Reinvesting Gain From Qualified Opportunity Funds

Discover the IRS tax rules that apply to reinvesting gain earned via qualified opportunity funds.

Starting in 2018, a taxpayer who has a capital gain on the sale or exchange of any property to an unrelated party may elect to defer, and potentially partially exclude, the gain from gross income if the gain is reinvested in a QOF within 180 days of the sale or exchange. Due to the Covid-19 pandemic, Notices 2020-23, 2020-39 and 2021-10 provided additional time beyond 180 days for taxpayers to invest in a QOF if the 180th day would have fallen on or after April 1, 2020, and before March 31, 2021.

Only one election may be made with respect to a sale or exchange. If less than the full amount of the gain is reinvested in the QOF, the part not reinvested is taxable as usual in the sale year. Unlike Sec 1031 deferrals, the amount of the gain, not the amount of the proceeds of sale, is what needs to be reinvested in order to defer the gain.

Making the Election

The IRS has developed Form 8997 to be used by an investor in a QOF to inform the IRS of the QOF investments and deferred gains held at the beginning and end of the current tax year, as well as any capital gains deferred by investing in a QOF and QOF investments disposed of during the current tax year. In addition, if electing to defer gain into a QOF from a sale in the current tax year, Form 8949 is also required.

According to the instructions of the 2021 Form 8949, when electing to defer the gain on an eligible asset, report the sale as usual on Form 8949, and then report the deferral of the eligible gain on its own row of Form 8949 (Part I with box C checked if short-term gain or Part II, box F, if long-term gain). If multiple investments were made in different QOFs or in the same QOF on different dates, a separate row needs to be used for each investment. If eligible gains of the same character (i.e., ST or LT) but from different transactions on the same date were invested in the same QOF, these can be grouped on the same row. In column (a), enter only the EIN of the QOF into which the investment was made and in column (b), enter the date of the investment. Leave columns (c), (d) and (e) blank, and enter code Z in column (f) and put the amount of the gain being deferred as a negative number in column (g).

There is no need to trace or allocate the funds invested in a QOF to the specific gain being deferred, but the QOF investment must have occurred within the 180-day period beginning on the date the deferred gain was realized. If both short-term and long-term gains were realized during the 180-day period the taxpayer can choose how much of each gain to defer by reporting the deferral in Part I or Part II, as applicable. The character of the eligible gain transfers to the investment in the QOF so that when the eligible gain is recognized, the gain recognized will be the same character as the gain deferred.

Deferral Period

The gain income is deferred until the earlier of the date the investment in the QOF is sold or December 31, 2026. If the taxpayer continues to hold the investment after December 31, 2026, the taxpayer still has to include the deferred gain in the 2026 tax return. If that is the case, the gain reported in 2026 adds to the basis of the QOF.

Qualified Opportunity Fund Basis

To the extent the QOF is purchased with the deferred gain, the basis in the QOF is zero. Then when the QOF is sold, the deferred gain subject to tax is the excess of the lesser of (a) or (b), below, over the QOF’s basis (or enhanced basis (explained next), if applicable):

-

The deferred gain, or

-

The fair market value of the investment as determined at the end of the deferral period.

Enhanced Basis

If the taxpayer holds the QOF for 5 years, the basis of the QOF investment is increased by 10% of the deferred gain, and if held for 7 years, the basis is increased by an additional 5%, for a cumulative increase of 15%. In other words, if held at least 5 years, 10% of the original gain is excluded, or if held 7 years, 15% of the original gain is excluded. When the deferred gain is included in income – either as of 12/31/2026 or when sold, if before 12/31/2026 – the amount of the deferral that is taxable also increases basis. (IRC Sec.1400Z-2(b)(2)(B)(ii))

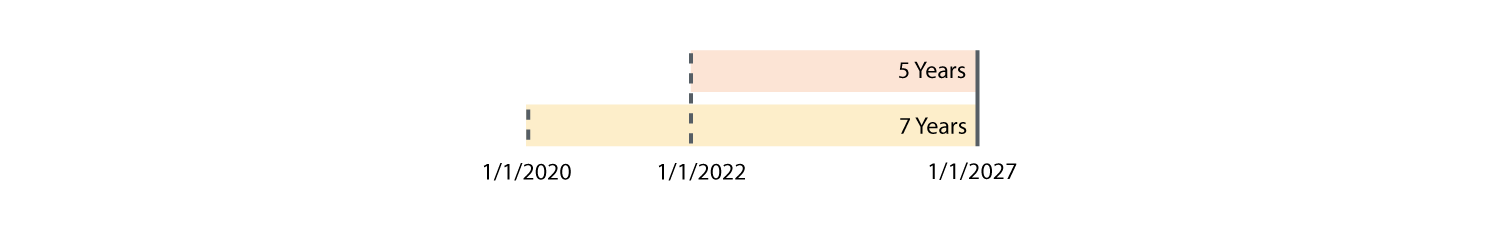

CAUTION: Because only gains incurred before 2027 can be deferred, time has expired on the extra 5% basis increase, since the gain must have been incurred before 1/1/2020 (see adjacent diagram). That means gains incurred after 2019 will not qualify for the 5%. In addition, to qualify for 10% basis adjustment the gain must be incurred before 2022, meaning gains after 2021 will not qualify for the 10% basis adjustment.

