Dividend Income and Taxes

The IRS has specific rules regarding how dividend income should be treated on federal income tax returns.

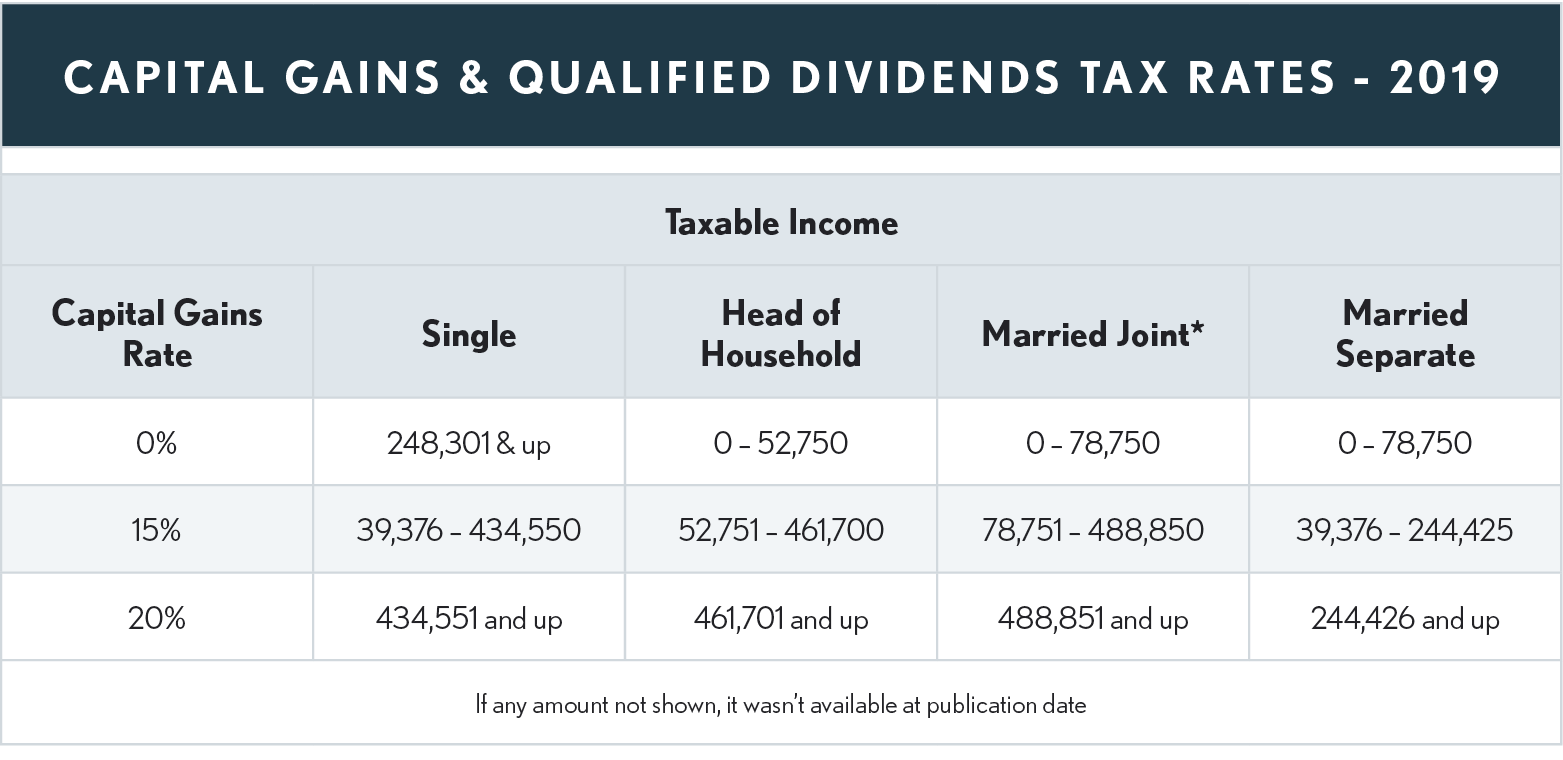

