Partial Home Sale Exclusion and the Sale of a Rental

In specific situations, the IRS may require a homeowner to take a partial home sale exclusion following the sale of a rental home.

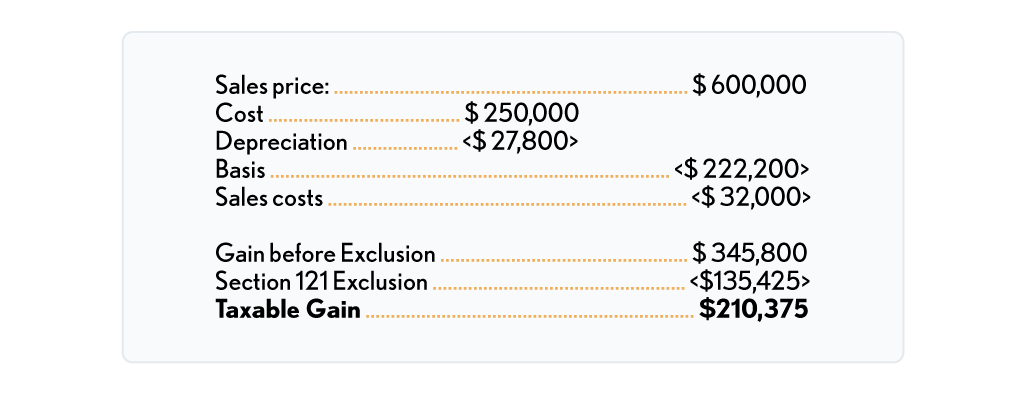

Say, for example, a single taxpayer sells a home for $600,000. The home was originally purchased on January 1, 2012 for $250,000. The taxpayer lived in the home through March 31, 2018 at which time the taxpayer began renting the home out. It continued to be used as a rental up to the date of sale on February 28, 2022. The reason the taxpayer sold the home was due to a job-related move to Florida in February of 2022. The sales costs were $32,000, and the depreciation taken during the rental period was $27,800. What is the taxpayer’s taxable gain from this sale?

This problem is unique in that the taxpayer sold the home while it was in rental service, and the underlying question is whether the taxpayer qualifies for a partial exclusion. The answer to that question lies in Code Sec. 121(c)(2), which says:

The reduced exclusion applies to any sale or exchange of a principal residence if:

-

The exclusion would not (but for these rules relating to the reduced exclusion) apply to the sale or exchange by reason of:

-

A failure to meet the ownership and use requirements, or

-

The limit of only one sale every two years, and

-

-

The sale or exchange is by reason of a change in place of employment, health, or (to the extent, provided in regulations), unforeseen circumstances.

Therefore, the partial exclusion applies to any sale or exchange of a principal residence, and in this case, by virtue of the job-related move by the taxpayer. Thus, since the taxpayer used the home as a residence for 13 months of the 60-month qualifying period, the solution is as follows:

-

Home used as a rental - April 1, 2018, to February 28, 2022, = 47 Months

-

Home used several years prior to April 1, 2018, as principal residence = 13 Months of the 60-month look-back period.

-

Section 121 Exclusion: (13/24 = .5417) x $250,000 = $135,425 (24 is used as the denominator since 24 is the number of qualifying months.)

-

Total time owned: 2012 thru 2021 = 10 yrs. x 12 mos. = 120 + 2 mos. in ’22 = 122 mos.

Note: if the exclusion had been figured based on the number of days instead of months, the exclusion would be $200 more: 396 days/730 = .5425 x 250,000 = 135,625. In addition, part or all of the balance of the gain could be deferred under Section 1031 if the taxpayer acquired a replacement rental and meets all the requirements for a Section 1031 exchange.