IRS Insolvency Exclusion

The IRS insolvency exclusion is designed for debtors who are insolvent but are not actively engaged in bankruptcy.

If the indebtedness is discharged when the debtor is insolvent -- but, again, not in a bankruptcy case -- the discharge is excluded from the debtor's gross income up to the amount of the insolvency (IRC Sec 108(a)(1)(B)).

Note: COD income to a grantor trust or disregarded entity is treated as income of the owner of the grantor trust or disregarded entity.

Definition of Insolvent

The term “insolvent” means the excess of liabilities over the fair market value (FMV) of assets determined with respect to the taxpayer's assets and liabilities immediately before the discharge.

This means that the discharged debt counts as a liability and the property’s FMV as an asset (unless the discharge is in a subsequent year and the taxpayer no longer owns the property) for purposes of determining the taxpayer's insolvency. The taxpayer's financial status immediately after the discharge is irrelevant. (IRC Sec. 108(d)(3))

Calculating Insolvency

There are several court cases and rulings that need to be taken into consideration when determining insolvency:

-

Some debts may not count as liabilities - A taxpayer claiming to be insolvent must prove by a preponderance of the evidence—i.e., must prove that it is more likely than not—that he or she will be called upon to pay an obligation claimed to be a liability, and that the total amount of liabilities so proved exceeds the FMV of his or her assets., (Merkel, Dudley B. v Commissioner, 1999, CA9).

-

Nonrecourse liabilities - Where a debtor has property subject to nonrecourse debt in excess of the value of the property, the excess of the amount of the nonrecourse debt over the FMV of the property securing the debt is taken into account in determining whether, and to what extent, the debtor is insolvent only to the extent that the excess debt is discharged. The reason is that the excess nonrecourse debt that isn't discharged does not affect the debtor's solvency. So even though the cancellation of nonrecourse debt in excess of the value of the property is treated as taxable income, the excess nonrecourse debt is not taken into account in determining solvency. (Rev Rul 92-53, 1992-2 CB 48). ,

-

Assets Exempt From Claims of Creditors - Tax courts have ruled that assets exempt from claims of creditors must be included as assets for purposes of determining insolvency.,

-

Pension Plans – Although they are exempt from creditors, pensions or annuities (including Social Security) must be taken into account when adding up the assets. The IRS says the value of an individual’s benefits under a defined contribution plan is simply the value of the individual’s account or accounts under the plan. If an individual has started receiving benefits under a defined benefit plan and has elected to receive benefit payments as an annuity or in installment payments, the value of the benefit should be the actuarial present value of the payments as of the date on which the insolvency determination is made. If the individual has not started receiving benefits, then the value of the benefit should be the greater of (1) the actuarial present value of the accrued benefit payable at the plan’s normal retirement age or (2) the amount of any single-sum distribution that the participant could receive under the plan on the date insolvency is determined. (Service Center Advice 1998039), The Tax Court has held that the part, of a retirement plan that can be withdrawn as a loan is an asset. If an outstanding plan loan is listed as a liability, then the collateral that secures the loan must be listed as an asset. (Shepherd, Bernard R., (2012) TC Memo 2012-212)

-

Married Taxpayers - The filing of a joint return by taxpayer and a spouse, who isn't insolvent, doesn't cause the spouse's separate assets to be taken into account in determining the taxpayer's insolvency. ,(IRS Letter Ruling 8920019)

-

Measuring partner’s insolvency when partnership discharges excess nonrecourse debt – For purposes of measuring a partner’s insolvency, each partner treats as a liability an amount of the partnership’s discharged excess nonrecourse debt that is based on the allocation of debt relief income to that partner under IRC Sec. 704(b) and the regs. (Rev. Rul. 2012-14)

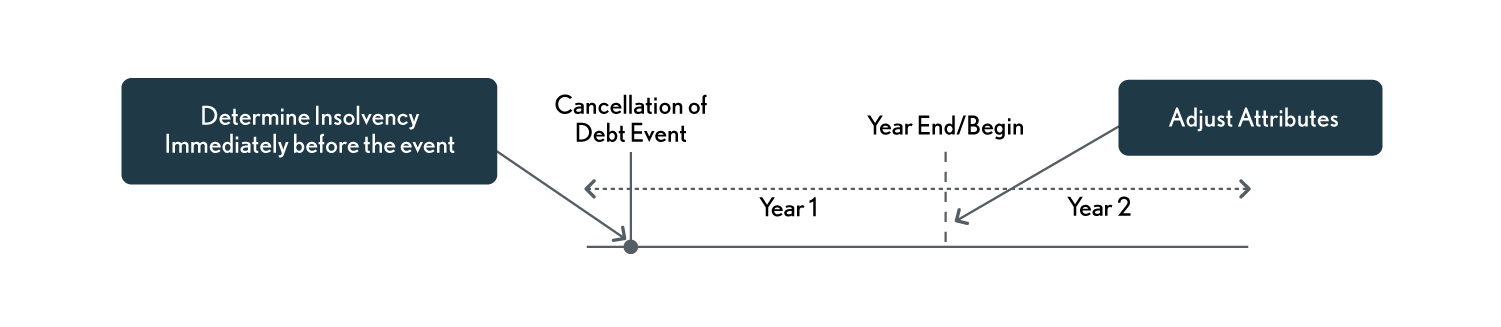

When is Insolvency Determined?

