FINCEN Form 114 - Foreign Account Reporting Requirements (FBAR)

The IRS's Foreign Account Reporting Requirements are clear and stringent. FINCEN Form 114 is among the most important documents foreign accountholders need to submit annually. Find full details below.

FBAR Reporting Requirement

Each United States person, including a citizen, resident, corporation, partnership, LLC, trust and estate, who has a financial interest in or signature or other authority over any foreign financial accounts, including bank, securities, or other types of financial accounts, in a foreign country, if the aggregate value of these financial accounts exceeds $10,000 at any time during the calendar year, must report that relationship to the U.S. government each calendar year. This is done by filing FinCEN Form 114.

Due Date - The annual due date for filing Reports of Foreign Bank and Financial Accounts (FBAR) is April 15 of the subsequent year. As with the 1040, if April 15 falls on a Saturday, Sunday or legal holiday, the FinCEN 114 due date is extended to the next business day. So, it will be the same as the 1040 due date.

Extension - To implement the statute with minimal burden to the public and the government, FinCEN will grant filers failing to meet the FBAR annual due date of April 15 an automatic extension to October 15 each year. Accordingly, specific requests for this extension are not required (instructions to FinCEN Form 114, available at https://www.fincen.gov/sites/default/files/shared/FBAR%20Line%20Item%20Filing%20Instructions.pdf .

Purpose of the FBAR Filing Requirement - The Treasury Department's Financial Crimes Enforcement Network FinCEN) uses the FBAR filings in conjunction with Suspicious Activity Reports, Currency Transaction Reports, and other BSA (Bank Secrecy Act) reports to provide law enforcement and regulatory investigators with valuable information to fight fraud, money laundering, terrorist financing, tax evasion and other financial crime.

Reportable FBAR Accounts - Financial account includes the following types of accounts:

-

Bank accounts such as savings accounts, checking accounts, and time deposits,

-

Securities accounts such as brokerage accounts and securities derivatives or other financial instruments accounts,

-

Commodity futures or options accounts,

-

Insurance policies with a cash value (such as a whole life insurance policy),

-

Mutual funds or similar pooled funds (i.e., a fund that is available to the general public with a regular net asset value determination and regular redemptions),

-

Any other accounts maintained in a foreign financial institution or with a person performing the services of a financial institution.

A financial account is foreign when it is located outside of the United States, defined for this purpose as the 50 states, the District of Columbia, U.S. territories and possessions (Commonwealth Northern Mariana Islands, American Samoa, Guam, Commonwealth of Puerto Rico, U.S. Virgin Islands and Trust Territories of the Pacific Islands), and Indian lands as defined in the Indian Gaming Regulatory Act. Typically, then, a financial account that is maintained with a financial institution located outside of the United States is a foreign financial account.

An account maintained with a U.S. financial institution is generally not considered a foreign account for FBAR purposes, even if the account contains holdings or assets of foreign entities. In general, the FBAR rules also don't apply to certain types of custodial arrangements in which a U.S. bank, acting as a “global custodian,” combines the assets of multiple investors and creates pooled cash and securities accounts in non-U.S. markets. U.S. customers with these types of accounts typically have no rights in the foreign accounts and can access their holdings only through the U.S. financial institution. Caution: a U.S. customer is considered to have a foreign financial account if the custodial arrangement allows him to directly access his foreign holdings maintained at the foreign institution.

Examples:

-

Adam has an account with a branch of a U.S. bank that is physically located in Germany. This is a foreign financial account.

Bonnie maintains an account with a branch of a French bank that is physically located in California. This is not a foreign financial account.

Carl, who is a U.S. citizen, purchased securities of a French company through a securities broker located in New York. Carl is not required to report these securities on a FBAR because he purchased the securities through a financial institution located in the U.S.

