Incentive Stock (Statutory) Options

Note

Under TCJA the AMT exemption amounts have been increased and the phase-out threshold for the exemptions has been substantially increased (see Chapter 8.). As a result, larger blocks of incentive option stock can be exercised and held long term without triggering the AMT. Of course you will have to run the numbers to determine where the AMT is triggered.

An incentive stock option (ISO) -- sometimes called a statutory stock option -- is typically awarded to members of a company's upper management for retention or to reward performance. There are several regulations that apply to these plans, including the fact that they must have an accompanying document denoting how many options are allotted to which employees.

If the option is an incentive stock option, generally no amount of income is included in income either at the time the option is granted or at the time it is exercised. Income or loss is recognized when the stock is sold. If the stock acquired under the option is held for:

-

More than 1 year after the stock option was exercised, and

-

More than 2 years after the option was granted,

the gain or loss from the sale of the stock is generally a capital gain or loss. The gain for regular tax purposes will be the difference between the exercise price and the sales price. If the stock is sold prior to the required holding period, the income to the extent of the bargain element will be treated as ordinary income (wages).

No FICA Tax on ISOs

Both the income from exercising an ISO and the proceeds received upon disposition of the stock acquired in exercising the ISO are exempt from FICA tax. Thus, if not considered FICA wages, the income from exercising the ISO won’t be subject to the extra 0.9% Medicare (Hospital Insurance) withholding when wages exceed $200,000. This also means that the ISO income isn’t taken into account for purposes of determining Social Security benefits. (This provision does not apply to nonstatutory stock options; when income from a nonstatutory stock option is recognized, it is subject to FICA.) However, when the stock acquired from the ISO is sold in a qualifying disposition, any capital gain from the sale is considered investment income for purposes of the 3.8% surtax on net investment income when the taxpayer’s MAGI exceeds the NII MAGI threshold.

