IRS Form 3520 - Reporting Receipt of Foreign Gifts or Bequests

IRS Form 3520 is used to report the receipt of foreign gifts or bequests by American taxpayers. Details about when this document needs to be submitted to the federal government can be found below.

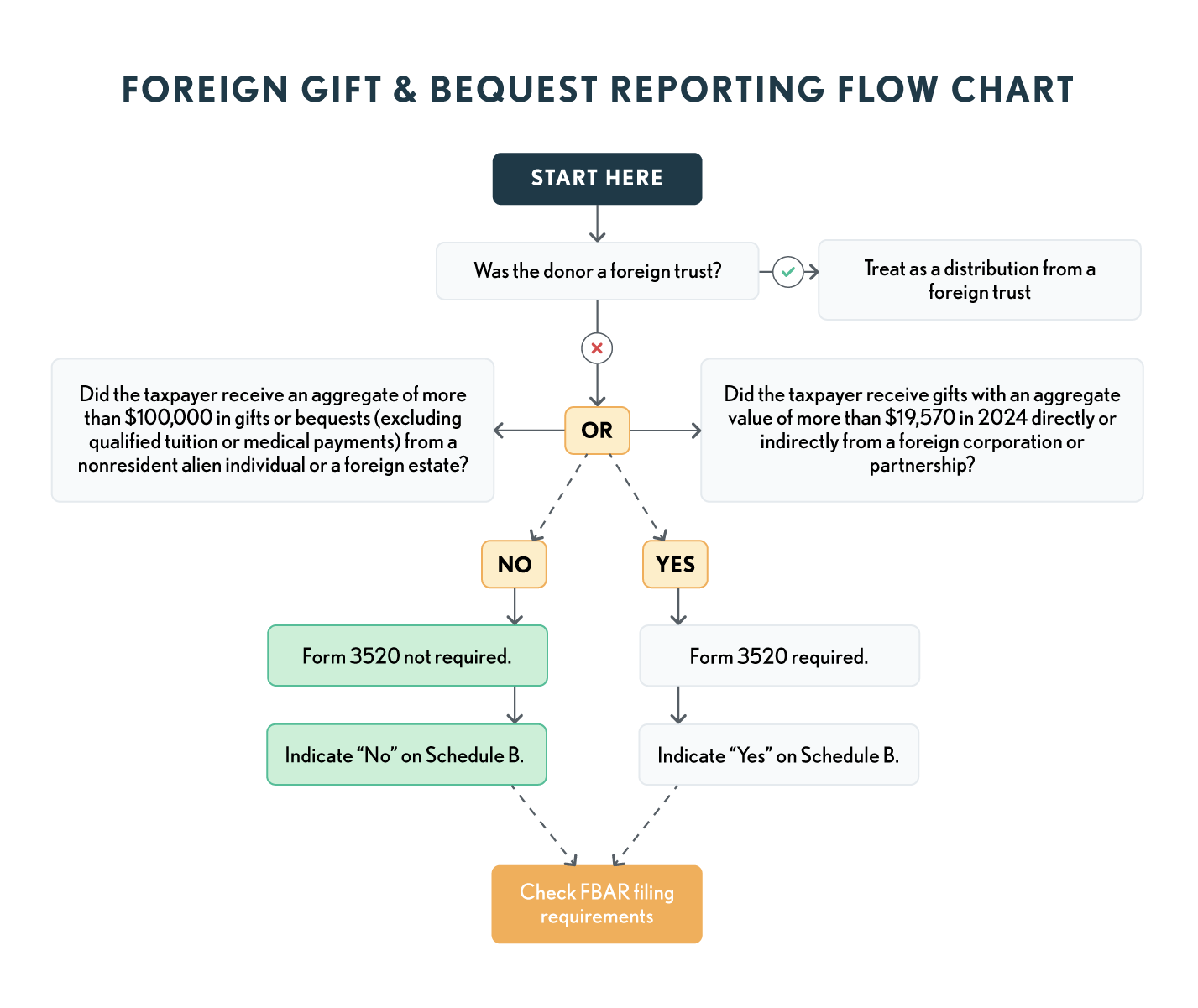

If the value of the aggregate “foreign gifts” (described below) received by a U.S. person (other than an exempt organization) exceeds specified amounts, the U.S. person must report each foreign gift to the IRS. (Code Sec. 6039F) These amounts are:

-

More than $100,000 from a non-resident alien individual or a foreign estate (including foreign persons related to that non-resident alien individual or foreign estate) that are treated as gifts or bequests (Notice 97-34); or

-

More than the amount for a specific year shown in the following table from foreign corporations or foreign partnerships (including foreign persons related to such foreign corporations or foreign partnerships) that are treated as gifts. The threshold amount for gifts from foreign corporations or partnerships is adjusted annually for inflation.

Foreign Gifts

Foreign gifts generally include any amounts received from a person that isn't a U.S. person that the recipient treats as a gift or bequest. The term doesn't include any qualified tuition or medical payments made on behalf of a U.S. person.

Reporting Forms

-

1040 Schedule B – Individuals with foreign gifts need to answer the line 8 question correctly at the bottom of the Schedule B.

-

Form 3520 - Complete the identifying information on page 1 of Form 3520 and Part IV. See the instructions for Part IV.

-

FBAR - Taxpayers may also be required to file FinCEN Form 114 if the conditions of transfer and account balance require it.,

Caution - If the ultimate donor is a foreign trust, then treat the amount as a distribution from a foreign trust and see “reporting ownership of or transactions with foreign trusts” later.

Penalties

The penalty for not reporting a foreign gift that must be reported is 5% of the amount of the gift for each month the failure to report continues, up to a maximum of 25%. The penalty will be excused if reasonable cause for the failure to report can be established. (Code Sec. 6039F(c)(1)(B)).

Form 3520 Common Issues

Form 3520 is used for several purposes including:

-

Certain Transactions with Foreign Trusts

-

Ownership of foreign trusts under the rules of sections 671 through 679

-

Receipt of large gifts or bequests from certain foreign persons. Each of these purposes is addressed separately in this material.

Joint Return Filers

Two transferors or grantors of the same foreign trust, or two U.S. beneficiaries of the same foreign trust, may file a joint Form 3520, but only if they file a joint income tax return.

Due Date

Form 3520’s due date is the 15th day of the 4th month after the end of the U.S. person’s tax year (April 15th for calendar year taxpayers). Six-month extension available; use Form 7004 for filing extensions.

Filing

The form is NOT included with the 1040 and instead is mailed to P.O. Box 409101, Ogden UT, 84409. However double check the current version of the 3520 instructions for possible changes in filing address.

Consistent Treatment

The U.S. beneficiary and U.S. owner’s tax return must be consistent with the Form 3520-A, Annual Information Return of Foreign Trust with a U.S. Owner, filed by the foreign trust unless the taxpayer reports the inconsistency to the IRS. If items are being treated on the tax return differently from the way the foreign trust treated them on its return, file Form 8082, Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR). See Form 8082 for more details.

Foreign Trust

A foreign trust is any trust other than a domestic trust. A domestic trust is any trust if:

-

A court within the United States can exercise primary supervision over the administration of the trust; and

-

One or more U.S. persons have the authority to control all substantial decisions of the trust.