Virtual Currency – FBAR regulations have not defined a foreign account holding virtual currency as a type of reportable account. (See 31 CFR 1010.350(c)). Thus, as of September 2023, when this chapter was updated, a foreign account holding virtual currency is not reportable on the FBAR (unless it is a reportable account because it holds reportable assets besides virtual currency). However, FinCEN has said that it intends to propose to amend the regulations implementing the Bank Secrecy Act regarding FBARs to include virtual currency as a type of reportable account. (FinCEN Notice 2020-2, Jan. 4, 2021)

Signature or Other Authority - FinCEN has ruled that under the definition of “signature or other authority” for FBAR purposes an individual has such authority over an account if the foreign financial institution will act upon a direct communication from the individual regarding the disposition of assets in the account. The signature authority definition applies only to individuals.

-

Proposed rule change – FinCEN has proposed an amendment to the FBAR regulations to eliminate the requirement for officers, employees, and agents of U.S. entities to report signature authority over entity-owned foreign financial accounts for which they have no financial interest, if those accounts are already required to be reported by their employer or any other entity within the same corporate or other business structure as their employer. (FinCEN Proposed Rule (RIN 1506-AB26, Mar. 2, 2016)) Employers would be required to maintain for 5 years information identifying all officers, employees, or agents with signature authority over, but no financial interest in, those same accounts. However, if the entity that has a financial interest in the foreign financial account over which the officer, employee, or agent has signature authority does not have an obligation to report to FinCEN its financial interest in such accounts, the employee, officer or agent would still be required to file a FBAR.,

-

Filing extension – Until the matters raised in the proposed rule change are settled, certain individuals who have signature authority over one or more foreign financial accounts, but no financial interest in the accounts, have been given an additional extension for filing a FBAR for signature authority they held during calendar year 2023. The extension also applies to reporting deadlines previously extended for years 2011 through 2022. The extended due date is April 15, 2025. (FinCEN Notice FIN-2023-NTCS) This extension applies only to the following individuals:

-

an employee or officer of a covered entity who has signature or other authority over, and no financial interest in, a foreign financial account of another entity that is more than 50-percent owned, directly or indirectly, by the covered entity (a controlled person)

-

authority over, and no financial interest in, a foreign financial account of the entity or another controlled person of the entity; or

-

officers and employees of investment advisors registered with the Securities and Exchange Commission with signature or other authority over, and no financial interest in, the foreign financial accounts of persons that are not registered investment companies.

Financial Interest - A United States person has a financial interest in a foreign financial account for which:

1. The United States person is the owner of record or holder of legal title, regardless of whether the account is maintained for the benefit of the United States person or for the benefit of another person; or

2. The owner of record or holder of legal title is one of the following:

(a) An agent, nominee, attorney, or a person acting in some other capacity on behalf of the United States person with respect to the account.

(b) A corporation in which the United States person owns directly or indirectly:

(i) more than 50 percent of the total value of shares of stock or

(ii) more than 50 percent of the voting power of all shares of stock.

(c) A partnership in which the United States person owns directly or indirectly:

(i) an interest in more than 50 percent of the partnership's profits (e.g., distributive share of partnership income taking into account any special allocation agreement) or

(ii) an interest in more than 50 percent of the partnership capital;

(d) A trust of which the United States person:

(i) is the trust grantor and

(ii) has an ownership interest in the trust for United States federal tax purposes. See 26 U.S.C. sections 671-679 to determine if a grantor has an ownership interest in a trust.

(e) A trust in which the United States person has a greater than 50 percent present beneficial interest in the assets or income of the trust for the calendar year; or

(f) Any other entity in which the United States person owns directly or indirectly more than 50 percent of the voting power, total value of equity interest or assets, or interest in profits.

Deceased Person - The requirement to file an FBAR does not end upon the death of an individual. If the deceased person had a requirement to file an FBAR for the year of their death, the FBAR must be filed by the person handling the estate.

