Military, Foreign Service, Intelligence Community 5-Year Test

Due to the nature of their work, the IRS provides special home sale test provisions for members of the military, United States foreign services, or intelligence community.

Military personnel often retain ownership of a home while away on duty but eventually sell it without returning to live in it, perhaps failing the use test completely. Those on qualified extended duty in the U.S. Armed Services or the Foreign Service can suspend this five-year test period for up to 10 years of such duty time, effective for home sales after May 6, 1997. A taxpayer is on qualified extended duty when at a duty station that is at least 50 miles from the residence sold, or when residing under orders in government housing, for more than 90 days or for an indefinite period. A taxpayer may use this provision for only one property at a time and may exclude gain on only one home sale in any two-year period.

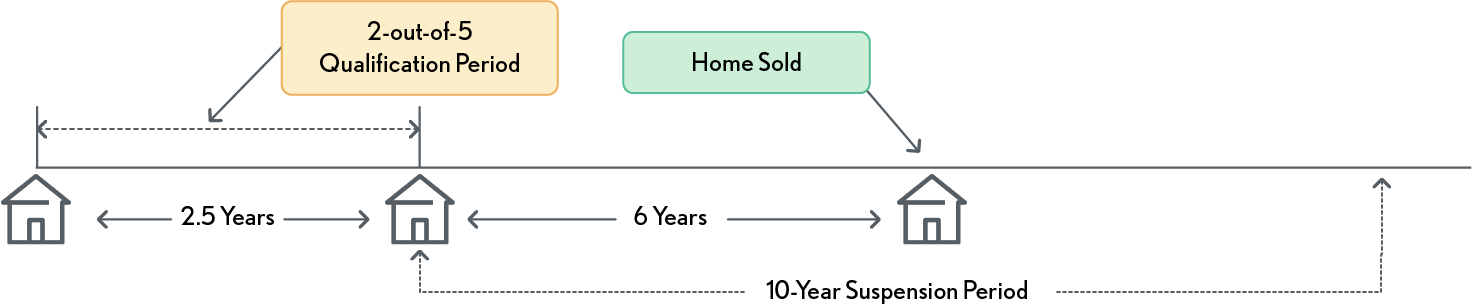

“ Example – Sarge bought and moved into a home in 2014 that he lived in as his main home for 2½ years. For the next 6 years, he did not live in the home because he was on qualified official extended duty with the Army. He sold the home for a gain in 2022. To meet the use test, Sarge chooses to suspend the 5-year test period for the 6 years he was on qualifying official extended duty – he disregards those 6 years. Sarge’s 5-year test period consists of the 5 years before he went on qualifying official extended duty. He meets the ownership and use tests because he owned and lived in the home for 2½ years during this test period. ”

-

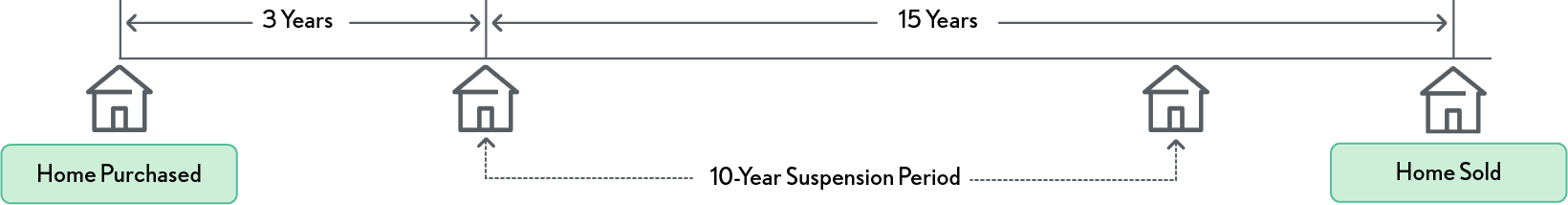

“ Example – Col. Potter owned and lived in his home for 3 years in Virginia until he was stationed overseas in January 2007. He was still overseas in January 2022 when he sold the house. He may disregard just 10 of the 15 years he was overseas, with the result that the 5-year test period covers only years he did not live in the house. Col. Potter will not be eligible for the home sale gain exclusion. ”

-