Gain Attributable to Non-Qualified Periods Not Excludable (Sec 121(B)(5))

With the rise of AirBnb, VRBO, and other vacation rental services, an ever-increasing number of homeowners own residences they don't live in. There are also those families who own private vacation homes or generational homes that are no longer principal residences.

If one of these types of properties is sold, the sellers may not be eligible for the home sale tax exclusion due to a 2009 IRS rule.

Effective for sales beginning in 2009, the amount of gain allocated to periods of non-qualified use is the amount of gain multiplied by a fraction the numerator of which is the aggregate periods of nonqualified use during the period the property was owned by the taxpayer and the denominator of which is the period the taxpayer owned the property. Gain allocable to the nonqualified use period is not eligible for the exclusion.

Non-Qualified Use

A period of non-qualified use means any period during which the property is not used by the taxpayer or the taxpayer's spouse or former spouse as a principal residence except as noted below. Examples of nonqualified use include using the home as a vacation residence, renting it out, allowing a relative to live in it, and simply letting it stand vacant. For this purpose, periods of nonqualified use do not include any period:

-

Before January 1, 2009,

-

After the last date the property is used as the principal residence of the taxpayer or spouse (regardless of use during that period), and,

-

Not to exceed two years that the taxpayer is temporarily absent by reason of a change in place of employment, health, or, to the extent provided in regulations, unforeseen circumstances.

The present-law election for the uniformed services, Foreign Service and employees of the intelligence community is unchanged.

If any gain is attributable to post-May 6, 1997 depreciation, the exclusion does not apply to that amount of gain and that gain is not taken into account in determining the amount of gain allocated to nonqualified use.

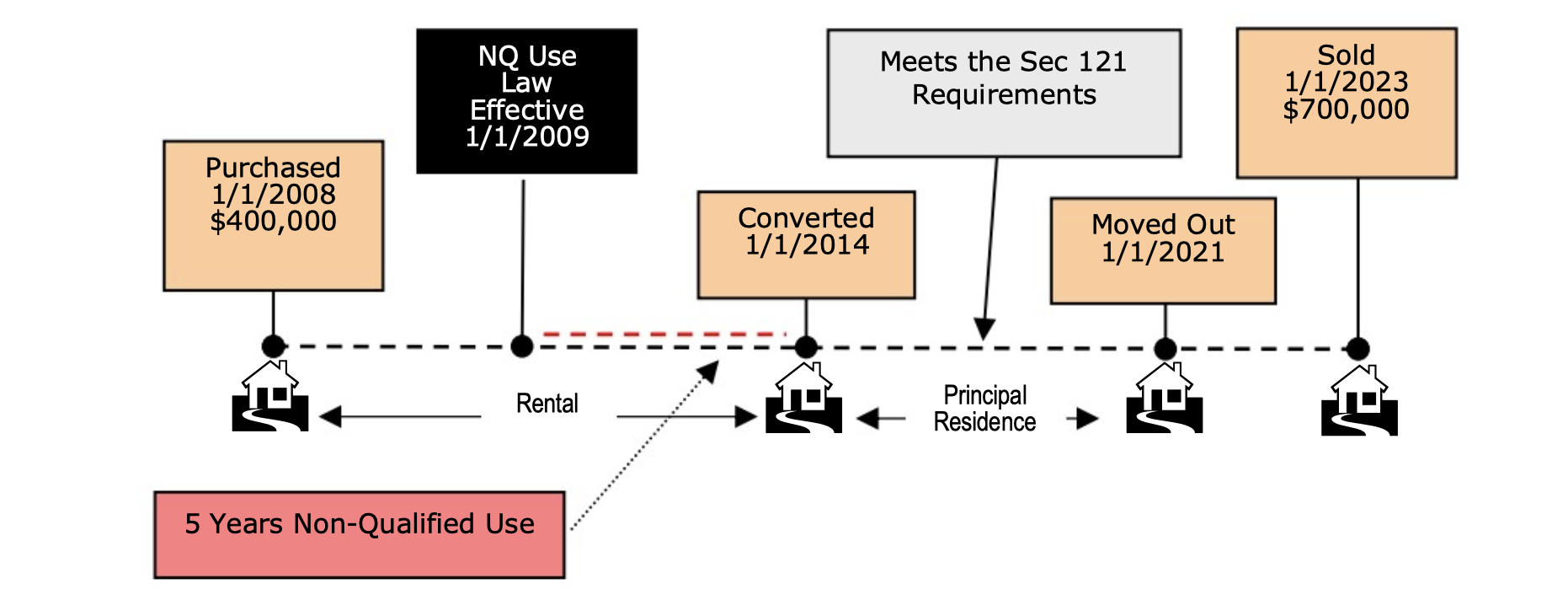

Example – Assume that a married couple buys a property on January 1, 2008, for $400,000, and uses it as rental property for five years claiming $30,000 of depreciation deductions. On January 1, 2014, the taxpayers convert the property to be their principal residence. On January 1, 2021, the taxpayers move out, and they sell the property for $700,000 on January 1, 2023.

-

Without considering purchase or sales costs and assuming there were no improvements or other basis adjustments, the sale would result in a gain of $330,000 ($700,000 – (400,000 – 30,000)). The $30,000 gain attributable to the depreciation deductions is included in income. Of the remaining $300,000 gain, 33.3% of the gain (5 years (2009-2014) of non-qualified use divided by the 15 years of total ownership), or $99,900 is attributable to the non-qualified use period. Since it is less than the maximum gain of $500,000 that may be excluded, the remaining gain of $200,010 ($300,000 - $99,900) is excluded from gross income.