Step #3 – Determine If There Is Also an Asset Sale

Step #3 in a debt relief plan is to determine if there is an asset sale that must also be dealt with.

If the debt cancelled was secured by an asset, then the disposition of the asset must also be taken into account. Here are some possible scenarios:

-

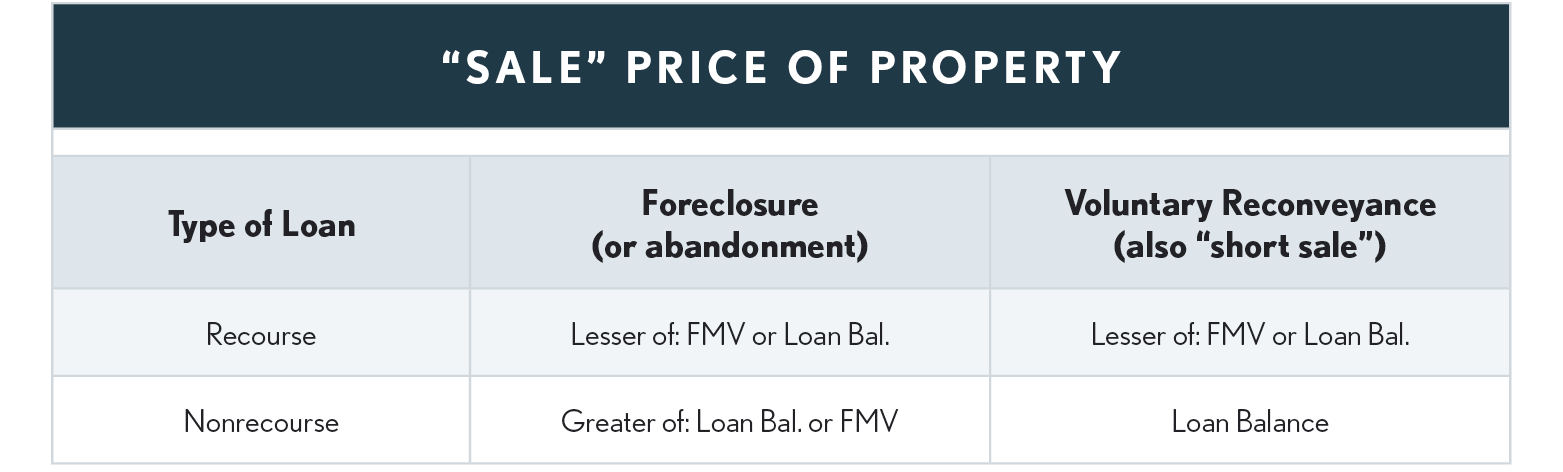

Short Sale – In a short sale, by agreement with the lender, the property is sold for a value less than the mortgage balance., Even though the lender ends up with all the net proceeds from the sale, the borrower must report the transaction as a sale on the tax return in the normal manner., Determine the sales price from the table below.

-

Foreclosure (or abandonment) – In a foreclosure, the lender has taken possession of the property through legal channels., This usually generates a Form 1099-A., The property sale must be reported on the tax return in the normal manner., Determine the sales price from the table below.

-

Repossession – Generally a term associated with having a vehicle reclaimed by the lender of personal property. If that personal property was also business property (in whole or in part) the disposition of the business portion of the property must be reported as a sale. Report the sale in the normal manner for the asset using the table below. Note: Generally all debts on personal property are recourse; thus the sales price would be the lesser of the FMV or the loan balance.

Caution

Remember that personal use property such as a principal residence, 2nd home, personal use vehicles, etc., cannot result in recognizable loss. So when reporting the sale the loss must be zeroed out. On Form 8949, enter code “L” in col. (f) and the nondeductible amount as a positive number in col. (g).

IMPORTANT ISSUE – HOME SALE

If a property subject to the debt relief is the taxpayer’s primary home then the Sec 121 (home sale gain) exclusion applies, or if needed, the unforeseen circumstances reduced-gain exclusion applies. If there is a loss, the loss would not be deductible since it is personal use property.• If the home was partially business “mixed use” property at the time of sale, no loss is allowed. Mixed use means it is used both for personal and business use. (“Reg 1.165-9(a) LOSSES NOT ALLOWED. A loss sustained on the sale of residential property purchased or constructed by the taxpayer for use as his personal residence and so used by him up to the time of the sale is not deductible under section 165(a).” Thus this regulation presumably applies in a mixed use situation.)• If the business use was in a separate structure then there would be two separate sales with no loss allowed on the personal use portion. The gain or loss would be recomputed for the business use portion taking into account the depreciation taken. If the result is a loss, the loss is allowed on the business part. If the result is a gain, the gain is taxable and does not qualify for the Sec 121 exclusion.• The sale of the home must be reported on Form 8949 if there’s a gain and all of the gain isn’t excludable under Sec 121, or if Form 1099-S was received for the sale, even if the sale results in a nondeductible loss.

