Forms to Be Filed After Taxpayer's Death

When a taxpayer dies, there are a number of forms that must be filed. If you are a family member or executor, you'll find everything you need here. If you have questions, a local tax professional can help you through the process.

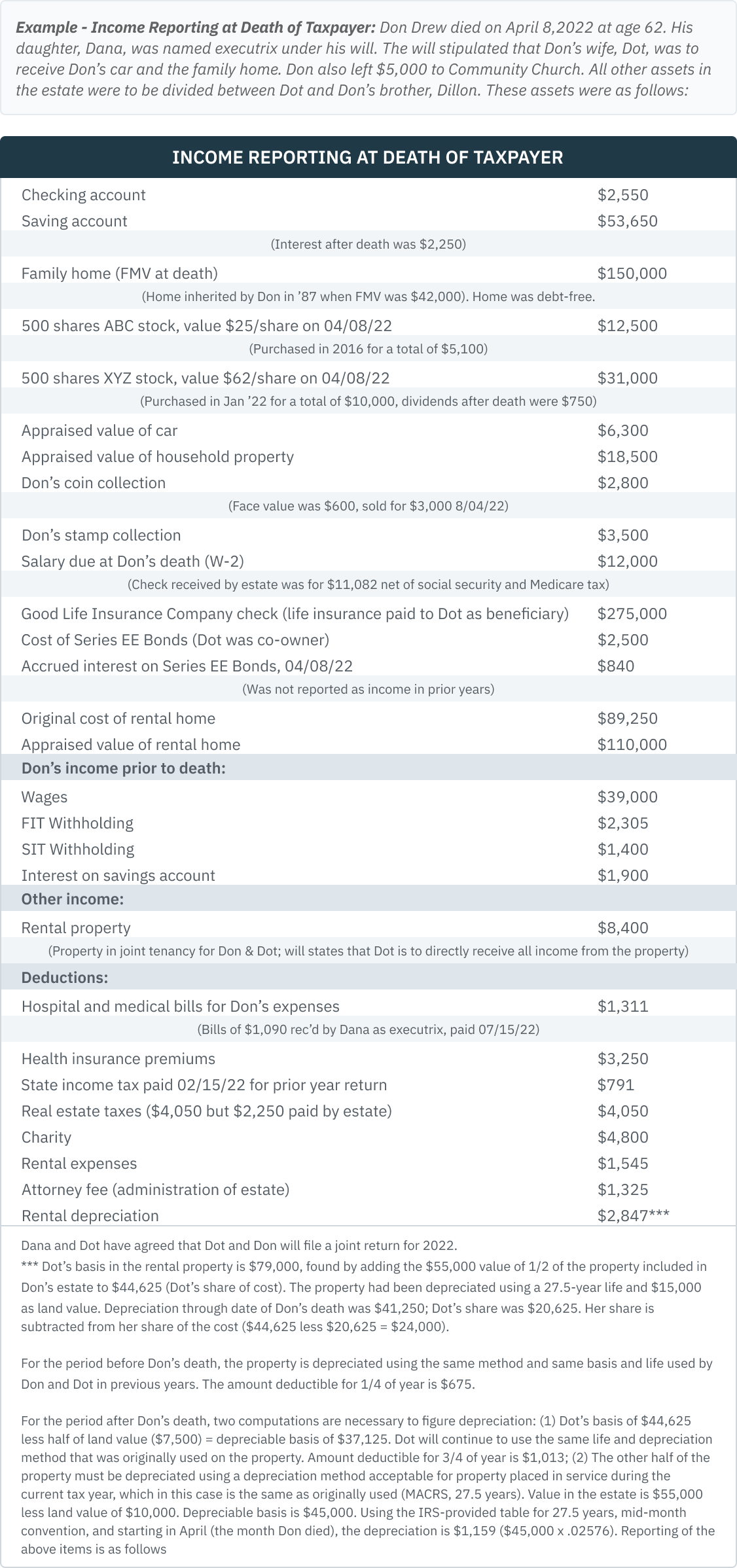

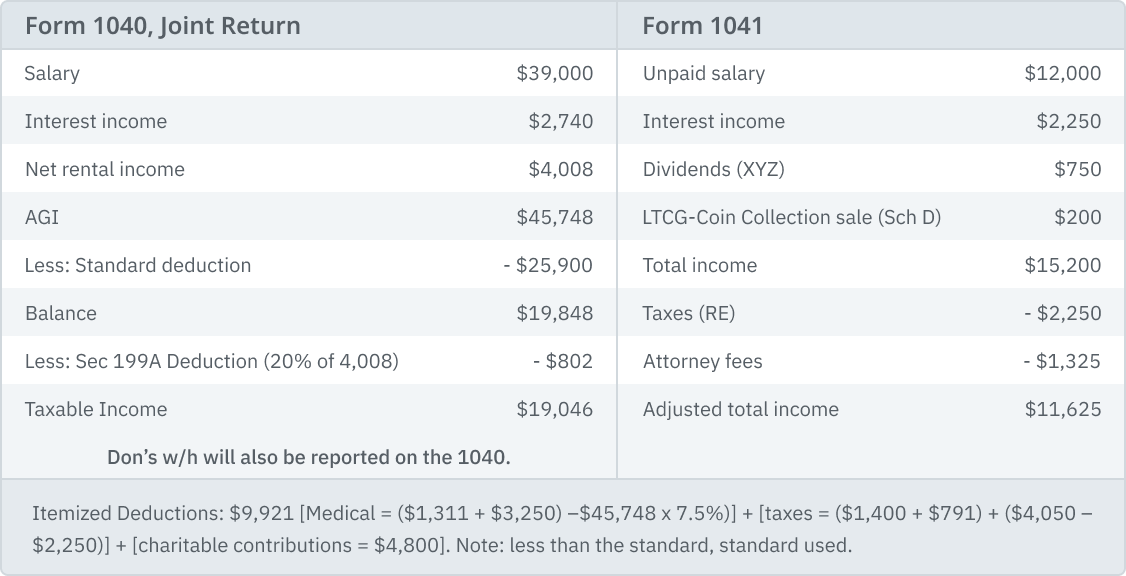

Use the chart on page 1.05.09 as a guide to the various forms that must be filed following a taxpayer’s death. The following are the basic forms and returns, which may need to be filed (dependent on the filing requirements of each):

Form 56 – The trustee, executor, administrator, or other personal representative (collectively referred to as a fiduciary) must file a written notice with the IRS stating that he or she has been appointed to act in a fiduciary capacity for the decedent, i.e., that the fiduciary is assuming the powers, rights, duties, and privileges of the decedent. This is done on Form 56, Notice Concerning Fiduciary Relationship, which should be filed as soon as all the necessary information (including the EIN obtained for the estate or trust) is available. This form is also used to notify the IRS when the fiduciary relationship has been terminated or when a successor fiduciary is appointed.

Form 1040 - File the decedent’s final return as usual on Form 1040 and comparable state return.

Form 1041 - This is the income tax return of the estate--used to report income on the assets in the estate, including sales of property. The estate exists until final distribution of its assets. An estate’s tax year can be a calendar year, or a fiscal year--the type of year is chosen when the first 1041 is filed for the estate. Once chosen, the tax year can only be changed with IRS permission. If distributions have been made to beneficiaries, the income of the estate generally passes to them via Schedule K-1 for tax reporting purposes. Losses incurred by the estate generally are not passed to the beneficiaries other than on the return and K-1 for the estate’s final year.

