Insurance Information Reporting Rules

The Tax Cuts and Jobs Act (TCJA) of 2017 added new IRC Section 6050Y information reporting rules for “reportable policy sales” of life insurance contracts and “reportable death benefits” paid after December 31, 2017. The IRS issued proposed regulations, NPRM REG-103083-18, in late March 2019, and final regulations were issued in late October 2019 (T.D. 9879) and apply to reportable policy sales made and reportable death benefits paid after December 31, 2018. Transition relief applies.

A reportable policy sale is the direct or indirect acquisition of an interest in a life insurance contract, if the acquirer has no substantial family, business, or financial relationship with the insured other than the acquirer’s interest in the life insurance contract. A reportable death benefit is any amount paid by reason of the death of the insured under a life insurance contract that has been transferred in a reportable policy sale.

Under Sec 6050Y(a)(1), any person who acquires a life insurance contract or any interest in a life insurance contract in a reportable policy sale during a tax year must file a return for the tax year (at the time and in the manner as the Secretary of the Treasury shall prescribe) that includes the:

-

Name, address, and TIN of the reporting person and of each recipient of payment in the reportable policy sale;

-

Date of the sale;

-

Name of the issuer of the life insurance contract sold and the policy number of the contract, and

-

Amount of each payment (defined in Sec 6050Y(d)(1) as the amount of cash and the fair market value of any consideration transferred in any reportable policy sale).

In addition, the person required to file the return must furnish to each person named in the return a written statement showing (1) the name, address, and phone number of the information contact of the person required to make the return, and (2) the information required to be shown on the return with respect to such person (except that in the case of an issuer of a life insurance contract, the statement is not required to include the amount of each payment). (Code Sec 6050Y(a)(2))

There is also a requirement that the life insurance company, upon receipt of the statement described above or upon notice of a transfer of a life insurance contract to a foreign person, must file an information return that reports the name, address and TIN of the seller who transfers an interest in the contract, the seller’s investment in the contract and the policy number of the contract. (Code Sec 6050Y(b)(1))

Every person required to file a return reporting the seller’s basis must furnish to each person whose name is required to be reported in the return a written statement showing (1) the name, address, and phone number of the information contact of the person required to file the return, and (2) the information required to be shown on the return with respect to each seller whose name is required to be set forth in the return. (Code Sec 6050Y(b)(2))

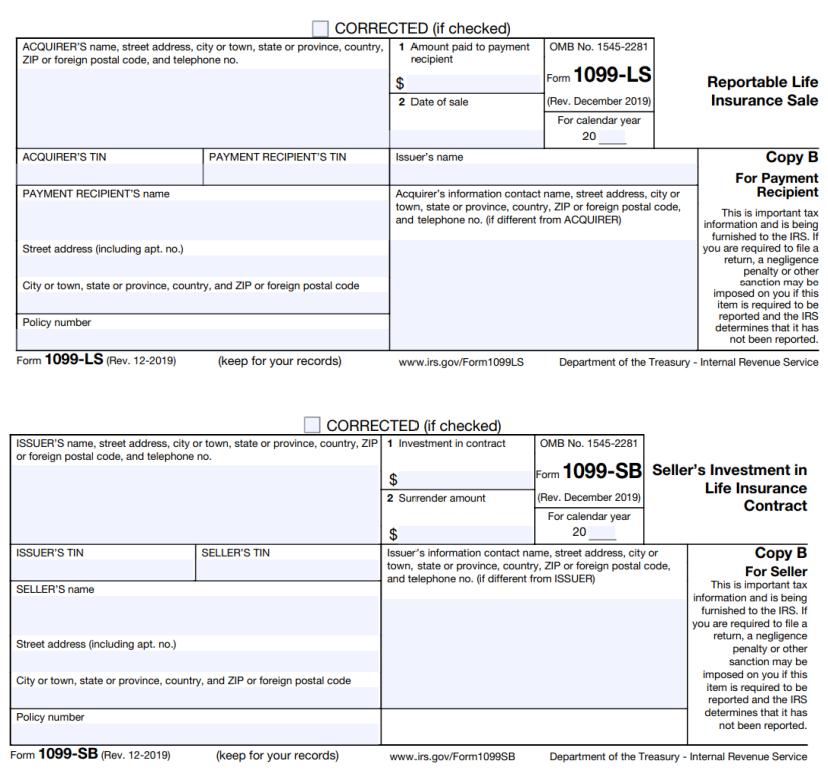

The IRS has developed two forms for these Sec 6050Y filing requirements: 1099-SL, Reportable Life Insurance Sale, and 1099-SB,Seller's Investment in Life Insurance Contract. As of June 2022, the IRS has not updated the 12/2019 versions shown below.

California Differences

California follows Federal taxation rules.