Tax Deductibility of IRA Contributions

Below, details about the tax deductibility of IRA contributions according to IRS regulations. This is important information for many taxpayers, as IRAs are a popular type of retirement account.

The contributed amount may or may not be deductible, depending on (1) the taxpayer’s income level and participation in other retirement plans, or (2) whether the taxpayer elects to treat the contribution to a traditional IRA as non-deductible.

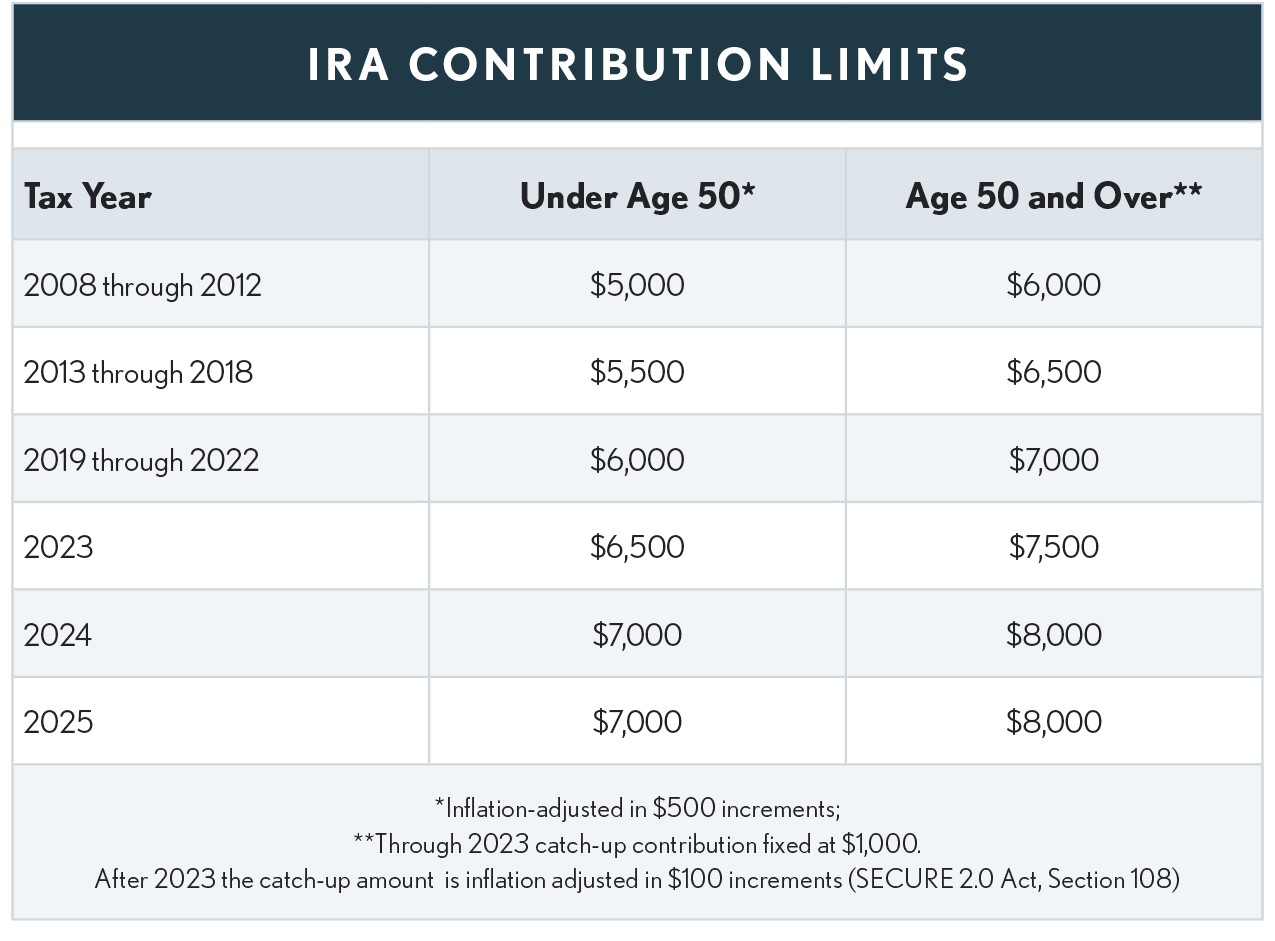

IRA Contribution Limits