Immediately before the debt is discharged. (IRC Sec. 108(d)(3))

Reduction of Tax Attributes

If the debtor has tax attributes, they must be reduced to the extent of the insolvency exclusion. If the attributes are less than the exclusion, they are simply reduced to zero and the debtor is still able to exclude the debt to the extent of insolvency. (IRC Sec. 108(b)(3))

If, after going through the attribute reductions sequence shown below, and the taxpayer surrenders attributes with a total value of LESS than the excludable debt relief, the balance of the debt relief is still forgiven and there is never a tax impact.

Sequence of Attribute Reduction

Attributes include loss and credit carryovers and basis in assets. Credit carryovers are reduced 33-1/3¢ per dollar of debt discharge amount while the others are reduced dollar for dollar. For insolvency, attributes are reduced in this strict order (but see a special election to first reduce the basis of depreciable assets on the next page).

-

Any NOL for: the taxable year of the discharge, and any NOL carryover to such taxable year, dollar for dollar. (IRC Sec 108(b)(2)(A))

-

General business credit carryovers to or from the taxable year of discharge are reduced, $1 for each $3 of debt relief. (IRC Sec 108(b)(2)(B))

-

Minimum tax credits - The carryover amount to the year immediately following the taxable year of the discharge is reduced $1 for each $3 of debt relief., (IRC Sec 108(b)(2)(C))

-

Any Net Capital Loss for the taxable year of the discharge, including any Capital Loss Carryover (CLCO) to such taxable year. (IRC Sec 108(b)(2)(D))

Carryovers and Carrybacks

Sec 108(b) – Makes it clear that a taxpayer may:(1) Utilize carryovers to the year of discharge (2) Utilize carrybacks from the year of discharge to prior years before reducing the attributes in the subsequent year.

-

Basis of assets - is reduced at the beginning of the year following the year of debt cancellation, based on the assets owned at that time. Here again, there is a strict order for which property bases get reduced:

-

Trade or business property purchased with the proceeds of the debt which was forgiven;

-

Trade or business property securing the loan;

-

All other trade or business assets;

-

Inventory and notes and accounts receivable;

-

Property held for investment;

-

Other assets.

-

The limit for basis reduction under the insolvency rule is the extent to which basis of assets (not the FMV) after debt relief exceeds liabilities after the debt relief. This limit will not apply if the taxpayer elects to reduce basis first (see special election below).

Where there are multiple assets in a particular category the basis reduction is allocated to the basis of the properties in proportion to their aggregate basis.

-

Suspended passive losses - Reduce the suspended passive activity losses from the year of discharge $1 for each $1 of excluded debt relief; reduce suspended passive loss credits from the year of discharge by $1 for each $3 of excluded debt relief (IRC Sec 108(b)(2)(F)).

-

Foreign tax credit carryovers - Reduce the foreign tax credit carryovers from the year of discharge $1 of credit for each $3 of debt relief (IRC Sec 108(b)(2)(G)).

When are the Attributes Reduced?

The reductions are generally made after the tax is computed for the tax year of the discharge (but see NOL and Capital Loss details above). That means a calendar year taxpayer will adjust the attributes at the beginning of the year subsequent to the debt relief year. Thus, the debtor can utilize many of the attributes in the year of the relief. (IRC Sec 108(b)(4)(A)).

Election to First Reduce the Basis of Depreciable Assets

Rather than reduce the loss and credit carryovers first, a taxpayer can elect (on Form 982) to apply any or all of the excluded amount first to reduce his basis in depreciable assets (or real property held as inventory) before any other tax attributes are reduced under the normal ordering rules.

(IRC Sec. 108(b)(5)(A))

This special rule may be attractive to taxpayers who have net operating losses or other attributes that can be carried over and used in subsequent years and where the concern for basis reduction is a secondary issue. However, it should be noted that if the basis reduction is insufficient to offset the COD income, then the other tax attributes must be reduced beginning in the normal manner.

Reason for Making the Basis Reduction Election

This election is generally made by a debtor who wants to preserve the Net Operating Loss deduction, General Business Credit, Alternative Minimum Tax Credit, and Capital Loss Carryovers. If the taxpayer does not have sufficient depreciable property basis to cover the excluded debt income he may acquire additional up to end of the year of discharge. However, the reduced basis will recapture as ordinary income when and if the property whose basis was reduced is sold. So the decision is whether or not to utilize the tax benefit currently and suffer the consequences in the future.

Basis Reduction Limitations

A debtor making the election to first reduce basis may not reduce the aggregate adjusted bases of his depreciable property below zero and can't elect to have excluded debt discharge income applied to first reduce depreciable property basis in an amount greater than the aggregate adjusted bases of depreciable property held by the debtor as of the beginning of the tax year following the tax year in which the discharge occurs. (IRC Sec. 108(b)(5)(B))

Special Election – Dealers in Real Property

Dealers in real property may elect to treat real property held for sale in the ordinary course of business as depreciable. This election must be made on the original return for the year of debt forgiveness and can only be revoked or elected on a later return with reasonable cause and IRS consent. (IRC Sec. 1017(b)(3)(E))

Calculating Insolvency

The IRS provides an insolvency worksheet in Publication 4681 – page 7 (2021). Another possibility would be to use Form 433-A (for individuals) or 433-B (for businesses) that IRS Collections uses as a financial statement.