What Is Active Participation In a Non-IRA Plan?

The question of what constitutes active participation in a non-IRA retirement plan is a common one. Get answers about annuities and more below.

An individual is an “active participant” for a taxable year if either the individual or his/her spouse (with whom the individual files a joint return) participates in any of the following:

Plans That Create “Active Participation”

-

A qualified annuity plan;

-

A tax-sheltered annuity;

-

A simplified employee pension (SEP);

-

An employer-sponsored qualified pension, profit-sharing or stock bonus plan;

-

A plan established by a governmental agency for its employees, other than an unfunded deferred compensation plan for employees of state and local governments or exempt organizations (§ 457 plan);

-

An employee-only contributory plan exempt from tax under § 501(c)(18).

Special rules allow certain members of the Armed Forces reserves and certain volunteer firefighters not to be treated as active participants. (§ 219(g)(6))

Special Situations

-

Determination of active participation is made without regard to whether an individual’s rights under a retirement plan are vested. Notice 87-16, IRB 1987-5 states that retired taxpayers who are receiving pension benefits ARE NOT active participants in the paying plan.

-

An individual is an active participant in a defined benefit plan if the individual is eligible to participate, even if he/she elects not to participate. For a defined contribution plan, an individual generally is an active participant if employer or employee contributions or forfeitures are allocated to the employee’s account for a plan year ending within the individual’s tax year.

-

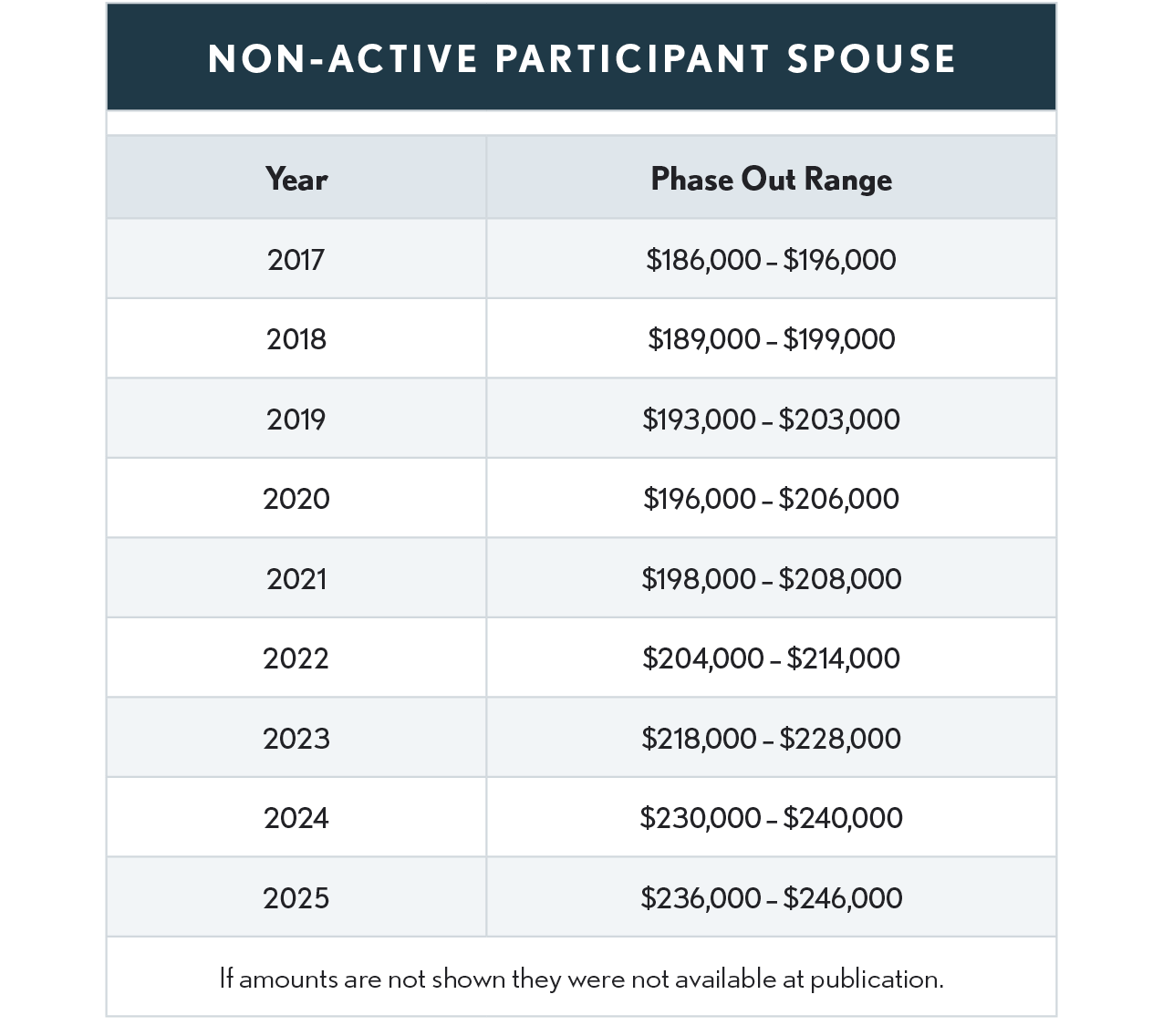

Special rule for a nonactive participant spouse - The maximum deductible IRA contribution for an individual who is not an active participant but whose spouse is an active participant, is phased out for the nonactive participant based upon their combined AGI. See the AGI phase-out limits in the table below.

Example - Phase Out for Joint Taxpayers - Sandra actively participates in a retirement plan at work, but her husband, Tim, is not involved in any plan. The couple has a combined AGI of $230,00 for 2023.

-

Result: Sandra: No Traditional IRA deduction due to her active participation in another plan and AGI is over $136,000. Tim: No Traditional IRA deduction because combined AGI is over $228,000. Assume that the couple’s combined AGI was only $140,000.

Result: Sandra: No Traditional IRA deduction due to her active participation in another plan and AGI is over $136,000. Tim: No active participation & AGI under $218,000; thus, he would be allowed a deductible Traditional IRA.