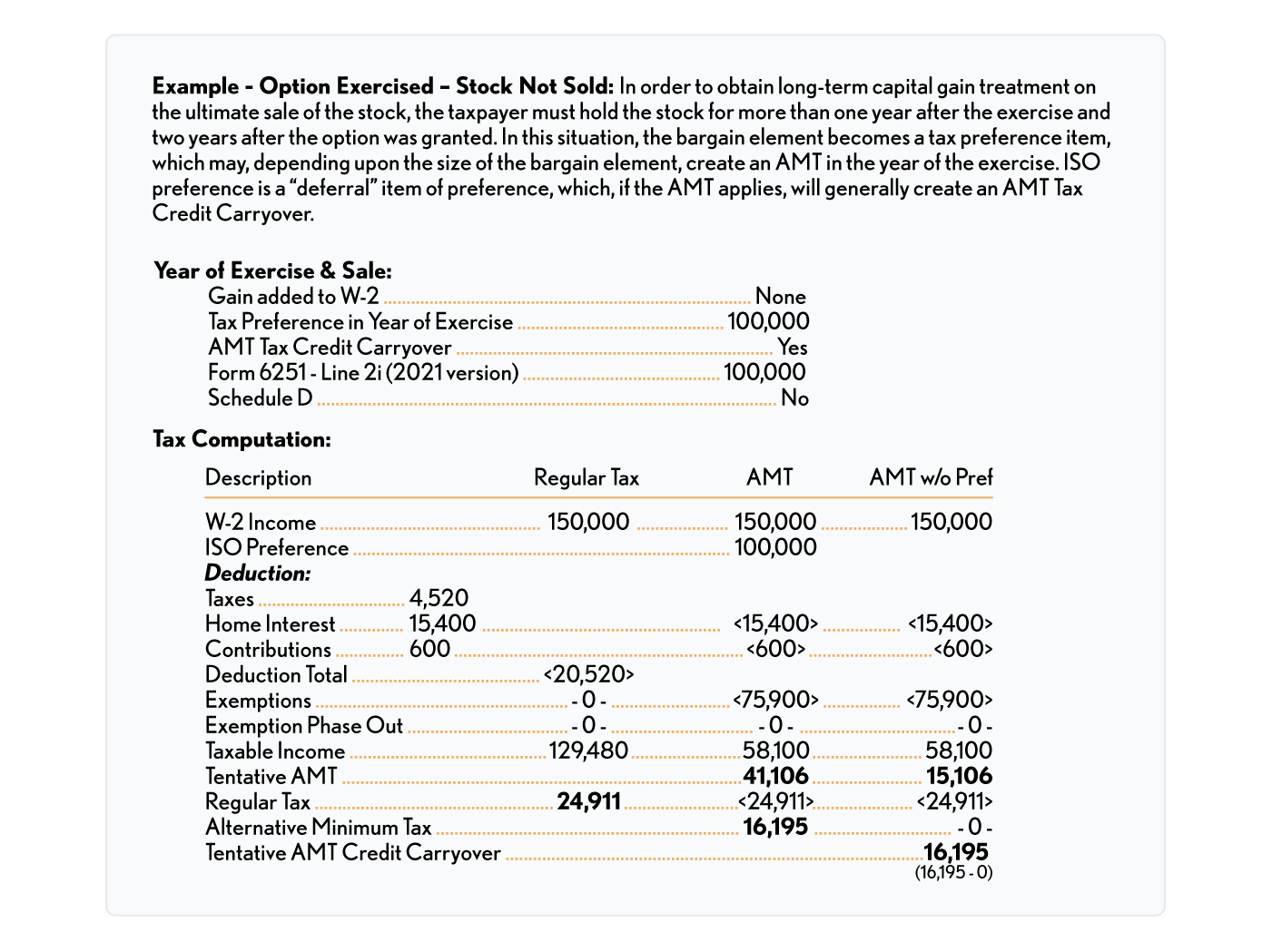

AMT Deferral Preference

A taxpayer who exercises an incentive stock option generally recognizes alternative minimum taxable income equal to the excess of the fair market value of the stock on the exercise date over the exercise price; since the ISO preference is a deferral item of preference, an Alternative Minimum Tax Credit carryover may be generated. The basis of the purchased stock, for alternative minimum tax purposes, would be increased by the amount of the AMTI that was recognized when the stock was purchased via the exercise of the option.

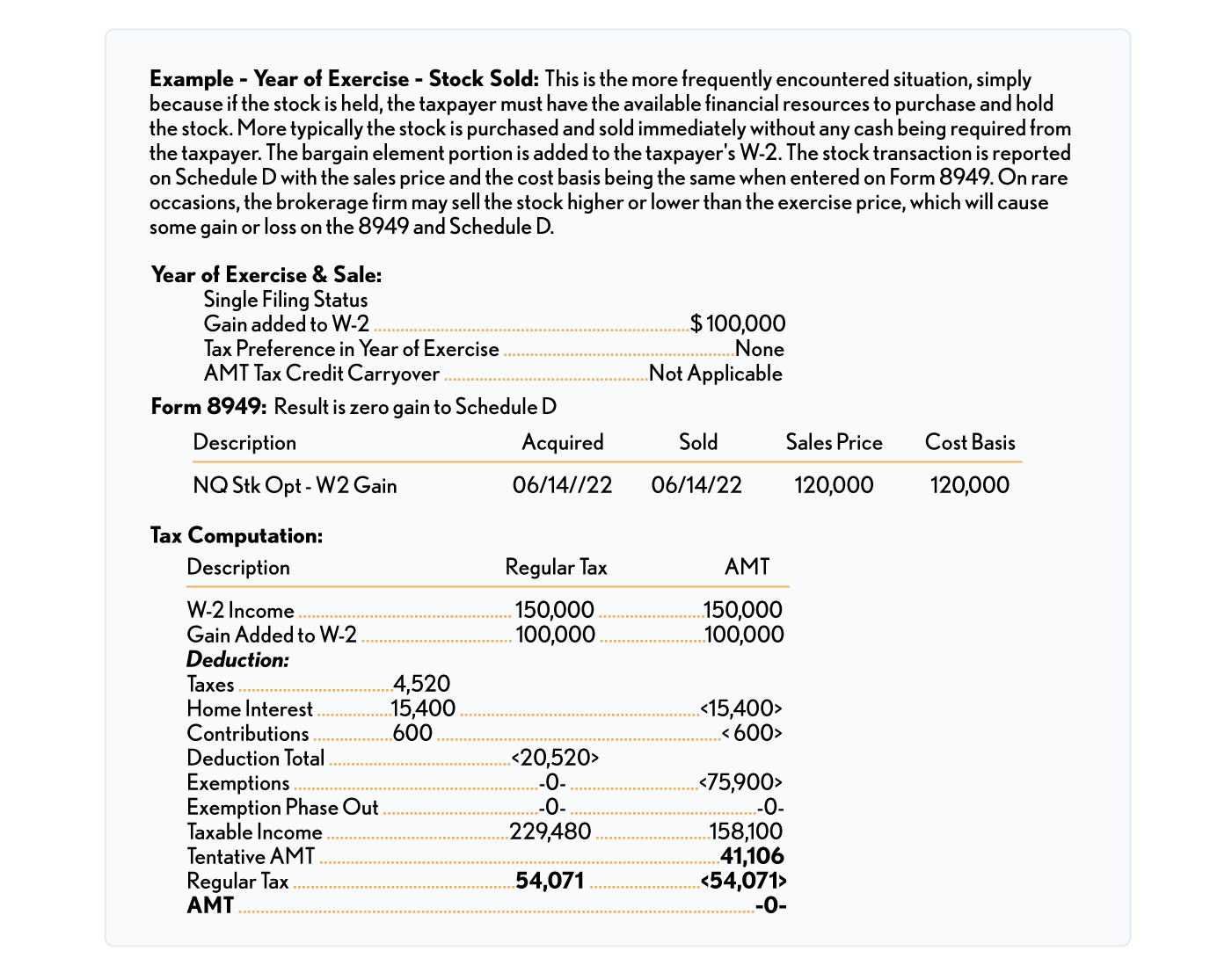

The best way to understand incentive stock options is to look at the various possibilities using our comparative example. Note: examples don’t show the additional $450 of 0.9% Medicare tax when wages are $250,000.