Record Keeping Requirements - Persons required to file an FBAR must retain records that contain the name in which each account is maintained, the number or other designation of the account, the name and address of the foreign financial institution that maintains the account, the type of account, and the maximum account value of each account during the reporting period. The records must be retained for a period of 5 years from the filing due date.

Note

The FBAR generally contains all of the required information and retaining copies of the FBAR returns should satisfy the record keeping requirements.

Individuals who have signature authority over their employer's foreign financial accounts and who are required to file Form 114 are not personally required to maintain the records of that employer for 5 years.

Definition of “U.S. Resident” - FinCEN, in rules issued in 2011, clarified that, in determining whether an individual is a U.S. resident, the elections under Code Sec. 6013(g) (under which a non-resident alien married to a U.S. citizen or resident can elect to be treated as a resident for tax purposes) and Code Sec. 6013(h) (where a non-resident alien who becomes a U.S. citizen or resident before the close of the tax year and is married to an individual who is a U.S. citizen or resident on the last day of that tax year is treated as a citizen for the entire year) are disregarded.

Retirement and Other Financial Accounts - Life insurance policies and annuities are accounts for FBAR purposes. The obligation to file an FBAR rests with the policy holder and not the beneficiary.

Proposed rule change – In the rules changes proposed in March 2016, FinCEN clarifies that participants and beneficiaries in retirement plans under IRC sections 401(a), 403(a), or 403(b), as well as owners and beneficiaries of Traditional and Roth IRAs, are not required to file an FBAR with respect to a foreign financial account held by or on behalf of the retirement plan, IRA, or Roth IRA.

Interests in Trusts - FinCEN clarified in the 2011 rules that, to avoid confusion for discretionary beneficiaries or remaindermen, only beneficiaries who have a present beneficial interest in excess of 50% of a trust’s assets or who are receiving more than 50% of a trust’s current income are subject to the FBAR rules. (31 CFR 1010.350(e)(2)(iv))

Proposed rule change – The March 2016 rules change would relieve the beneficiary of a trust described in the paragraph above from having to report the trust's foreign financial accounts if the trust, trustee of the trust, or agent of the trust is a United States person that files a FBAR disclosing the trust's foreign financial accounts.

Person - A person means an individual and legal entities including, but not limited to, a limited liability company, corporation, partnership, trust, and estate.

United States Person - United States (U.S.) person means U.S. citizens; U.S. residents; entities, including but not limited to, corporations, partnerships, or limited liability companies created or organized in the U.S. or under the laws of the U.S.; and trusts or estates formed under the laws of the U.S.

Note: The federal tax treatment of an entity does not determine whether the entity has an FBAR filing requirement. For example, an entity that is disregarded for purposes of the Internal Revenue Code must file an FBAR, if otherwise required to do so. Similarly, a trust for which the trust income, deductions, or credits are taken into account by another person for purposes of the IRC must file an FBAR, if otherwise required to do so.

Filing Exceptions

Certain Accounts Jointly Owned by Spouses - The spouse of an individual who files an FBAR is not required to file a separate FBAR if the following conditions are met:

-

All the financial accounts that the non-filing spouse is required to report are jointly owned with the filing spouse;

-

The filing spouse reports the jointly owned accounts on a timely filed FBAR electronically signed; and,

-

The filers have completed and signed Form 114a, Record of Authorization to Electronically File FBARs (maintained with the filer’s records).

Otherwise, both spouses are required to file separate FBARs, and each spouse must report the entire value of the jointly owned accounts.

Consolidated FBAR - If a United States person that is an entity is named in a consolidated FBAR filed by a greater than 50 percent owner, such entity is not required to file a separate FBAR.

A financial account maintained with a financial institution located on a United States military installation is not required to be reported, even if that military installation is outside of the United States.