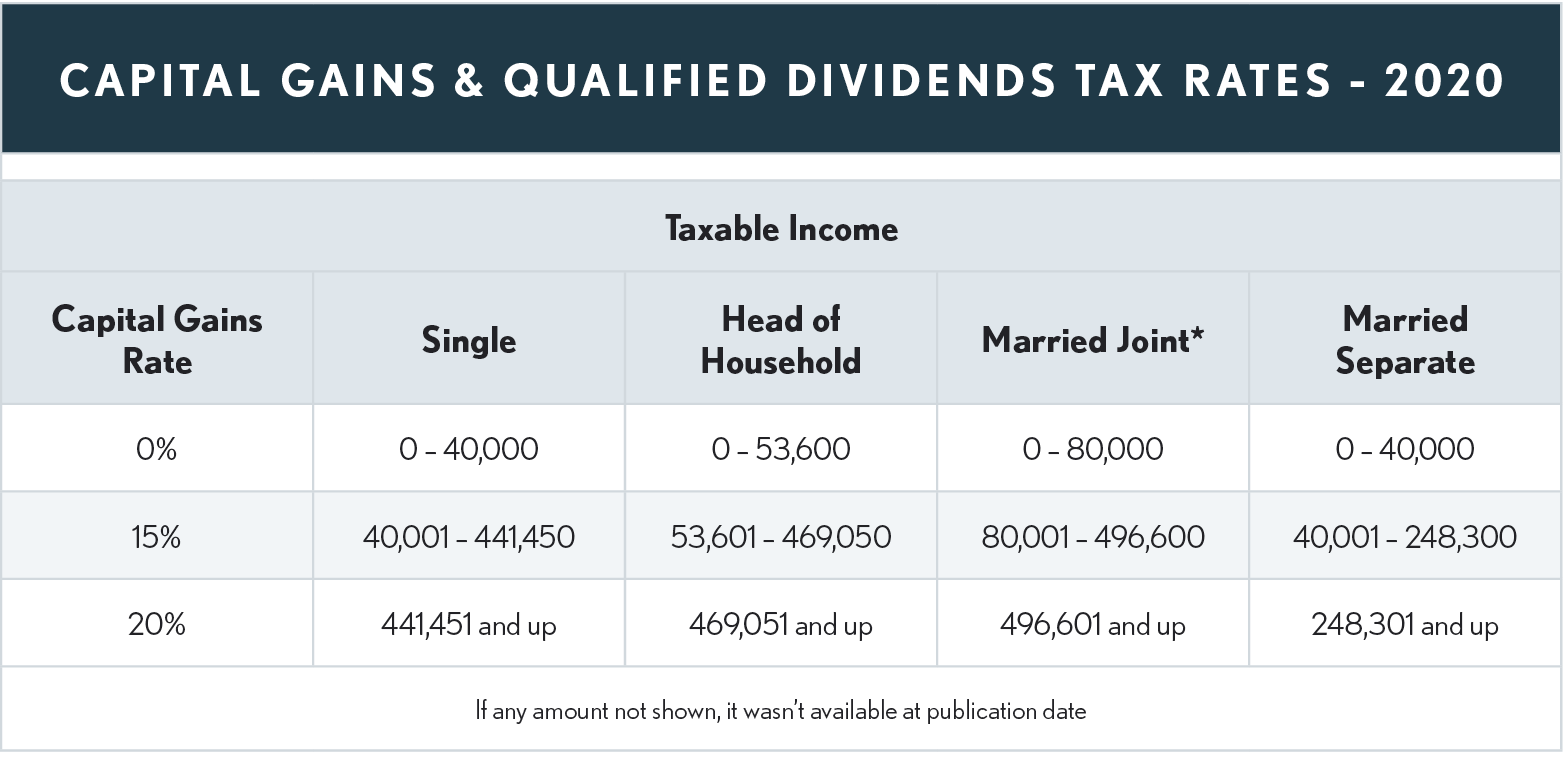

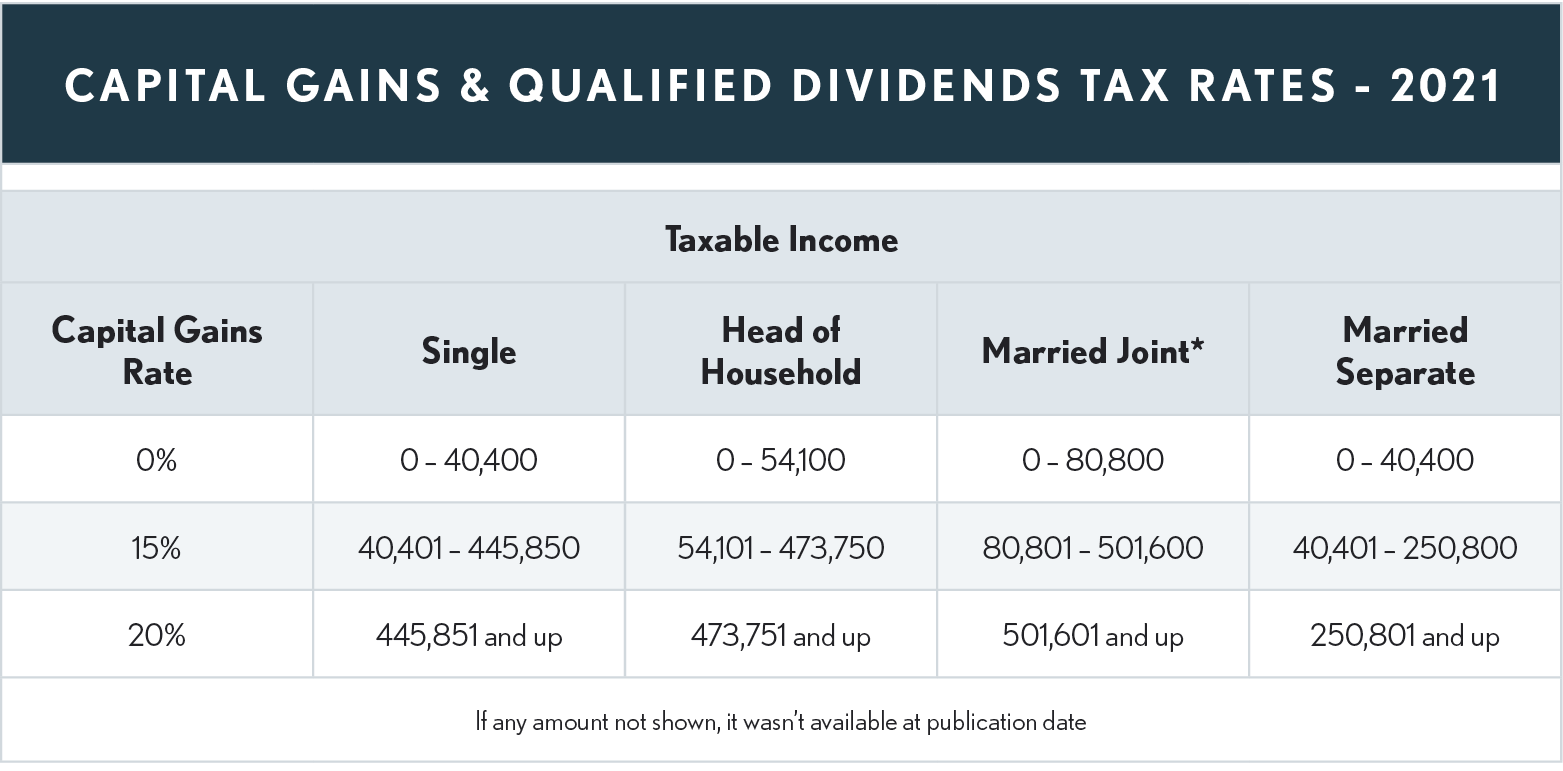

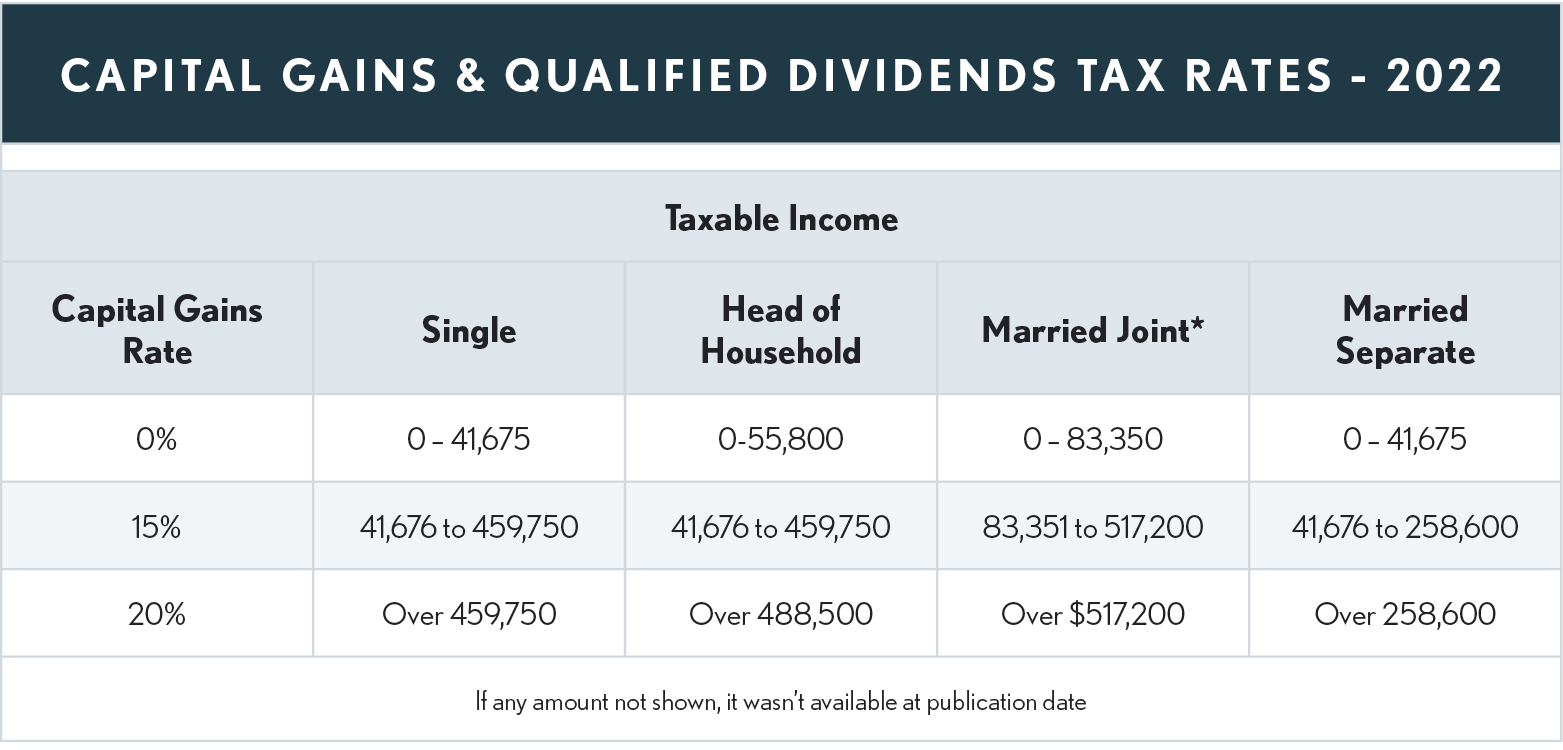

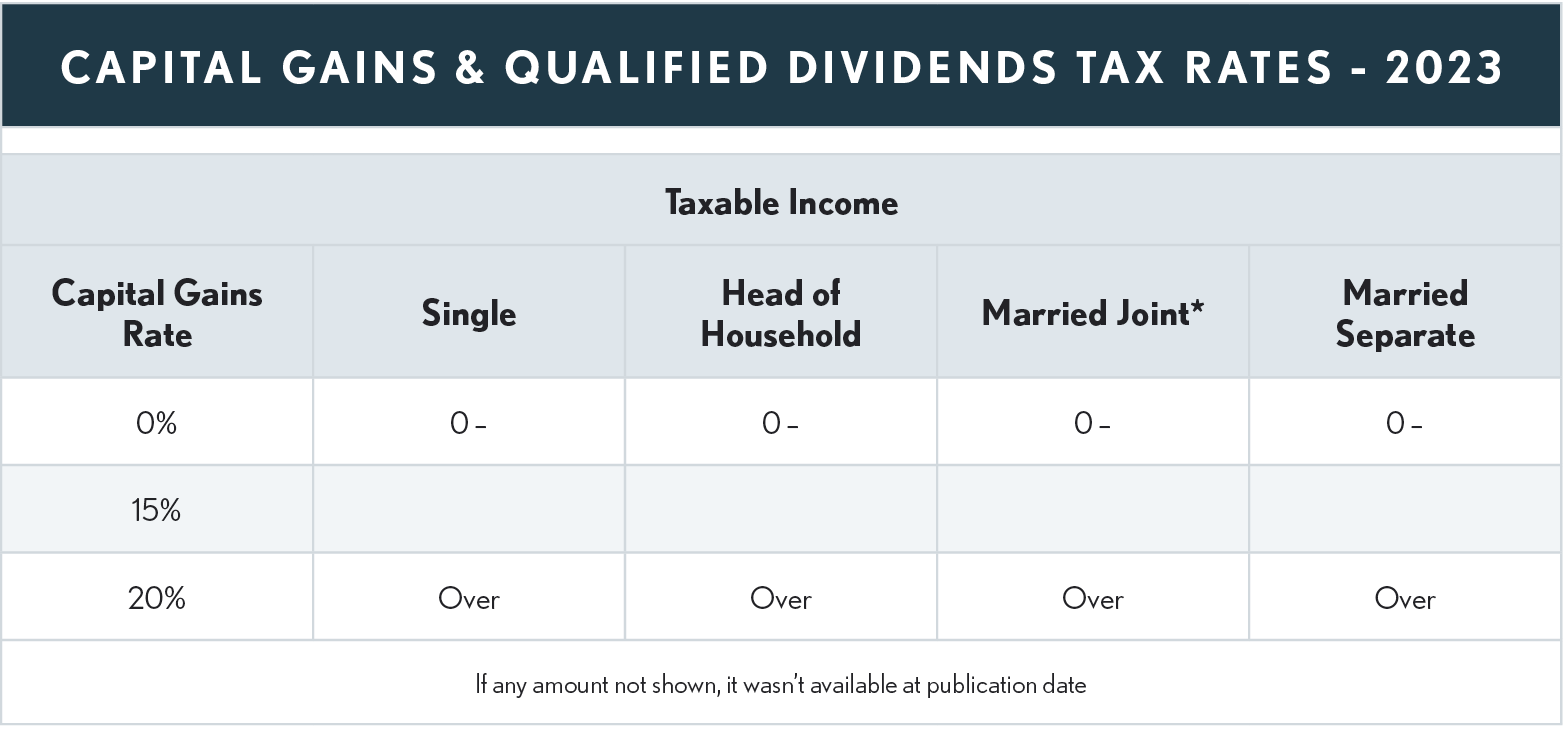

“Qualified” dividends from domestic corporations and qualified foreign corporations received by noncorporate taxpayers are treated as net capital gain taxed at 0%, 15% or 20% determined according to the taxpayer’s taxable income as shown in the following tables. Prior to 2018, the rate breakpoints exactly matched the breakpoints for the ordinary income tax brackets. The TCJA revised the breakpoints, and they no longer exactly match the ordinary tax bracket breakpoints but are annually adjusted for inflation. The capital gains rates apply for both regular income tax and alternative minimum tax.

*also includes Qualifying Widow(er)

