Exception For Individuals With A Disability (Reg. §1.121-1(C)(2)(Ii))

The IRS provides an exception to the home sale use test in the event that a homeowner is, or becomes, disabled. Specific details are provided below.

There is an exception to the use test if, during the 5-year period before the sale of the home, the taxpayer:

-

Becomes physically or mentally unable to care for themselves, and

-

Owned and lived in the home as their main home for a total of at least 1 year.

Under this exception, the taxpayer is considered to have lived in the home during any time that he or she owns the home and lives in a facility (including a nursing home) that is licensed by a state or political subdivision to care for persons in the taxpayer's condition. A taxpayer meeting this exception to the use test, still has to meet the 2-outof-5-year ownership test to claim the exclusion.

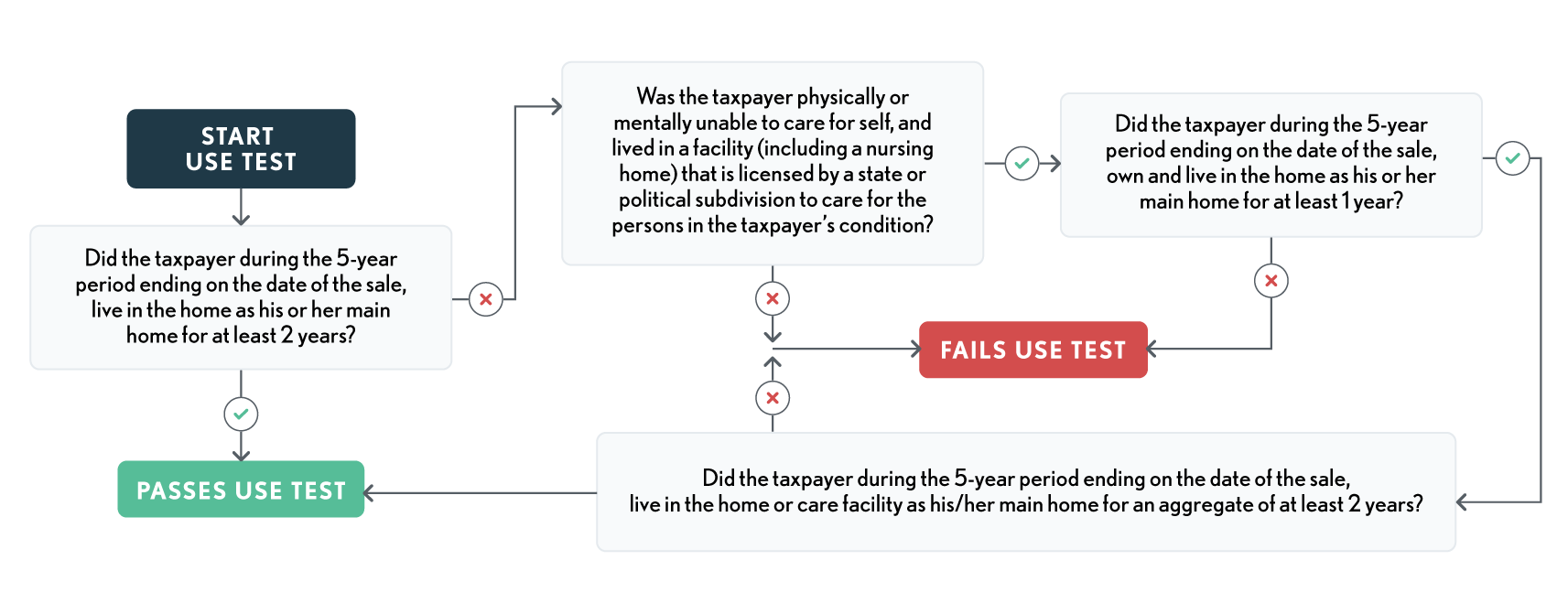

Use Test Qualification Chart - Before using this chart, refer to the Use Test Chart for each taxpayer to see if they meet the use test or use test exemption. CAUTION: This is the use test only - do not confuse it with the separate ownership test.