Watch for Overlooked Accounts

Some taxpayers may not realize that they have accounts that fall under this reporting requirement, such as:

-

Family Accounts – Recent immigrants to the U.S. may still have parents or other family members residing in the “old” country, and those relatives may have included them on an account in the foreign country., This is common practice for some ethnic groups., The taxpayer does not really consider the account theirs, but it falls under the reporting requirement if they have signature or other authority over the account.

-

Inherited Accounts – Accounts that are in a foreign country and are inherited fall under the FBAR reporting requirement even if the funds are subsequently transferred to the U.S., The FBAR rules state that reporting is required if at any time during the year the foreign account exceeds $10,000., CAUTION: An inheritance may also require the filing of Form 3520 (see Reporting Receipt of Foreign Gifts in this chapter).

-

Business Accounts – An officer or board member may have signature authority over a business account held in a foreign country and inadvertently overlook the need to meet the FBAR reporting requirements.

-

Foreign Retirement Savings Accounts – For example a U.S. Resident with Canadian RRSPs and RRIFs retirement plans with values exceeding $10,000.

-

Clients with On-Line Gambling Accounts – The Tax Court has held that an on-line gambler was required to file an FBAR for on-line gaming accounts with out-of-the-country on-line casinos. He was fined for not making an FBAR reporting of his online account and the tax court sided with the government. Upon appeal, the court ruled that only the account where the taxpayer’s financial institution acted as an intermediary between his U.S. bank account and the online poker sites, he used was a foreign account that was reportable on the FBAR. (Hom (DC CA, 6/4/2014); J.C. Hom, CA-9, 2016)

Determining Maximum Account Value - For each foreign account, it is necessary to determine the maximum value in the currency of that account for the calendar year being reported. The maximum value of an account is a reasonable approximation of the greatest value of currency or nonmonetary assets in the account during the calendar year. If periodic account statements fairly reflect the maximum account during the year, they may be relied on to determine the maximum value of the account. Each account must be valued separately. For accounts in non-U.S. currency, the maximum account value must be converted into U.S. dollars by using the Treasury Department’s Bureau of Fiscal Service rate, which can be found at https://fiscaldata.treasury.gov/datasets/treasury-reporting-rates-exchange/treasury-reporting-rates-ofexchangefrom the last day of the calendar year. If the Treasury’s rate is not available, another verifiable exchange rate can be used if the source of the rate is identified. If the aggregate of the maximum account values exceeds $10,000, an FBAR must be filed.

Example: A U.S. person has a bank account that is denominated in Euros at a bank in Bucharest, Romania. The highest value of the account during 2023 was on October 4, 2023. To convert the October 4th value to U.S. dollars, use the exchange rate for a Euro as of December 31, 2023 as found on the Treasury Department's website.

-

Filing Information – The Form 114 is not included with an individual’s 1040; must be submitted electronically; and is not filed with the IRS. Instead, it is filed through the BSA E-filing System.

Tax Preparers - Tax preparers intending to submit their clients’ 114 forms to FinCEN will need to enroll with FinCEN to do so. According to FAQs on the FinCEN website:

“An attorney, CPA or an Enrolled Agent always may assist its clients in the preparation of electronic BSA forms for BSA E-Filing, including the FBAR. Consistent with FinCEN's recent proposal to provide for approved third-party filing of the FBAR, if an attorney, CPA or Enrolled Agent has been provided documented authority [such as a Form 2848 power of attorney or similar form unique to FinCEN] by the legally obligated filers to sign and submit FBARs on their behalf through the BSA E-Filing System, that attorney, CPA or Enrolled Agent can do so through a single BSA E-Filing account established for the attorney, CPA or Enrolled Agent. If such authority is not provided, the filings must be signed and submitted through a BSA E-Filing account unique to each client.”