Qualified Dividend Income Does NOT Include

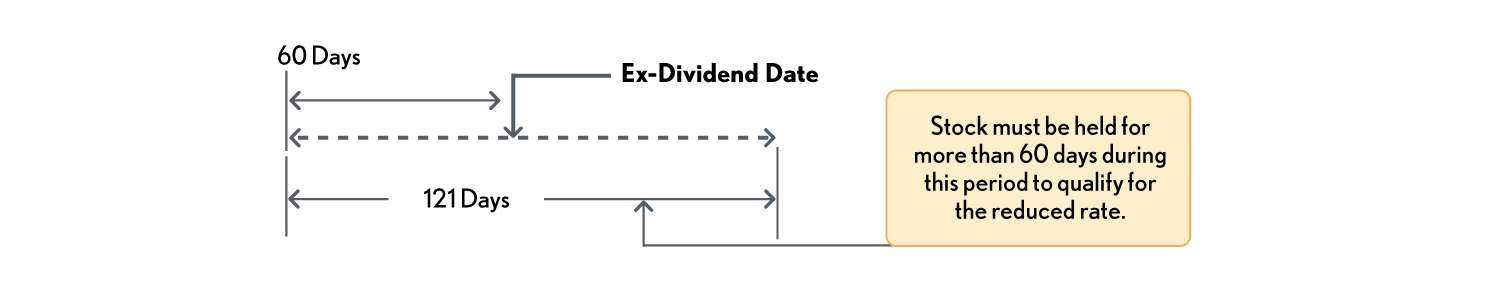

• Dividends on stock not held for more than 60 days during the 121-day period beginning 60 days before the ex-dividend date (longer for preferred stock – see below). (Code Sec. 1(h)(11)(B)(iii)(I))

If a taxpayer receives dividends with respect to preferred stock which are attributable to a period or periods aggregating more than 366 days, the holding period is 90 days during the 181-day period beginning 90 days before the ex-dividend date.

Example – Jeff bought 500 shares of To the Moon (TTM) Corp. on July 6, 2022 and sold the shares on August 9, 2022. TTM paid a 20 cents per share cash dividend, with an ex-dividend date of July 12. The $100 dividend Jeff received is not a qualified dividend because he only held the stock for 34 days during the 121-day testing period.This is so even though the 1099-DIV reports it in both boxes 1a (ordinary dividends) and 1b (qualified dividends).

-

Moral of this story: you can’t depend on the 1099-DIV to properly report the qualified dividend amount.

-

Dividends on any share of stock to the extent that the taxpayer is under an obligation (whether pursuant to a short sale or otherwise) to make related payments with respect to positions in substantially similar or related property. (Code Sec. 1(h)(11)(B)(iii)(II)) Also see Payment in Lieu of Dividends below.

-

Any amount taken into account as investment income under Code Sec. 163(d)(4)(B) (which treats qualified dividend income as investment income only where taxpayer so elects) allowing the dividend to support a deduction for investment interest. (Code Sec. 1(h)(11)(D)(i))

-

Dividends from corporations that are exempt from tax under Code Sec. 501 (charitable, religious, scientific, etc., organizations) or Code Sec. 521 (farmers' cooperatives).

-

Amounts allowed as a deduction under Code Sec. 591 (dividends paid by mutual savings banks).

-

Dividends paid on employer securities held by an employee stock ownership plan (ESOP). (Code Sec. 1(h)(11)(B)(ii))

What is a Dividend?

A dividend is defined in Code §316 as a distribution by a corporation to its shareholders out of its current or accumulated earnings and profits. The distribution, therefore, must be:

-

Made by a corporation, not some other kind of entity,

-

Must be received by shareholders, in their capacity as shareholders, not by lenders, employees or customers, and

-

The corporation must have earnings and profits.

Types of Dividends and Do They Qualify?

The following is a discussion of the various types of dividends and whether they qualify for the lower rates. Those noted as qualifying will qualify only if the holding period stated above is met.

• Common Stock – Common stock dividends will generally qualify for the lower rate.

-

Preferred Stock – Generally, dividends paid on preferred stock should be eligible for the reduced dividend rate., However, some preferred stock is not preferred stock; it is debt masquerading as preferred stock. It has been developed and marketed to corporations to enable corporations to deduct the distributions as interest expense on the corporate tax return. If the corporation is entitled to an interest expense deduction, it is not preferred stock, and the distributions, with respect to that instrument, are not dividends.

-

Return of Capital - A distribution to shareholders by a corporation without earnings and profits is a return of capital, not a dividend. Return of capital is not taxable but reduces the basis of the investor’s stock. Once basis is entirely recovered, the distribution gets capital gain treatment (long- or short-term depending on how long the stock is held).

-

Mutual Funds – Mutual fund companies pass through earnings to fund holders in the form of ordinary dividends or capital gains. Short-term capital gain distributions from mutual funds are treated as ordinary dividends. Mutual fund ordinary dividends are classified into qualifying and nonqualifying dividends on Form 1099-DIV.

