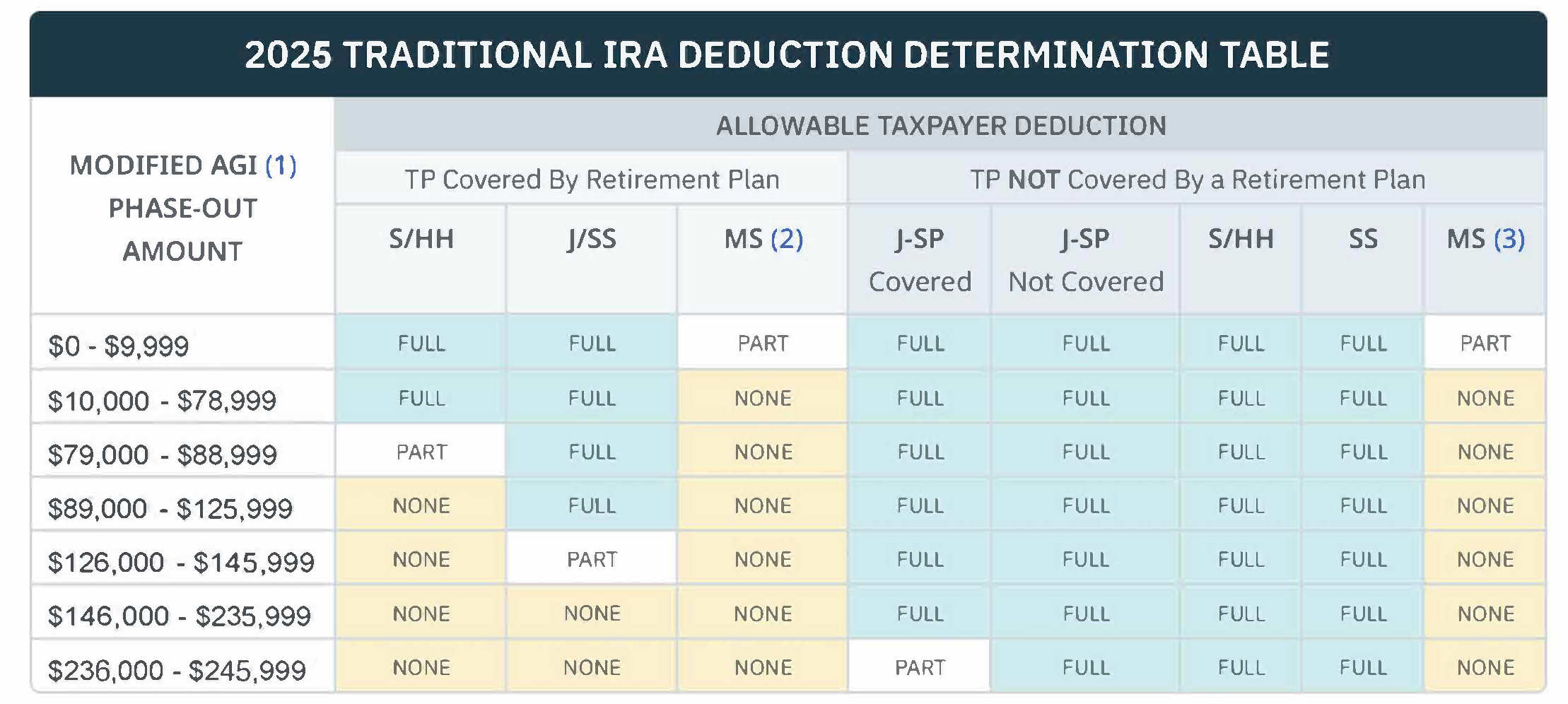

IRA Phase Out Modified AGI

Discover details about IRA phase out modified adjusted gross income (AGI) in this section. There are a number of factors that impact AGI, all of which are outlined here.

To compute the IRA phase out, adjusted gross income (AGI) is calculated without regard to the IRA deduction, exclusion for savings bond proceeds, adoption expenses reimbursement exclusion, student loan interest deduction, qualified higher education expenses deduction (in years the deduction is applicable), domestic production activities deduction (in years the deduction is applicable), foreign earned income and/or housing exclusion, or foreign housing deduction, but with regard to taxable social security benefits and the passive loss limitations. This is called modified AGI (MAGI). However, computation of taxable social security is dependent on the IRA deduction, presenting a calculation dilemma.

IRS Announcement88-38, 1988-10 IRB provided guidelines for calculating the IRA limitations when a taxpayer has social security income. Tax software uses these guidelines to compute the allowable IRA deduction and taxable Social Security income.

(1) Modified AGI is regular AGI (before any IRA deductions) increased by any excluded savings bond interest, foreign earned income or housing exclusions, foreign housing deduction, student loan interest deductions, adoption expenses reimbursement exclusion, qualified higher education expenses deduction (in years applicable), and domestic production activities deduction (in years applicable).

(2) If a taxpayer did not live with his/her spouse at any time during the year, filing status for this purpose is considered Single. Determine the IRA deduction from the Single column.

(3) A taxpayer is entitled to the full deduction if he/she did not live with his/her spouse at any time during the year.