-

FinCEN has provided Form 114a, Record of Authorization to Electronically File FBARs, on which persons with an obligation to file a FBAR (e.g., your clients) can authorize a third party (you or your firm) who is registered with FinCEN to submit the filing electronically. A copy of the completed Form 114a should be retained for 5 years by both you and your client; a copy is not sent to FinCEN. Check the FinCEN website for additional information and to register to be authorized to file on behalf of your clients:

http://bsaefiling.fincen.treas.gov/main.html or contact the BSA E-Filing Help Desk at 1-866-346-9478 with questions.

Amending an FBAR - To amend a previously filed FBAR, check the "Amended" box in the upper right-hand corner of the first page of the FBAR and enter the prior report BSA identifier (which was provided in a secure message from BSA when the original FBAR was filed). Complete the form in its entirety and include the amended information.

Statute of Limitations - The statutes of limitations on assessment (ASED) and collection (CSED) of FBAR penalties are defined under Title 31, the Bank Secrecy Act. (MSSP Guide 8.11.6.3.1)

-

Failure to file FBAR report (either willful or negligent): 6 years from the due date of the FBAR report.,

-

Failure to maintain required records (either willful or negligent): 6 years from the date the IRS first asks for the records.

Note: If both types of violations have occurred, examiners can assert both the failure-to-file an FBAR report penalty and failure to maintain required records penalty on the same account for the same period. However, compliance policy in IRM 4.26.16.6.7 allows examiners discretion over whether to assert multiple violations against one FBAR report.

FBAR Penalty Application – Does the non-wilful FBAR penalty apply to each unreported account or only to the unfiled or erroneous FBAR? In US v. Kaufman, (DC CT 1/11/2021) the district court found the nonwillful FBAR penalty applies per form, not per account. Thus, the penalty was capped at $10,000. This is unlike the situation of a willful violation, where the statutory cap for the penalty is based on the balance of the account. However, in US v Boyd (CA 9) 127 AFTR 2d ¶2021-541, the district court hearing that case held that the penalty for a non-willful FBAR violation relates to each account required to be shown on the FBAR. The Court of Appeals for the Ninth Circuit, in reasoning that was like the reasoning in Bittner, Kaufman, and Giraldi, reversed the district court and found that the FBAR non-willful penalty applies per form, not per account. The split in authority between the 5th and 9th circuit courts was settled when the U.S. Supreme Court ruled in February 2023 that the $10,000 maximum penalty under the Bank Secrecy Act (BSA) for the nonwillful failure to file a compliant FBAR accrues on a per-report, not a per-account, basis. (Bittner v. United States 19 F. 4th 734) This ruling saved taxpayer Bittner over $2 million in penalty.

FBAR Penalties - Examiner Discretion (IRM4.26.16.5.2.1 (06-24-2021)) - The examiner may determine that the facts and circumstances of a particular case do not justify asserting a penalty. The examiner has discretion in determining the amount of the penalty, if any, based on the facts and circumstances of the case. Examiners may consider whether the issuance of a warning letter and the securing of delinquent and/or amended FBARs, rather than the determination of a penalty, will achieve the desired result of improving compliance with the FBAR reporting and recordkeeping requirements in the future.

-

Factors to consider when applying examiner discretion may include, but are not limited to, the following:,

-

Whether the person who committed the violation had been previously issued a warning letter or has been assessed the FBAR penalty;

-

The nature of the violation and the amounts involved;

-

The filer’s conduct contributing to the violation;

-

Whether the filer cooperated during the examination;

-

The balance in each account during the year; and

-

The total amount of all penalties to be asserted for all violations.

-

-

Given the magnitude of the maximum penalties permitted for each violation, the assertion of multiple penalties and the assertion of separate penalties for multiple violations with respect to a single FBAR, should be considered and calculated to ensure the amount of the penalty is commensurate to the harm caused by the FBAR violation.

The IRS developed mitigation and other guidelines to assist examiners in determining the amount of civil FBAR penalties. These guidelines are discussed in IRM 4.26.16.5.3; 4.26.16.5.4; and 4.26.16.5.5 with respect to negligence penalties, penalties for non-willful violations and penalties for willful violations, respectively.

