Post-1984 to 2018 Decrees and Agreements

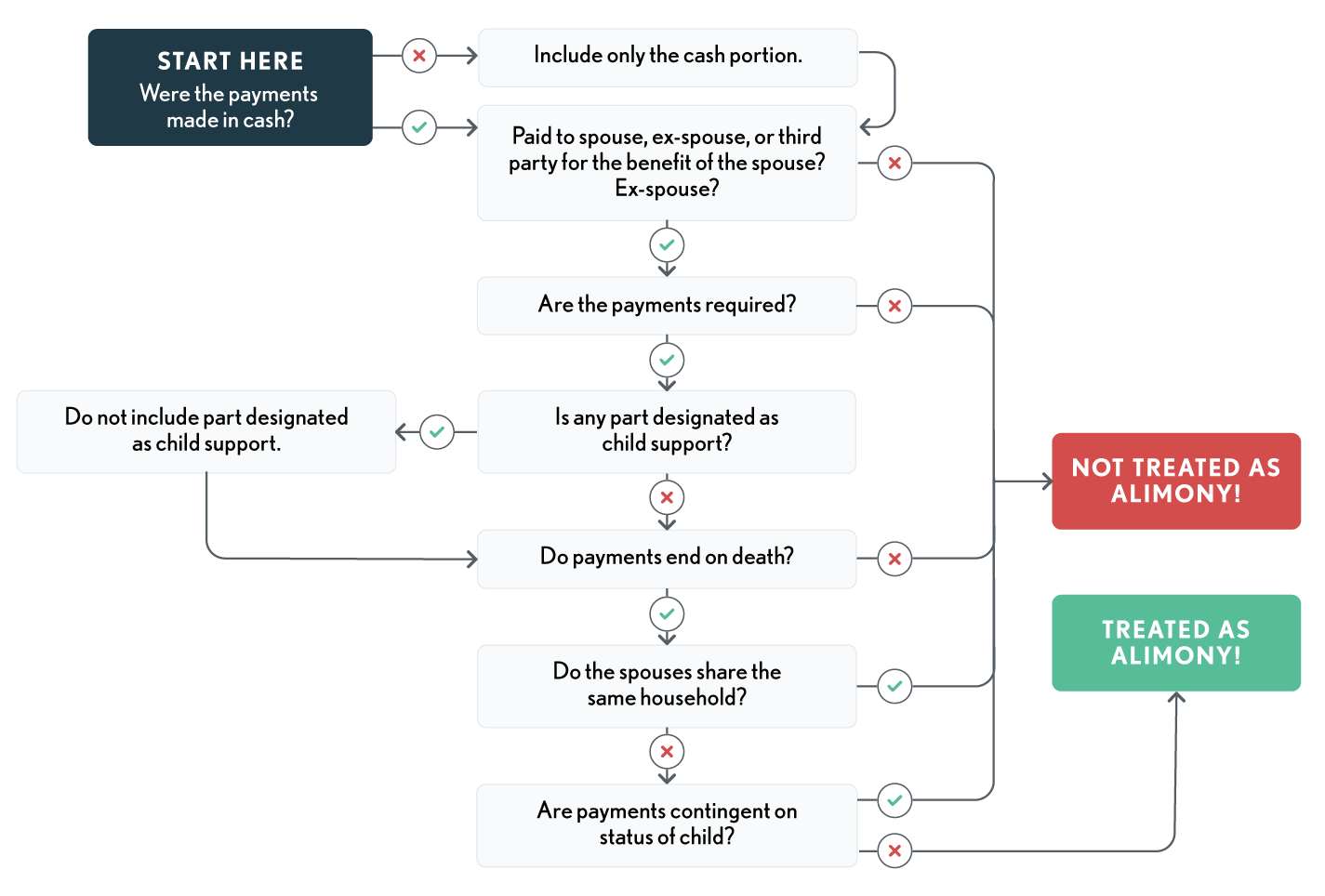

All alimony payments related to divorce decrees issued from 1985 through 2018 must adhere to the following rules and regulations, as set forth by the IRS:

Payments:

-

Must be in cash, paid to the spouse, ex-spouse or a third party on behalf of a spouse or ex-spouse, and the payments must be made after the decree (Reg § 1.71-1(b)(1)(i)). If made under a separation agreement, the payment must be made after execution of that agreement (Reg § 1.71-1(b)(2)).

-

Must be required by a decree or instrument incident to divorce, a written separation agreement, or a support decree (IRC § 71(b)(1)(A) prior to repeal by the TCJA);

-

Cannot be designated as child support (IRC § 71(c)(1) prior to repeal by the TCJA)

-

Are valid alimony only if the taxpayers live apart after the decree., Spouses who share the same household can’t qualify for alimony deductions., This is true even if the spouses live separately within a dwelling unit. (IRC § 71(b)(1)(C) prior to repeal by the TCJA)

-

Must end on the death of the payee (IRC § 71(b)(1)(D) prior to repeal by the TCJA); Linda Hoover, (1995) TC Memo 1995-183 held that failure to include terminate-at-death language in a final divorce decree converted payments that would have been deductible as alimony into a nondeductible property settlement., Where the divorce decree is silent, courts will generally consider state law and where state law is vague may make their own decision based on the facts and circumstances of the case.,

-

Cannot be contingent on the status of a child (IRC § 71(c)(2) prior to repeal by the TCJA) – that is, any amount that is discontinued when a child reaches 18, moves away, etc., is not alimony—contrast the former treatment of the Lester-type agreement described in the “Payments Under Pre-1985 Decrees and Agreements” section later in this chapter.