Example 1 – Car Repossession – Sonja purchased a car for $15,000 which was not used for business. She paid $2,000 down and took out a $13,000 recourse loan from a credit company. Sonja stopped making her loan payments and the credit company repossessed the car. The balance on the loan at the time of repossession was $10,000 and the FMV of the car was $9,000. The credit company decided they would not be able to collect the $1,000 balance on the loan because Sonja had insufficient assets and forgave it. Following the worksheet provided in Publication 4681, we compute the cancellation of debt income and the gain or loss resulting from the repossession:

-

Part I

1a. Enter the amount of outstanding debt immediately before the transfer

of property……………………………………………………………………………... $10,000

1b. Enter any amount of line 1a for which the taxpayer remains

personally liable immediately after the transfer of property…………................…… 0

1c. Subtract 1b from 1a …………………………………………………………...... $10,000

2.Enter the fair market value of the transferred property………………...........…… $9,000

3.Ordinary income from the cancellation of debt,

(Subtract line 2 from line 1c. If less than zero, enter zero).……………................. $1,000

PART II

4.If Part 1 was completed enter the smaller of line 1c, ,or line 2

If Part 1 was not completed, enter the amount of,

outstanding debt immediately before the transfer of property……………….........…….. $9,000

5. Enter any proceeds the taxpayer received from the foreclosure sale…........………. 0

6. Add line 4 and line 5 ……………………………………………………………….... $9,000

7. Enter the adjusted basis of the transferred property……..…………..……..……… $15,000

8. Gain or loss from foreclosure or repossession.

Subtract line 7 from line 6……………………………………………………..……… <$6,000>

Note

Just because the worksheet results in ordinary income does not necessarily mean it is taxable. It may be excludable under one of the provisions discussed in Step #2.

Note

Since the car was personal use property the loss is not allowed. Had it been partially business use property, the business portion of the gain or loss after taking into account the depreciation recapture would be reportable on Form 4797.

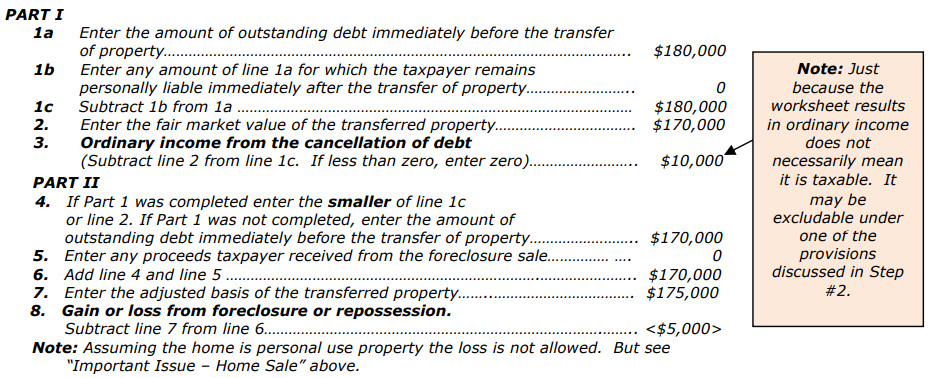

Example 2 – Home Foreclosure - Joan paid $200,000 for her home. She paid $15,000 down and took a recourse loan of $185,000 from a bank. Joan was unable to continue making payments and the bank foreclosed. When the bank foreclosed on the loan, the balance due was $180,000, the FMV of the house was $170,000, and Joan’s adjusted basis was $175,000 due to a casualty loss she had previously deducted. At the time of the foreclosure, the bank forgave the $10,000 debt in excess of the FMV ($180,000 minus $170,000). In this case, Joan has ordinary income from the cancellation of debt in the amount of $10,000. Following the worksheet provided in Publication 4681:

-

Joan’s Tax Return: 1040, Schedule 1, Line 8c (2021) – If no exclusion applies, enter $10,000.Form 8949 – When a 1099-A is issued there is a presumption of a sale. When a home’s sale price is less than the Sec 121 exclusion, and a 1099-S hasn’t been issued, technically the home sale need not be reported. However, those, including the author, who like to ensure all gross proceeds are accounted for on the tax return can show the transaction on Form 8949, and then enter the loss amount as a positive number in column (g) as an adjustment, thus zeroing out the loss. Code L is entered in column (f) to indicate a nondeductible loss.

