. Three months after B moves into the condominium, the condominium association decides to replace the building's roof and heating system. Six months later, B's monthly condominium fee doubles. B sells the condominium in 2022 because B is unable to pay the new condominium fee along with the monthly mortgage payment. The safe harbors listed above do not apply. However, under the facts and circumstances, the primary reason for the sale is unforeseen circumstances, and B is entitled to claim a reduced maximum exclusion. ”

-

“ Example (5) - In 2021, C buys a house that he uses as his principal residence. The property is located on a heavily trafficked road. C sells the property in 2022 because the traffic is more disturbing than he expected. C is not entitled to claim a reduced maximum exclusion under Section 121(c)(2) because the safe harbors of the regulations (listed above) do not apply and, under the facts and circumstances, the traffic is not an unforeseen circumstance. ”

-

“ Example (6) - In 2021, D and her fiancé E buy a house and live in it as their principal residence. In 2022, D and E cancel their wedding plans and E moves out of the house. Because D cannot afford to make the monthly mortgage payments alone, D and E sell the house in 2022. The safe harbors do not apply. However, under the facts and circumstances, the primary reason for the sale is unforeseen circumstances, and D and E are each entitled to claim a reduced maximum exclusion. ”

-

CAUTION – UNFORESEEN CIRCUMSTANCES

Taxpayer Preference or Financial Gain - The final regulations clarify that a sale because of unforeseen circumstances (other than a sale within a safe harbor) does not qualify for the reduced maximum exclusion if the primary reason for the sale is a preference for a different residence or an improvement in financial circumstances. (Reg. § 1.121-3(e)(1))Published Guidance - The final regulations clarify that taxpayers may rely on only those determinations made by IRS in published guidance of general applicability. A ruling directed to a specific taxpayer (i.e., a private letter ruling) does not establish a safe harbor of general applicability. (Reg. § 1.121-3(e)(3))

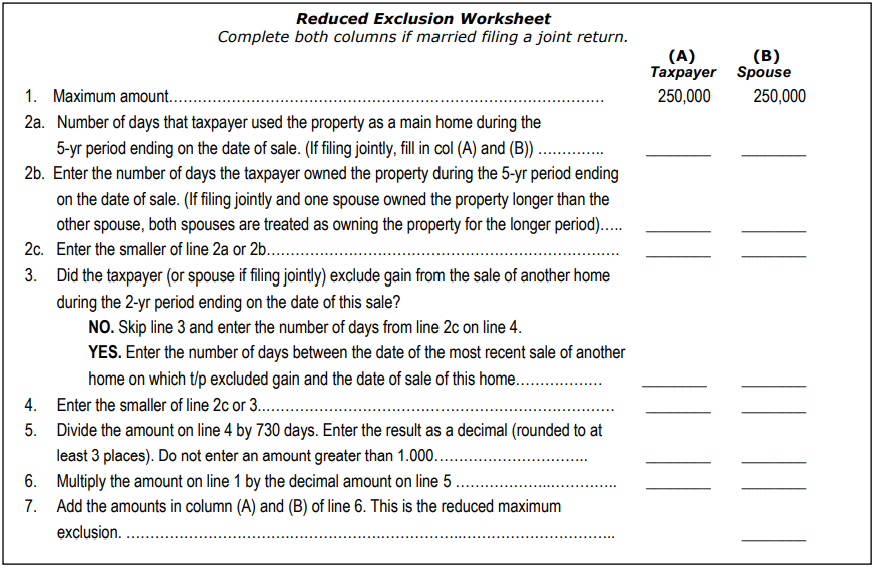

Amount of Reduced Exclusion

For those who qualify for the reduced exclusion, the gain excluded from gross income can’t be more than the $250,000/$500,000 maximum exclusion amount multiplied by a fraction. The denominator of the fraction is 730 and the numerator of the fraction is of the shorter of:

-

the number of days, during the five-year period just prior to the current sale that the property was owned and used by the taxpayer as his/her principal residence, or

-

the number of days after the date of the most recent earlier sale to which the exclusion applied and which occurred before the date of the current sale.

“ Example - Reduced Exclusion Calculation - Sally sold her principal residence because she got a new job in another city. On the date of the sale, she had used and owned the home as her principal residence for the last 18 months; she had never excluded gain under these rules before. However, since she fails to meet the full use and ownership requirements (i.e., two years of five) by the sale date, the amount of gain she can exclude is reduced using the following calculation (computed using months):$250,000 (maximum exclusion for Sally is limited to her gain) times [18 months (aggregate time of use under (1) above)/24 months]Result: Sally can exclude up to $187,500 (250,000 x (18/24)) of her gain on the sale of her principal residence. ”

-