Form 1041 is also used to file the income tax return of a trust. Many individuals will establish a revocable trust during their lifetime, which will become irrevocable upon the individual’s death. If the individual is unmarried, commonly the trust serves merely to administer the assets until they can be distributed to the beneficiaries and then it terminates. Form 1041 is used to report the income during the administrative period, which may include more than one tax year; a 1041 will then be needed for each year. If the individual was married, frequently the revocable trust splits into two or more trusts; the surviving spouse’s trust continues to be revocable while the other trust(s) become irrevocable. In most cases Form 1041 need only be filed for the irrevocable trust(s). Refer to the instructions for Form 1041 for more information.

-

Filing Requirement – An income tax return (1041) must be filed if the estate has gross income of $600 or more., However, if one or more beneficiaries is a non-resident alien, Form 1041 must be filed even if the gross income is less than $600.

-

K-1s - K-1s are filed with the 1041 for each beneficiary showing the income, deductions, etc., allocable to each., Each beneficiary is to be furnished a copy of the K-1 pertinent to him or her.

Form 706 - Used to compute the tax on the value of the assets in the estate. Required if the gross estate exceeds the exclusion amount which is $12,060,000 for deaths in 2022 ($11,700,000 for deaths in 2021; $11,580,000 for deaths in 2020). See chapter 11.05 for exclusion amounts for other years.

-

For deaths in 2010 - there was a choice to be subject to the estate tax and use FMV basis for beneficiaries or not be taxed and use modified carryover basis (Sec 1022 election)., If the option to be not taxed was selected, then no 706 was required and instead the Form 8939 was filed (see previous discussion of Form 8939). Generally, executors of estates valued at no more than $5 million (the 2010 exclusion amount) opted to be subject to the estate tax, but because the estate’s value did not meet the filing threshold, the 706 was not required to be filed.

-

For deaths after 2010 - The decedent’s unused portion of the exclusion may be transferred to the surviving spouse (the so-called portability election), provided Form 706 is timely filed (including extension), even if the value of the decedent’s assets totals less than the inflation-adjusted exclusion noted above. See Reg. Sec. 20.2010-2(a) and Form 706 instructions for further details.