Managers must perform a meaningful review of the employee’s penalty determination prior to assessment (see IRM 4.26.16.5.6).

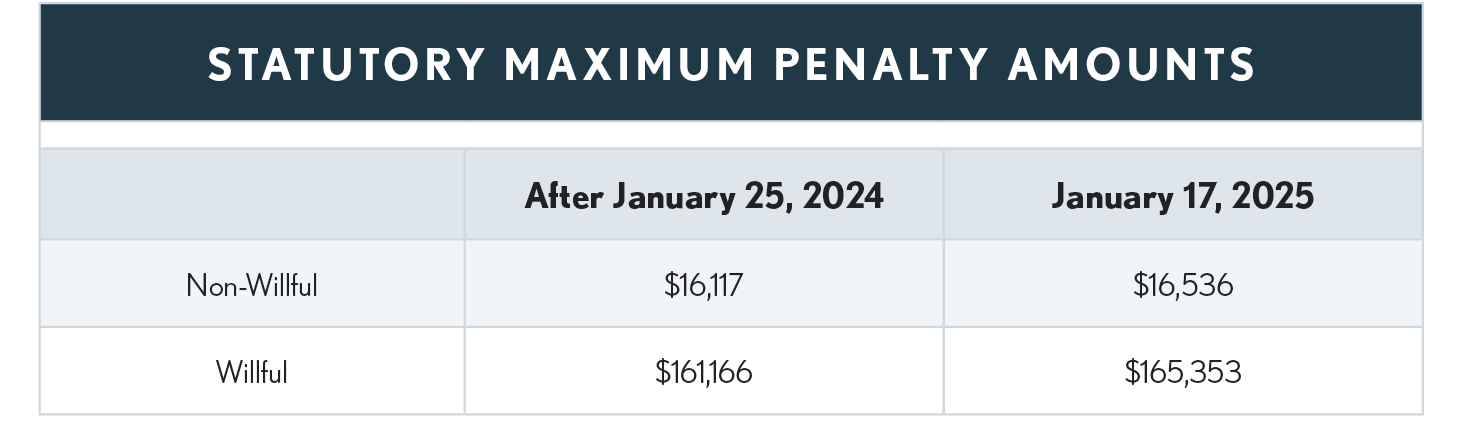

Statutory Maximum Penalty Amounts – For each non-willful violation, the statutory maximum penalty is $10,000 while the maximum penalty for willful violations is $100,000. These amounts are inflation-adjusted.

Penalty Mitigation Guidelines (IRM Exhibit 4.26.16-2). Note this is an overview; for more details consult the IRM.

Non-Willful:

| BALANCE | PENALTY |

| LEVEL I: If the maximum aggregate balance for all accounts to which the violations relate did not exceed $50,000 at any time during the year. | $500 for each violation, not to exceed an aggregate penalty of $5,000 per year. |

| LEVEL II: If the maximum aggregate balance of all accounts to which the violations relate exceeds $50,000 but does not exceed $250,000. | $5,000 for each violation. |

| LEVEL III: If the maximum aggregate balance of all accounts to which the violations relate exceeds $250,000. | The statutory maximum for non-willful violations. |

Willful:

| BALANCE | PENALTY |

| LEVEL I: If the maximum aggregate balance for all accounts to which the violations relate did not exceed $50,000 during the calendar year, penalty applies to all accounts | The greater of $1,000 per year or 5% of the maximum aggregate balance of the accounts during the year to which the violations relate. |

| LEVEL II: If the maximum aggregate balance for all accounts to which the violations relate exceeds $50,000 but does not exceed $250,000, Level II penalties are computed on a per account basis. | For each account for which there was a violation, the greater of $5,000 or 10% of the maximum account balance during the calendar year at issue. |

| LEVEL III: If the maximum aggregate balance for all accounts to which the violations relate exceeds $250,000 but does not exceed $1,000,000, Level III penalties are computed on a per account basis. | For each account for which there was a violation, the greater of 10% of the maximum account balance during the calendar year at issue or 50% of the account balance on the day of the violation. |

| LEVEL IV: If the maximum aggregate balance for all accounts to which the violations relate exceeds $1,000,000, Level IV penalties are computed on a per account basis. | For each account for which there was a violation, the greater of 50% of the balance in the account at the time of the violation or the statutory maximum penalty. |

