U.S. Sourced Income Earned By Resident & Nonresident Aliens

Learn about the three categories of U.S. sourced income, and how it is taxed when earned by resident and nonresident aliens living in within United States borders.

Generally, income is considered U.S. sourced income if it is paid by a domestic corporation, a U.S. citizen, a resident alien or an entity formed under the laws of the United States. If the property that produces the income is located in the U.S. or if the services for which the income is paid were performed in the U.S. the income is considered U.S. sourced income. Some examples of income that may be from sources within the U.S. include:

-

Compensation for personal services

-

Interest and dividends

-

Pensions and annuities

-

Rental and royalty income

-

Taxable scholarship and fellowship grants

-

Other taxable grants, prizes and awards

Income sourcing rules are contained at IRC 861 through IRC 865. Caution: income tax treaties can modify these rules.

Remember

A nonresident alien is only taxed on U.S. sourced income.

U.S. Sourced Income is broken down into three categories:

Effectively Connected Income (ECI)

If the U.S. source income paid to a foreign person is determined to be from the conduct of a trade or business within the United States, it is considered ECI.

-

ECI is subject to the graduated income tax rates applicable to U.S. persons, not the 30 percent rate (discussed below).,

-

A foreign person receiving ECI is required to file a U.S. income tax return because they are conducting a trade or business within the United States.,

-

ECI is subject to reporting requirements by the U.S. payer or withholding agent.

-

ECI is not subject to a withholding obligation.

U.S. Source Non-Business Income (FDAP)

Is income that is U.S. source non-business income paid to a foreign person or corporation that is not ECI. FDAP is the acronym for Fixed or Determinable, Annual or Periodic.

-

FDAP is subject to the 30% (or lower treaty) tax rate.

-

A foreign person receiving only FDAP income upon which the 30% (or lower treaty) rate has been withheld is not required to file a U.S. income tax return.

-

What may seem to fall under the category of FDAP income may in fact be ECI income., See explanation later. § , Examples of FDAP income where the income is U.S. Sourced but not ECI:

-

Portfolio income: interest (excluding OID but see other 30% income below), dividends, o , Annuities, rents,,

-

Salaries, wages, premiums and compensation (this applies only to services preformed in the U.S. Those performed by a nonresident alien in a foreign country are not taxable to the U.S.), and other fixed or determinable annual or periodic gains, profits, and income.

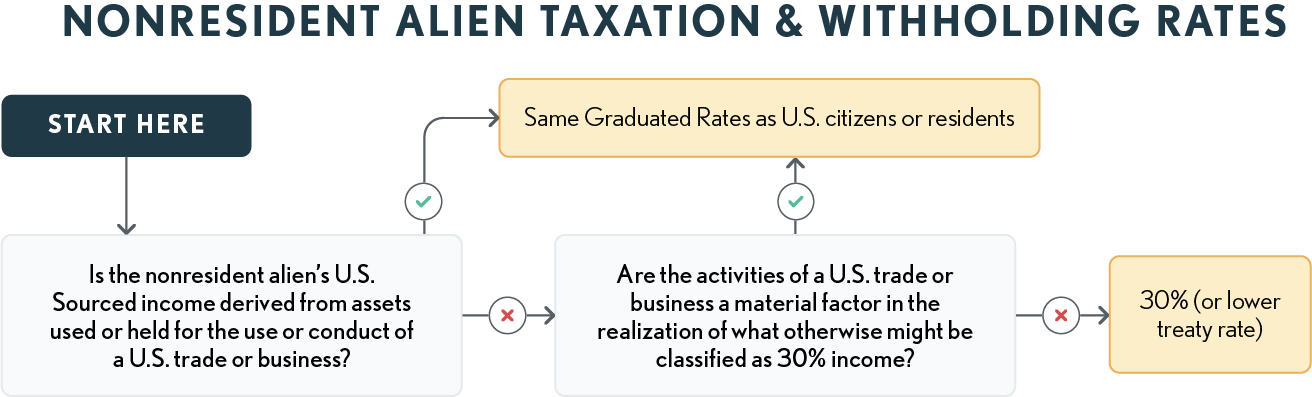

When FDAP Income May Become ECI

FDAP income can become effectively connected income if:

-

The income is derived from assets used in or held for the use in the conduct of that trade or business; or,

-

The activities of that trade or business in the US are a material factor in the realization of that income.

Other Income Subject to the 30% Withholding (or Other Treaty) Tax Rate

-

Payments on bonds with OID received at the time of disposition (i.e., does not follow the OID reporting rules for a U.S. resident).

-

85% of U.S. Social Security benefits paid to non-resident aliens.,

-

Gains on sale or exchange of patents, copyrights and the like, where payments are contingent on productivity.

-

Gains from the disposal, with a retained economic interest, of timber, coal, or iron ore.

-

Only in the case of a nonresident alien present in the U.S. for 183 days or more during the tax year, the excess of U.S.-source gains over losses from sales or exchanges of capital assets.