Gain Exclusion When Home Acquired Via Tax-Deferred Exchange

When a home is acquired by its owner in a tax-deferred exchange, there are specific IRS rules that apply to eligibility for the home sale gain exclusion.

Taxpayers will sometimes occupy a property that has been used as a rental and then live in that property long enough to meet home sale gain exclusion qualifications (own and use as their primary residence for the two out of five years prior to sale). They then qualify for the exclusion to the extent the gain exceeds the taxable depreciation recapture. Taxpayers can also exchange other real estate property for a single-family residence and then later occupy that residence. If the ownership and use tests are subsequently met, the home sale exclusion can be utilized to the extent the gain exceeds the taxable depreciation recapture.

Five-Year Ownership Requirement

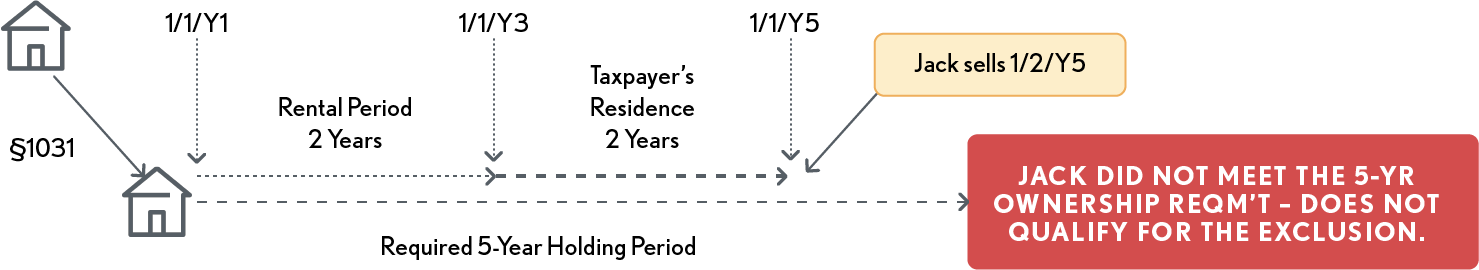

If a home was originally acquired via a §1031 tax-deferred exchange, the home must be owned for a minimum of five years before the home sale exclusion can be utilized, provided the taxpayer also meets the 2-year use test. (Code Sec. 121(d)(10)).

“ Example – Exclusion not Qualified - On 1/1/Yr#1 Jack acquires a residence to be used as rental property in a §1031 tax-deferred exchange. Jack rents the residence to unrelated parties during Years #1 and #2. Then on 1/1/Yr#3, Jack moves into the rental and uses it as his principal residence until he sells it on 1/2/Yr#5. Because Jack acquired the residence in a tax-deferred like kind exchange four years before the date of the sale, the five-year holding period has not been satisfied. Therefore, Jack does not qualify for the §121 home gain exclusion even though he met the two-year ownership and use requirements for the exclusion. ”

-

Reduced Exclusion - This 5-year ownership restriction also applies to partial exclusions. Under the §121 reduced exclusion rules, a taxpayer who does not meet the two-year ownership and use requirements by reason of a change in place of employment, health or unforeseen circumstances is allowed a prorated exclusion as discussed later in this course. However, partial exclusions DO NOT apply to a home acquired via a §1031 tax-deferred exchange unless the five-year ownership requirement is met.

Transfer Date – The five-year period begins on the date the property is acquired.

Like-Kind Property - For a like-kind exchange to be tax-deferred under §1031, both the property exchanged (“relinquished property”) and the property received in the exchange (“replacement property”) must be held by the taxpayer either for productive use in a trade or business or for investment. Neither may be used for personal purposes, such as a residence. (Code Sec. 1031(a)(1); IRS Pub No.544 (2021), p. 12) A limited exception applies for certain vacation home rentals that have been used personally – see Chapter 3.20.

Possible Scenarios – Virtually any real estate within the U.S. exchanged for any other real estate in the U.S. is considered like for like under §1031, provided that both the property relinquished, and the property acquired in the exchange are used for the active conduct of a trade or business or held for investment. It also must be your client’s intent to acquire the replacement property for business or investment; if that is not the case, the replacement property is not like-kind. Since both primary and second homes (not rented) are “personal use” property and not “business or investment,” they are NOT like-kind real estate. The following are some possible acceptable scenarios you may encounter:

-

Vacant land §1031 exchanged for residential rental then converted to primary residence.

-

Residential rental §1031 exchanged for residential rental then converted to primary residence.

-

Residential apartment building §1031 exchanged for residential rental then converted to primary residence.

-

Commercial real estate §1031 exchanged for residential rental then converted to primary residence.

Intent – Intent is an important issue., If a taxpayer exchanges into a property with the intent of not using that property for business or investment, then the property is not like-kind and therefore would not qualify for gain deferral., There is little to go on in regards to “intent” other than the two citations below:

-

Click, Dollie (1982) 78 TC 225 - If a taxpayer had an intent at the time of the exchange to make a gift of the exchange property (i.e., the replacement property received in the exchange), the exchange does not qualify as a like-kind exchange because the taxpayer did not intend to hold the replacement property for productive use in a trade or business or for investment., For example, an exchange didn't qualify for nonrecognition treatment, where seven months after the exchange of a farm for two residential properties, the taxpayer gave the residential properties to her two children and their families who then occupied them. The children selected the properties and paid insurance on them from the inception. Furthermore, the taxpayer was 72 years old and was working on an estate plan with her attorney. Under those circumstances, the court held that the taxpayer acquired the residences with the intent of making gifts of them to her children and not to hold as investments.

-

IRS Letter Ruling 8429039 - Exchange by a trust where the trust represented that the property to be received would be held for productive use in a trade or business or for investment for a period of at least two years after the exchange. Under the facts of the ruling, the trust owned a beach house that had been rented out. An individual who owned a personal residence wanted to exchange the residence for the beach house held by the trust. The residence had been rented to an unrelated party. The trust represented that the property to be received would be held as rental property for at least two years. IRS ruled that the two year period is sufficient to ensure that the residence to be acquired will meet the holding period test prescribed by Code Sec. 1031.

Note: In the case of exchanges between related persons, non-recognition treatment under Code Sec. 1031 doesn't apply if either the property transferred or the property received is disposed of within two years after the exchange. (Code Sec. 1031(f))