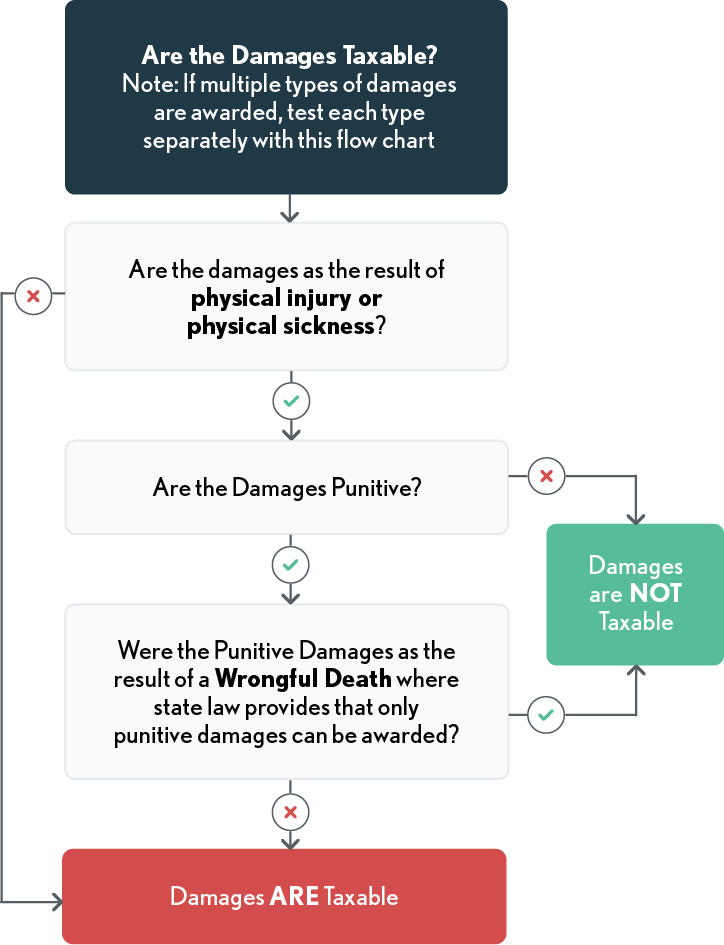

Damages Received Due to Physical Injury or Sickness

When an employer receives damages due to physical injury or sickness, the IRS has specific income reporting regulations.

Damages received on account of personal physical injuries or physical sickness are excludable from income whether:

-

Recovery is by suit or agreement, or

-

Amounts are received as a lump sum or in periodic payments.

Damages for personal injuries are monetary amounts (other than worker's compensation payments) received as the result of a judgment or settlement. Final regulations removed the requirement that, to qualify for exclusion from gross income, damages received from a legal suit, action or settlement agreement must be based upon “tort or tort type rights.” Instead, the exclusion may apply to damages recovered for a personal physical injury or physical sickness under a statute that does not provide for a broad range of remedies, and that the injury need not be defined as a tort under state or common law. For example, damages for personal physical injuries or physical sickness awarded under “no-fault” statutes are eligible for exclusion.

When an action originates with a physical injury or physical sickness, then all damages (other than punitive) are treated as payments due to physical injury or physical sickness (whether or not the recipient of the damages is the injured party).

Wrongful Death – Is considered physical injury or physical sickness for purposes of the income exclusion. In addition, where state law provides that only punitive damages can be awarded in wrongful death suits, punitive damages are excludable (Code Sec. 104(c)).

Emotional Distress - Emotional distress isn’t considered physical injury or physical sickness for purposes of the income exclusion.

Employment Discrimination - No exclusion is allowed for damages received in a suit involving employment discrimination or injury to reputation, which is accompanied by a claim of emotional distress. However, the exclusion would apply to a claim of emotional distress, which was related to a physical injury or physical sickness.