NOTE: Initially, the IRS’ position was that if the gross value of the estate was less than the exclusion amount for the year of death, and a 706 was not timely filed, the only way to achieve the portability election was by requesting an extension to file via a costly private letter ruling, and then filing the 706 within the extension period, if it was granted. (Chief Counsel Advice 201650017) Then later, the IRS provided relief from having to request a private letter ruling to obtain an extension to file a 706 when the value of an estate was less than the filing threshold in order for the surviving spouse to claim the deceased spouse’s unused exclusion (DSUE) amount. This simplified procedure was outlined in Rev Proc 2017-34, which in most cases, provided an automatic extension to file through the second anniversary of the decedent’s death. Rev Proc 2017-34 has been superseded by Rev Proc 2022-32, which updates the procedure by extending to the fifth anniversary of the decedent’s death the period the decedent’s estate may file and make the portability election, effective July 8, 2022. See Chapter 11.05 for additional details and requirements.

This is not an exhaustive list, and every form doesn’t apply to every estate or trust.

| Form# | Title | Due Date |

| FinCEN 114 | Report of Foreign Bank & Financial Accts | 04/15 of yr after decedent’s death/automatic 6-mo. extension |

| SS-4 | Application for EIN | As soon as possible |

| 56 | Notice Concerning Fiduciary Relationship | When all necessary info available |

| 706 | U.S. Estate (and GST) Tax Return* | 9 mos after date of decedent’s death |

| 706A | U.S. Add’l Estate Tax Return* | 6 mos after cessation or disposition of special-use valuation property |

| 706-CE | Certificate of Pmt of Foreign Death Tax* | 9 mos. after death. Filed with 706 |

| 706GS(D) | Generation-Skipping Transfer Tax Return* | See form instructions |

| 706GS(D-1) | Notification of Distribution from A GS Trust* | See form instructions |

| 706-NA | U.S. Estate Tax Return, Non Res/Non Citizen* | 9 mos. after date of decedent’s death |

| 712 | Life Insurance Statement* | Pt I to be filed with estate tax return |

| 1040/1040SR | U.S. Individual Tax Return | Generally, 04/15 of yr after death |

| 1040NR | U.S. Nonresident Alien Income Tax Return | 15th day of 6th mo after end of tax yr |

| 1041 | U.S. Income Tax Return for Estates | 15th day of 4th month after end of the estate’s tax year |

| 1041-A | U.S. Information Return--Trust Accumulation | 15th day of 4th mo after end of tax year |

| 1041-T | Allocation of Est Tax Pmts to Beneficiaries | 65th day after end of estate’s tax year |

| 1041-ES | Estimated Income Tax for Estates & Trusts | Generally, 04/15, 06/15, 09/15, and 01/15 for calendar year filers |

| 1042 | W/h Tax Rtrn for U.S. Inc of Foreign Persons | March 15 |

| 1042S | Foreign Person’s U.S. Source Inc. Subj. to w/h | March 15 |

| 1310 | Refund Due a Deceased Taxpayer | To be filed with 1040 in some cases if refund due |

| 3520 | Report Foreign Trust Transactions & Gifts | Generally 04/15 of yr after decedent’s death |

| 3520-A | Annual Info. Rtrn of Foreign Trust w/US Owner | 15th day of 3rd month after end of trust’s year |

| 4768 | Appl of Ext of Time to File Rtrn/Pay Estate Tax* |

By original due date if filing for automatic 6-month extension |

| 4810 | Request for Prompt Assessment IRC 6501(d) | As soon as possible after filing Form 1040 or Form 1041 |

| 7004 | Application for Automatic Extension (1041) | Unextended due date (generally 4/15 for calendar year) |

| 8300 | Report of Cash Payments Over $10,000 | 15th day after date of the transaction |

| 8822, 8822-B | Change of Address | As soon as the address is changed |

| 8971 & Sch A(s) | Info Re Beneficiaries Acq’ng Prop from Decedent | By 30 days after 706 filed or due date if earlier** |

*Or form 8939 if no estate tax was elected for decedents dying in 2010; due date of 8939 was Jan. 17, 2012.

**Supplemental reporting may be required if “final value” of property later revised because of audit, error, or omission

California Differences

Federal Estate Tax – Federal estate tax paid on income in respect of a decedent is not deductible for California. If federal deductions are itemized, enter the amount of federal estate tax shown on federal Schedule A as a negative adjustment on CA Schedule CA.

Forms to File - If the decedent was a California resident and federal Form 1041 is required, California Form 541 must generally be filed. California does not have an estate or inheritance tax, so there is no state form comparable to federal Form 706.

Inherited Basis of Property of Decedent’s Dying in 2010 – California does not conform to the federal modified carryover basis rules for 2010, so for California purposes, the inherited basis of assets of a decedent dying in 2010 is fair market value on the date of death. (R&TC 18031, 18035.6)