If an account is co-owned with one or more other persons, a penalty determination must be made separately for each co-owner. The penalty against each co-owner will be based on his or her percentage of ownership of the highest balance in the account. If the examiner cannot determine each owner’s percentage of ownership, the highest balance will be divided equally among each of the co-owners.

Practitioner Responsibility - Some practitioners had taken the position that the FinCEN 114 reporting form is not a tax document and therefore not within their legal responsibility to comply with the reporting requirement.

THIS IS NOT TRUE – The Office of Professional Responsibility (OPR) made it quite clear that practitioners must comply with the FBAR filing rules and use due diligence in determining if a client has a reporting requirement. The flow chart below is provided as an overview to a practitioner’s responsibilities.

Offshore Voluntary Disclosure Program (OVDP) - The IRS, for several years, offered “disclosure programs,” aimed at getting taxpayers with hidden offshore accounts to voluntarily come forward and comply with FBAR and foreign income reporting. Under these programs, participants needed to file all original and amended tax returns and include payment for back-taxes and interest for up to eight years, as well as pay accuracy-related and/or delinquency penalties.

The most current program was the 2014 OVDP, which the IRS shut down as of September 28, 2018 (IR-2018-52). The discontinuance of this program is a reflection of advances in third-party reporting (as a result of FATCA) and increased awareness by U.S. taxpayers of their tax reporting obligations. Only 600 disclosures were made under the program in 2017, down from a peak of 18,000 disclosures under an earlier OVDP. The Streamlined Filing Compliance Procedures program, discussed below, will continue to be available to eligible taxpayers.

IRS’s Streamlined Voluntary Filing Compliance Program - A U.S. taxpayer who has not reported their foreign financial assets on their tax returns and can certify that the reporting failure and non-payment of all tax due related to those assets did not result from willful conduct on the taxpayer’s part, can come into compliance with the IRS by doing the following:

-

For each of the most recent three years for which the U.S. tax return due date (including extended due dates) has passed, file amended tax returns, together with all required information returns (e.g., Forms 3520, 3520-A, 5471, 5472, 8938, 926, and/or 8621). These three years are referred to as the “covered tax return period”;

-

For each of the most recent six years for which the FBAR (foreign bank account report) due date has passed, file any delinquent FBAR returns (FinCEN Form 114). These six years are referred to as the “covered FBAR period”; and,

-

Pay a 5% miscellaneous offshore penalty plus any tax and interest due on the amended returns. The full amount of the tax, interest, and miscellaneous offshore penalty due in connection with these filings should be remitted with the amended tax returns.,

The miscellaneous offshore penalty is equal to 5% of the highest aggregate balance/value of the taxpayer’s foreign financial assets during the years in the “covered tax return period” and the “covered FBAR period.” For this purpose, the highest aggregate balance/value is determined by aggregating the year-end account balances and year-end asset values of all the foreign financial assets and selecting the highest aggregate balance/value from among those years.

Taxpayers who have completed the streamlined filing compliance procedures, will be expected to comply with U.S. law for all future years and file returns according to regular filing procedures.

Returns submitted under the streamlined offshore procedures will not automatically be subject to IRS audit, but they may be selected for audit under the IRS’s audit selection processes applicable to any U.S. tax return. If selected, they will be checked for accuracy and completeness, just as with any other audit. If errors or omissions are discovered, the taxpayer could be subject to additional civil penalties, and even criminal liability, if appropriate.