10 Year Election

If the QOF is held for 10 years or longer before it is sold, the taxpayer can elect to increase the basis to the fair market value amount. The effect of this adjustment is that none of the appreciation since the QOF was purchased is taxable when it is sold. This provision applies only to the investment in the QOF that was made with deferred capital gains. (Prop. Reg. 1.1400Z-2(c)-1(a))

All qualified opportunity zones now in existence will expire on December 31, 2028. So, after the relevant qualified opportunity zone loses its designation, will investors still be able to make a basis step-up election for QOF investments from 2019 and later? Yes, according to final regulations. Although the statute doesn’t so specify, the regulations would permit taxpayers to make the basis step-up election under section 1400Z-2(c) after a qualified opportunity zone designation expires for dispositions of QOFs up to December 31, 2047. (Reg. 1.1400Z-2(c)-1(b))

Example: Phil sold a rental apartment building August 30, 2021, for $3 million, which resulted in a capital gain of $1 million. He invests the $1 million within the statutory 180-day window into a QOF and elects the temporary gain deferral exclusion. On October 1, 2026, Phil sells his interest in the QOF for $1.5 million. Since Phil had held the investment over five years, his basis is enhanced by $100,000 (10% of $1 million deferred).Since the QOF included in the example had done well and appreciated to $1.5 million, the long-term capital gain reported by Phil would be:

-

Sales Price $1,500,000

Basis Enhancement (10% of $1 million deferred) < 100,000>

Reportable 2026 Capital Gain $1,400,000

Had Phil not sold the QOF until 2032, and if the value of the QOF as of 12/31/2026 was greater than his deferred gain, he would have paid tax on the entire $1 million of deferred gain when he filed his 2026 tax return. His basis is then $1,000,000. When he sells the QOF in 2032 for the fair market value of $2,000,000, having held the QOF investment for 11 years (more than the 10 years required to make the FMV election), Phil can elect to treat the fair market value as his basis and will have no taxable income ($2,000,000 sales price - $2,000,000 basis). Thus, he was able to defer for over 5 years paying tax on the original gain from selling the apartment and pays no tax on the $500,000 appreciation of the investment in the QOF.

However, if Phil had sold his QOF before holding it for 10 years, he would not have been able to exclude all the appreciation.

Mixed Investments

Investment in a QOF isn’t limited to deferred capital gain from the sale of another asset; a taxpayer can purchase an interest in a QOF with other funds. Where a taxpayer’s investment in a QOF consists of both deferred gain and additional investment funds, the investment is treated as two separate investments with the tax benefits of both the gain deferral election and the 10-year gain exclusion election applying only to the deferred gain portion.

Qualified Opportunity Funds (QOF)

To take advantage of the tax deferral of gains available from the TCJA-enacted opportunity zone program, taxpayers must invest in a QOF, which is any investment vehicle which is organized as a corporation or a partnership for the purpose of investing in qualified opportunity zone property (other than another qualified opportunity fund) acquired after December 31, 2017. The fund must hold at least 90% of its assets in qualified opportunity zone property, determined by the average of the percentage of qualified opportunity zone property held in the fund on the last day of the first 6-month period of the fund’s tax year and on the last day of the fund’s tax year. Taxpayers may not invest directly in QOZ property.

Partnerships

Because the basis of the QOF purchased with deferred capital gains is zero, taxpayers that invest in QOFs organized as a partnership may be limited in deducting losses that may be generated by these partnerships.

Qualified Opportunity Zones (QOZ)

These are population census tracts that are low-income communities that are specifically designated as QOZs after being nominated by the governor of the state or territory in which the community is located and then certified as a QOZ by the Treasury Secretary. Qualified opportunity zones retain this designation for 10 years.

The boundaries of the designated QOZs were established at the time they were designated and are not subject to change, even if the 2020 census results in a change to the boundaries of a census tract. Similarly, if the 2020 census results in a change to a 2010 census tract number listed in Notice 2018-48 and Notice 2019-42 and associated with a designated QOZ, the 2010 census tract number continues to apply for purposes of identifying the designated QOZ. (IRS Announcement 2021-10)

State Treatment

Most states have adopted some form of full or partial tax conformity, or don’t tax capital gains. The states that have not yet conformed to the OZ program include California, Mississippi, New York (as part of fiscal year 2022 budget, decoupled from the federal provision effective for tax years beginning on or after Jan. 1, 2021) and North Carolina.