Phase Out of IRA Deductions For Active Participants

-

Below, find detailed information and helpful tables pertaining to the phase out of IRA deductions for active participants. These are important facts for taxpayers to know.

-

-

Active participants (defined below) in qualified plans must limit their IRA deductions when their AGI reaches certain “threshold levels.”

-

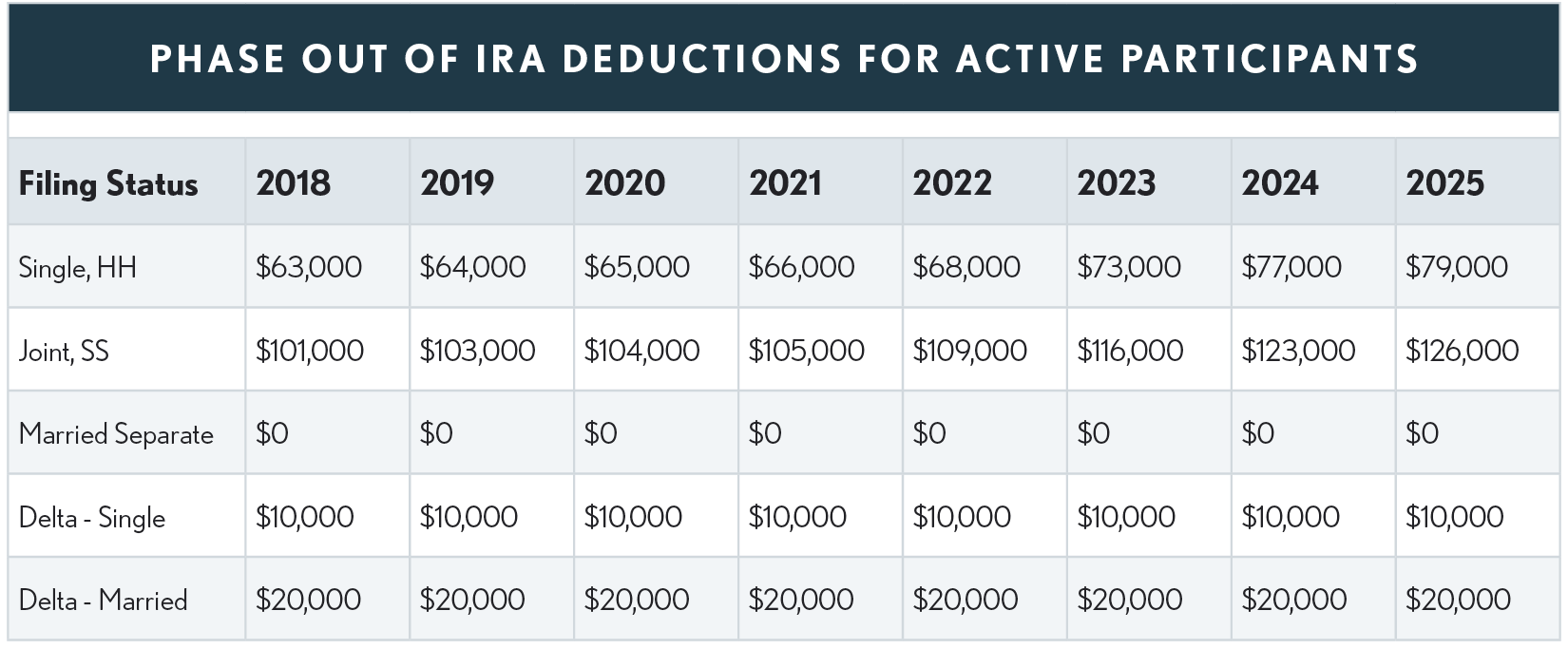

If AGI is below the “threshold,” even an active participant may deduct an IRA contribution within the IRA limits described above. The phase-out threshold levels for active participants are shown in the accompanying table:

If a taxpayer’s AGI exceeds the above thresholds by less than the “Delta Amount”, the IRA deduction will be limited; if it exceeds the thresholds by the “Delta Amount” or more, no IRA deduction is allowed.

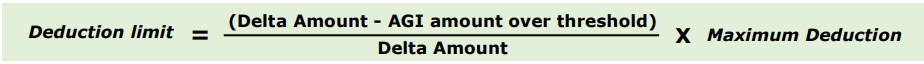

• Use the following formula to compute the phase out:

The result is rounded to the next higher $10. If the deduction limit turns out to be $1-$200, the deductible contribution can be as much as $200.