Ownership & Use Test Periods Are Different (Reg. §1.121-1(C)(4))

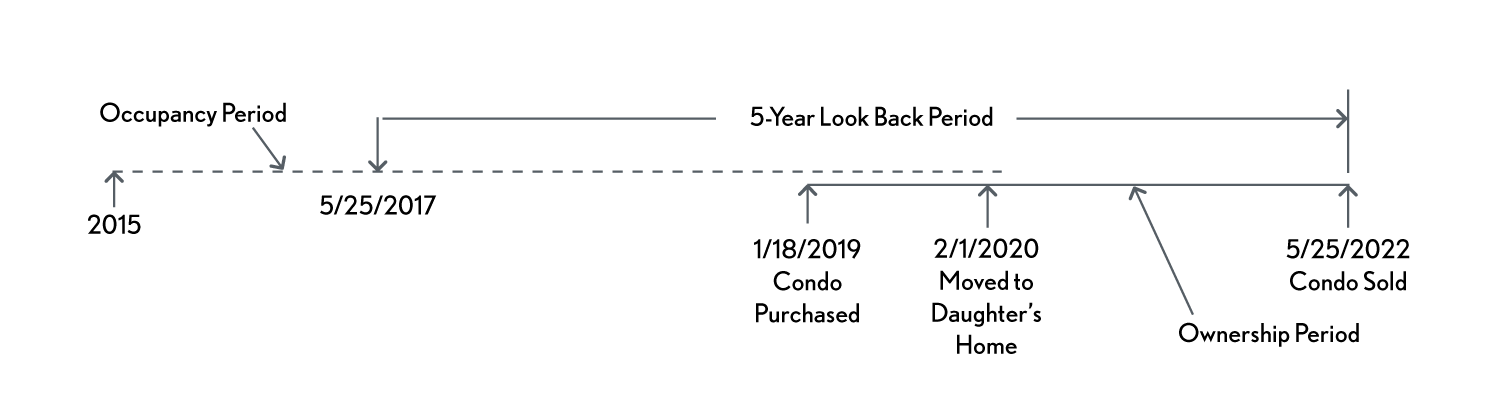

“ Example – Ownership & Use Periods Different - Taxpayer C lives in a townhouse that he rents from 2015 through 2018. On January 18, 2019, he purchases the townhouse. On February 1, 2020, he moves into his daughter's home. On May 25, 2022, while still living in his daughter's home, he sells his townhouse. The section 121 exclusion will apply to gain from the sale because C owned the townhouse for at least 2 years out of the 5 years preceding the sale (from January 19, 2019 until May 25, 2022) and he used the townhouse as his principal residence for at least 2 years during the 5-year period preceding the sale (from May 25, 2018 until February 1, 2020). ”

-

In regard to the home sale gain exclusion, ownership and use test periods are different. Discover how the IRS defines each of these in the charts above.