-

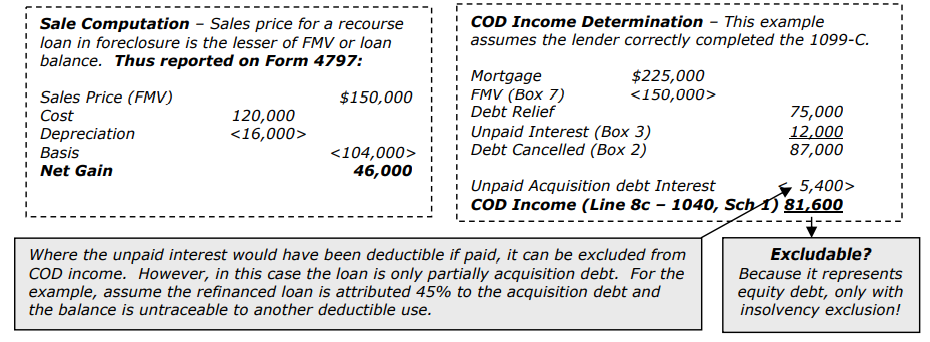

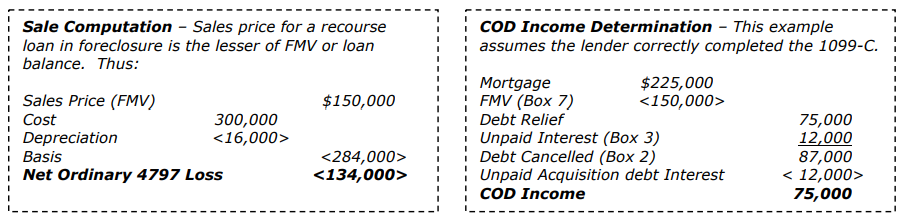

Example 3 – Rental foreclosure - Gain – Joe purchased a rental six years ago for $120,000. He had refinanced the original $100,000 acquisition debt and used the refinanced funds for uses other than substantial improvements on the rental. The debt is recourse and in the current year the bank foreclosed on the rental since Joe had stopped making payments. The outstanding debt at the time of the foreclosure was $225,000 and the FMV was $150,000. The accumulated depreciation to the date of foreclosure was $16,000. The 1099-C shows a FMV in Box 7 of $150,000 and the debt relieved in box 2 of $87,000 and $12,000 in Box 3. As a result of the foreclosure Joe has the sale of a rental and COD income.

-

Joe’s Tax Return: 1040, Schedule 1, Line 8c (2021) – If no exclusion applies enter $81,600.4797 – Report the sale of a rental – Result will be $16,000 carried to line 4 of 1040, Schedule 1 (2021), and $30,000 to Schedule D as a long-term capital gain. Form 982 – Form 982 is only required if a portion of the debt relief is excludable.

-

Exclusion & Basis

In this example, if Joe is insolvent he can exclude the COD income to the extent he is insolvent and still benefit from the 4797 loss. However, if the loss generates an NOL, that NOL will be subject to the attribute reductions shown in Step #4. If, to the extent he is solvent, he attempts to use the qualified real property business indebtedness exclusion he would have to reduce the sale basis by the amount of the forgiven debt, which would reduce the loss by the same amount of the COD income exclusion, simply offsetting each other and providing no benefit.

Example 5 – Rental Mortgage Modification – Pete, who is not insolvent, owns a rental that cost $200,000 on which the mortgage has a current balance of $150,000. The FMV of the rental is $110,000. Pete negotiates a loan modification with the bank and they reduce the mortgage to $110,000 and issue Pete a 1099-C in the amount of $40,000. Pete can utilize the Qualified Real Property Business Indebtedness exclusion rules and defer this $40,000 of COD income by reducing the basis of his rental property by $40,000 on January 1 of the succeeding year.Pete’s tax return: 1040, Schedule 1, Line 8c (2021) – No entry

-

Form 982 - check Box 1d, enter $40,000 on line 2 and $40,000 on line 11a