Payments need not be for support of the ex-spouse or based on the marital relationship. They can even be payments for property rights as long as they meet the above requirements. Payments need not be periodic, but there are dollar limits and “recapture” provisions (see below). Even if payments meet all the alimony requirements, the couple may designate in their agreement or decree that the payments are not alimony and that designation will be valid for tax purposes (i.e., not deductible by payer and not taxable to recipient).

Excess Front-Loading for Instruments Executed After 1986 And Through 2018 (IRC §71(F))

The rules affect the first three post-separation years. Recapture may apply to part of the payments made in the first two postseparation years that are more than $15,000. Post-separation years begin the year alimony payments begin. Excess alimony payments are defined as the total of the excess payments in the first and second post-separation years.

These rules apply to divorce instruments executed after Dec 31, 1986, and before January 1, 2019.However, they can also apply to instruments executed before Jan 1, 1987, if the decrees are amended to stipulate that the 1986 law is to apply.

Computing the Recapture Amount

The following computations cannot be made until the completion of the third post-separation year. The excess amounts from the first and second years are totaled and reported as income (or deducted) in the third year. The following steps are used to compute the recapture:

(1) Add alimony payments made in the third post-separation year to $15,000.

(2) Subtract the result in (1) from alimony payments made in the second post-separation year (not less than zero).

(3) Find the average alimony payments for the second and third post-separation years by adding the alimony paid in the second post-separation year less recapture amount computed in (2) and third post-separation year and dividing the result by 2. Add $15,000 to this average.

(4) Subtract the result in (3) from alimony payments made in the first post-separation year (not less than zero).

(5) Add the results of (2) and (4). This amount must be recaptured at the end of the third post-separation year.

“ Example - Excess Front-Loading: Agreements Executed After 1986 and Before 2019 Sammy and Sandra were divorced in Year #1 (which was prior to 2019). He has deducted the alimony he paid her each year; she has reported the alimony as income. The divorce decree stipulated that Sammy must pay alimony as follows: Year #1, $35,000; Year #2, $9,000; Year #3, $5,000. The following worksheet shows Sammy's alimony recapture computation: ”

-

| Do NOT enter an amount less than zero on any line. | |

| 1. Alimony paid in 2nd year | 9,000 |

| 2. Alimony paid in 3rd year | 5,000 |

| 3. Floor | 15,000 |

| 4. Add lines 2 and 3 | 20,000 |

| 5. Subtract line 4 from line 1 | 0 |

| 6. Alimony paid in 1st year | 35,000 |

| Adjusted alimony paid in 2nd year (line 1 less line 5) | 9,000 |

| Alimony paid in 3rd year | 5,000 |

| Add lines 7 and 8 | 14,000 |

| Divide line 9 by 2 | 7,000 |

| Floor | 15,000 |

| Add lines 10 and 11 | 22,000 |

| Subtract line 12 from line 6 | 13,000 |

| Recaptured alimony. Add lines 5 and 13 | 13,000 |

Post-1986 recapture rules do not apply if:

-

either spouse dies;,

-

the alimony recipient remarries within certain time limits;,

-

the payments made are “temporary support payments”;

-

the payments fluctuate due to conditions beyond the payer’s control because of a continuing liability to pay, for at least 3 years, a fixed part of business income.

Reporting the Recapture Amount

The excess amount is reported as income by the alimony PAYER in the year the excess is computed. This is shown as “alimony received” on Form 1040 (Sch 1, line 11 for 2018). Cross out the word “received” and write in “recapture” on the 1040. Also, indicate the social security number of the former spouse. Conversely, the alimony recipient is allowed a deduction in the same year the excess is reported by the payer. The amount is reported on the “alimony paid” line of Form 1040 (Sch 1, line 31(a) for 2018). “Paid” is crossed out and “recapture” is inserted on the form. The recipient must also include the social security number of the payer.

The Tenth Circuit Court held that estate beneficiaries were liable for tax on amounts received from their mother’s estate that had been received from the estate of her ex-husband under an alimony arrearage settlement. The Court disagreed with the beneficiaries’ argument that § 682 (Income of an Estate or Trust in Case of Divorce, Etc.) limited their income to the distributable net income of the ex-husband’s estate. Kitch v. Comm, (CA10, 12/31/96)

Pension Substitute Payments to Ex-Spouse

The Court of Appeals for the Ninth Circuit, reversing the Tax Court, has held that a divorced individual who resided in a community property state was taxable on amounts he paid from his wages to his ex-spouse as ordered by a state court. The court had awarded the spouse one-half of the individual's retirement benefits, but because he had not retired, these benefits were not yet payable, so the court ordered him to make alternative payments to the spouse until he retired.

Thus, the Ninth Circuit Court of Appeals ruled that even though the pension payments would be made under a qualified domestic relations order (QDRO) agreement and taxable to the spouse, the alternative payments were taxable to the taxpayer and not deductible as alimony under Code Sec. 71(b) since they were required to be made to the ex-spouse or her estate. One of the definitions of alimony is that the payments terminate upon the death of the alimony recipient. Comm. v. Dunkin (CA 9 8/31/2007)