IRS Form 709 - Tax on Non-Resident Alien Gifts of Property Situated In the U.S

IRS Form 709 must be filed in regard to tax on non-resident alien gifts of property situated in the U.S. Find details about when taxpayers need to submit this document to the federal government in this guide.

A non-resident alien is subject to gift tax when he makes a gift of real or tangible personal property situated in the U.S. (IRC §2501(a)(1)) A gift of U.S. intangible personal property is generally not subject to gift tax but there are exceptions. (IRC §2501(a)(2).

Unified Credit

Non-resident aliens are not entitled to the unified credit. However, non-resident aliens are entitled to:

-

$18,000 (2024); $17,000 (2023); $16,000 (2022); $15,000 (2018 - 2021) annual exclusion for gifts to any person.

-

Unlimited exclusion for gifts to defray educational or medical expenses.

-

The unlimited exclusion for gifts to citizen spouses.

-

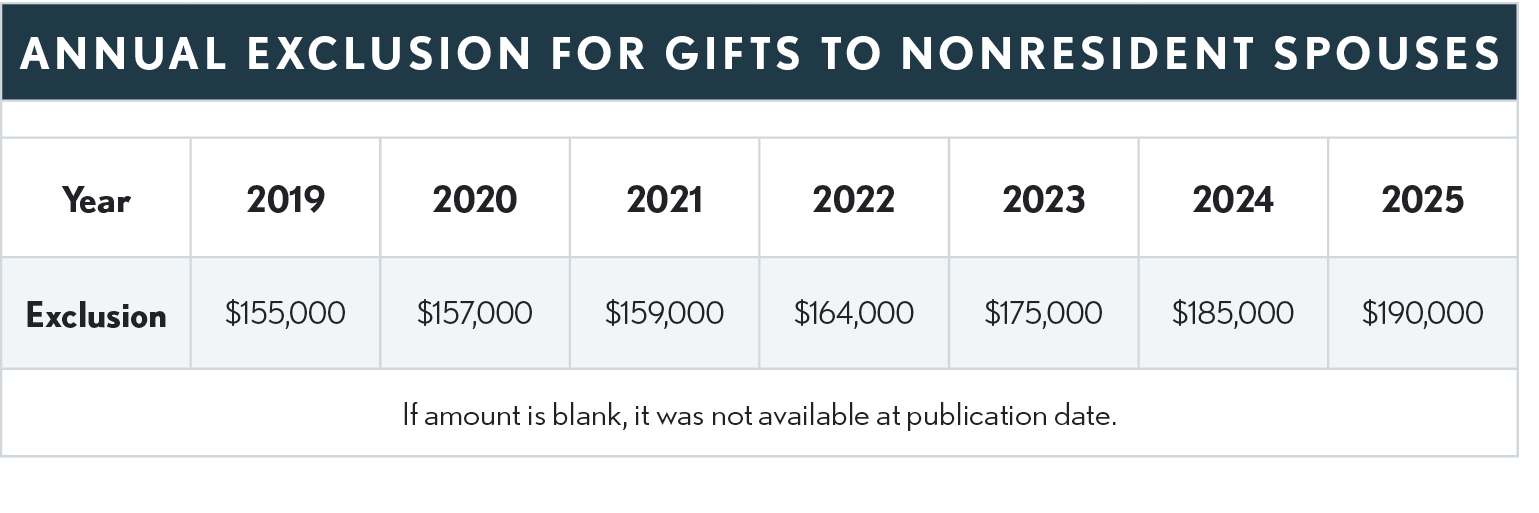

$185,000 for 2024 (see table below for other years) annual exclusion for gifts to noncitizen spouses.

-

Unlimited amount of property to U.S. charity free of gift tax (IRC §2522(b)).

-

Unlimited amount of property to a trust, or foundation, only if the gift is to be used within the U.S.

-

Basis of property, acquired by gift from a non-resident alien, is determined in the same manner as property basis acquired by gift from a resident alien (IRC §1015, 1015(d)).

Form 709

Use Form 709 to compute the gift tax for non-resident aliens following the special instructions for Part 2, Line 7 that apply to non-resident aliens.