Tax Planning Considerations

-

State income taxes - Since state income tax is not deductible against the AMT, care should be taken not to pay more during the year than can be used without incurring the AMT (in this example, none)., Generally defer to the 4th quarter paid in January of the following year., It may even be appropriate to reduce withholding., But consider if incurring the underpayment penalty, if any, is worth it.

-

Other taxes - Since taxes are not deductible against the AMT, attempt to prepay in a prior year or defer to the next year if the deduction will be wasted in the current year, also keeping in mind the TCJA imposed $10,000 annual deduction limit for state and local taxes.

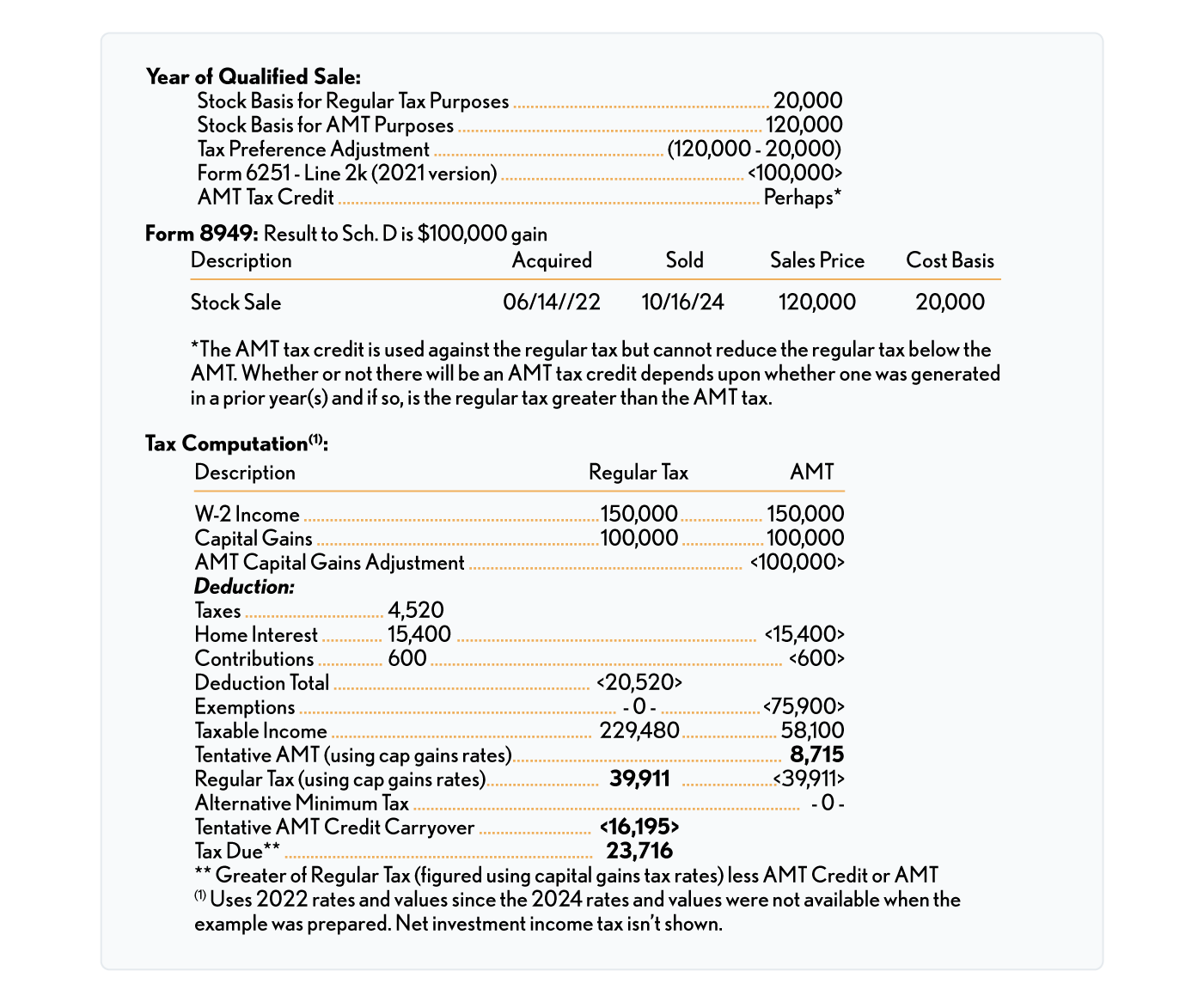

Year of Qualified Stock Sale

After meeting the qualified holding period of more than one year after the exercise and two years after the option was granted, the taxpayer qualifies for the long-term treatment and sells the stock. When this occurs, there is a stock basis for regular tax ($20,000) purposes and another for AMT ($120,000). This will create a negative capital gains adjustment on Form 6251 of $100,000 ($20,000 - $120,000). There is also an AMT Credit carryover in the amount of $16,195 (assuming the taxpayer did not utilize the credit in the intervening years).