Community Income

Community income is all the income from community property, including business property, salaries, etc., for the services of either or both spouses in a marriage.

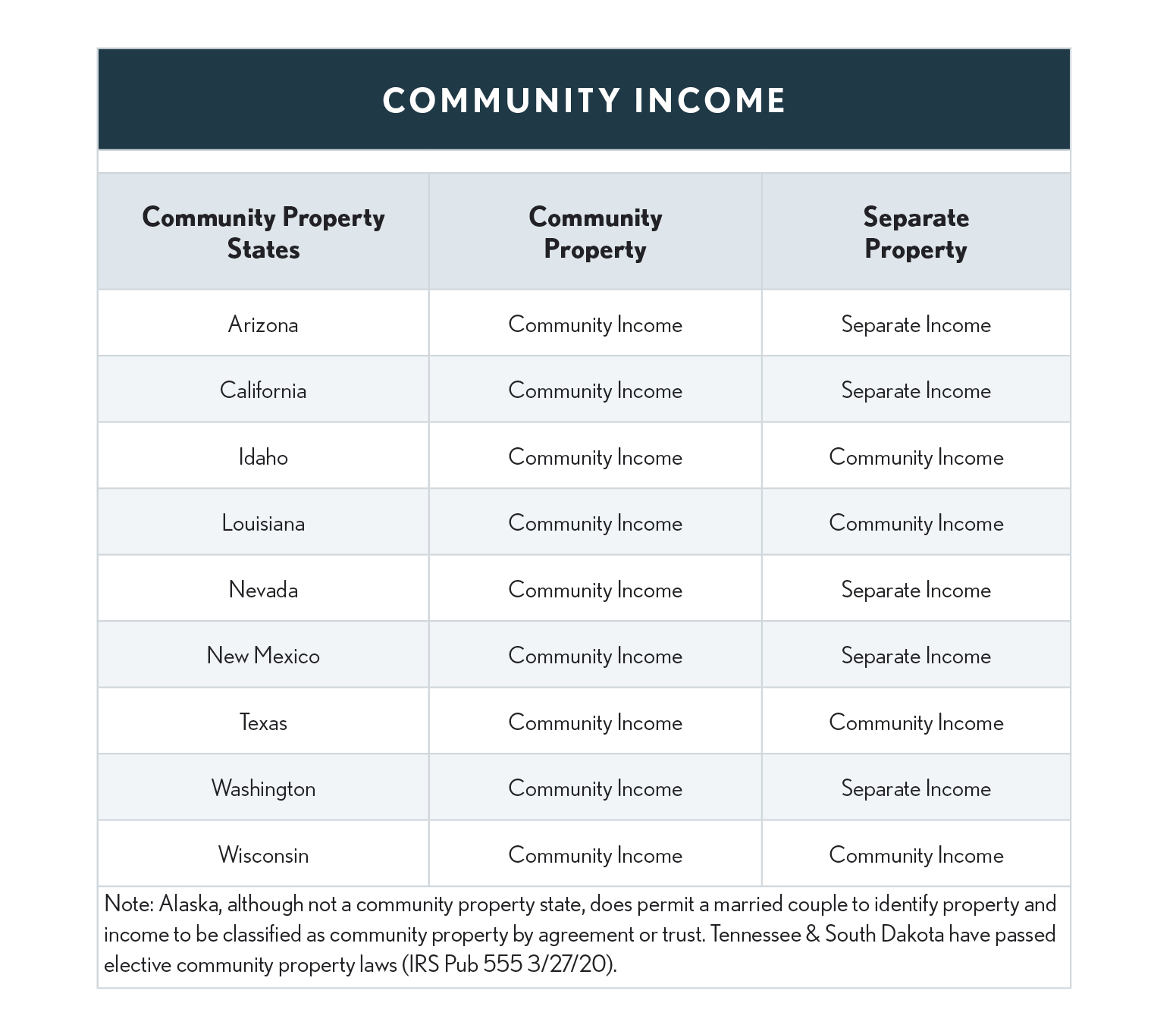

Income from separate property during the marriage is community income only in Idaho (ID), Louisiana (LA), Texas (TX), and Wisconsin (WI). Community income for federal purposes is community income as defined by state law.

Community income rules do not apply to income from property that was formerly community property, but in accordance with state law, has ceased to be community property, becoming, e.g., separate property or property held by joint tenancy or tenancy in common.

Community property laws of foreign countries, related to the taxation of U.S. citizens or residents, are recognized and applied for U.S. tax purposes.

Thus, where a determination must be made of whether a property located in a foreign country or income derived from a foreign country is community property or separate property, the community property laws of that country will apply.

In addition to the list below, taken from IRM 3.38.147.18.1 (01-01-2016), the Canadian province of Quebec, and most countries of the world with a European law tradition have community property as part of their overall civil law system