Employment-Related Judgments & Settlements

Below, discover how American taxpayers are required to report employment-related judgments and settlements, according to the Internal Revenue Service (IRS).

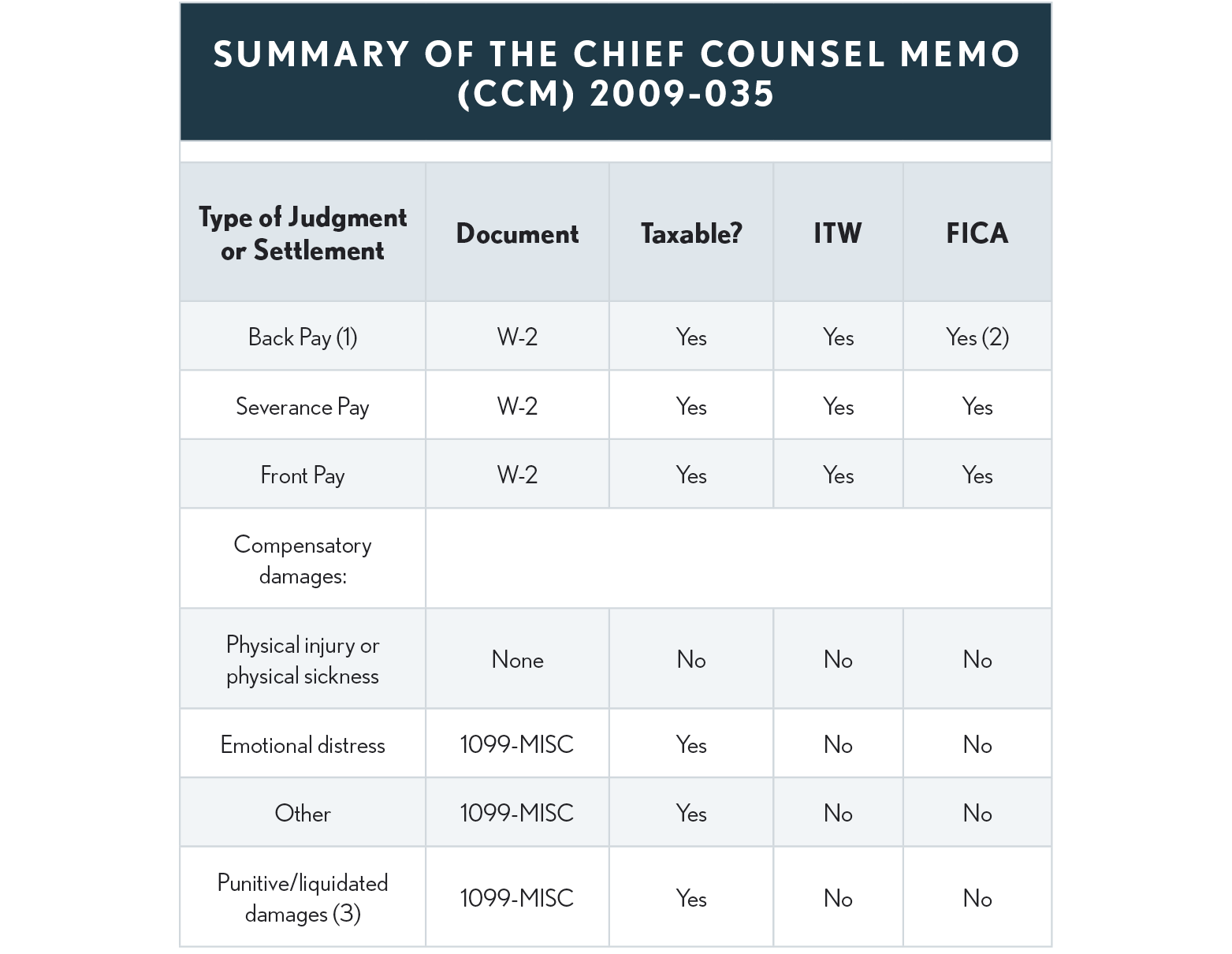

The following table is a summary of the Chief Counsel Memo (CCM) 2009-035, which details IRS's position on how to handle the income and employment tax consequences and reporting duties relating to employment related judgments and settlements.

-

Back pay (other than for lost wages received on account of personal physical sickness or physical injury) is taxable, subject to FICA and income tax withholding (ITW) and must be reported on Form W-2. The CCM reiterates IRS's rulings’ position that back pay awarded for an illegal refusal to hire is wages for federal employment tax purposes but acknowledges the Eighth Circuit's decision to the contrary in Newhouse v. McCormick & Co., (CA 8 10/2/1998). There, the Eighth Circuit (covering Minnesota, North and South Dakota, Iowa, Nebraska, Missouri, and Arkansas) held that FICA tax and ITW do not apply unless an actual employer-employee relationship existed.

-

FICA tax based on rates and limits for year paid and included on a W-2 in the year of payment. However, IRS Pub. 957 notes that payments for back pay awarded under a statute will remain posted to the employee's social security earnings record in the year reported on Form W-2, unless the employee or employer notifies the SSA of such a payment, via a separate special report procedure explained in IRS Pub. 957.

-

See exception for wrongful death under physical sickness or physical injury