-

Money Market and Bond Funds - Interest on money market and bond funds is taxable as dividend income but may not be qualifying dividends because the mutual fund may not hold the underlying financial instruments for the required time period. The 1099-DIV issued by the fund should identify the portion of the total dividends paid that can be treated as qualified dividends.

-

S Corporations - S corporations are corporations that make distributions to shareholders, but those distributions will, in general, not qualify as dividends for the reduced tax rates. S corporations typically do not have earnings and profits because they are allocated to the shareholders each year for pass through taxation. It is possible for an S corporation to have accumulated earnings and profits from a prior life as a C corporation, and therefore it is possible for an S corporation to pay dividends with respect to those earnings and profits, but that would be the exception rather than the rule.

-

Real Estate Investment Trusts (REITs) - REITs are corporations that make distributions to shareholders. However, they are required to distribute to their shareholders most of the REIT earnings for the year. If some portion of REIT earnings is retained in the REIT, it is taxed at the REIT level, and distributions with respect to those earnings would qualify for the reduced dividend tax rates. Also, if a REIT happened to be a shareholder in a corporation and passed dividends it received from the corporation through to its shareholders, that distribution would also qualify for favorable dividend treatment. These would be exceptions to the general rule; however, most REIT distributions would not qualify for the favorable dividend tax rates., REIT dividends qualify for the Sec 199A deduction (the 20% deduction for pass-through income). See chapter 3.24 for details.

-

Payment in Lieu of Dividends - Brokerage houses typically support the short sale industry by borrowing stock held by customers in brokerage accounts and using the borrowed stock to provide the stock needed by short sellers. If a dividend is paid while the stock is not part of the customer’s account, it has customarily resulted in a payment in lieu of dividend to make sure that the customer received the equivalent of the dividend that would have been received had the stock actually remained in the account. Since these payments are not being made by a corporation with respect to its shareholders, these payments in lieu of dividends would not qualify for the favorable tax treatment accorded dividends. In fact, these payments are reported by the broker on Form 1099MISC (box 8) and not on Form 1099-DIV. They are to be included on the miscellaneous income line of the customer’s Form 1040 (2021) Schedule 1, line 8z) and not on Schedule B.

-

Credit Union Dividends – Dividends from credit unions are not paid from earnings and profits and therefore do not qualify for the lower rates. These payments are reported as interest income on the tax return.

-

Foreign Corporations - The House and Senate had different views as to whether the favorable dividend rates should apply to dividends received from foreign corporations as well as domestic corporations. The result, as with most compromises, is complexity—some foreign corporate dividends meet the definition of qualified dividend income, while others do not. In general, for dividends from a foreign corporation to qualify for favorable treatment, the foreign corporation must be (1) incorporated in a U.S. possession, (2) traded on a U.S. exchange or (3) incorporated in a country covered by a comprehensive tax treaty with the United States (see Table 1-3 in IRS Pub 550 for a list of these foreign countries).

Dividends & Investment Income

Dividends qualifying for the reduced tax rates are not considered investment income for purposes of the investment interest deduction calculation unless the taxpayer elects to have them taxed at ordinary rates in the same manner as the election to treat capital gains as investment income. Dividends are treated as investment income for the 3.8% surtax on net investment income.

Exempt-Interest Dividends

Exempt-interest dividends received from a regulated investment company (mutual fund) are not included in taxable income. However, these payments must be reported on the return for information purposes and may affect the taxability of Social Security benefits. Payers include exempt-interest dividends on Form 1099-DIV, box 11. Exempt-interest dividends paid by the fund on private activity bonds will be shown in box 12 of the 1099-DIV. These dividends are generally subject to AMT in the same way as directly-paid private activity bond interest as explained in the “Interest Income” section below.

Dividends & AMT

Qualified dividends are taxed at the capital gains rate for both regular income tax and alternative minimum tax.

Retirement Accounts

There is no tax benefit associated with dividends qualifying for the lower rates that are earned within a qualified retirement account. Just as capital gains earned in retirement accounts do not qualify for favorable capital gain treatment when eventually distributed, dividends earned in those retirement accounts will not qualify for the favorable dividend rates when eventually distributed. Payers of dividends do not issue 1099-DIV forms for dividends paid to IRA or other retirement accounts.