California Differences - Traditional IRAs

There are certain differences between California law and federal law in regard to the taxation of traditional IRA accounts.

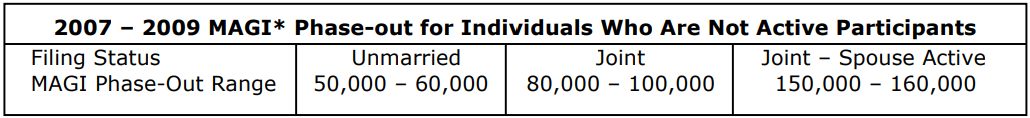

For tax years 2007 through 2009, California did not conform to the federal inflation adjusted AGI phase-outs for traditional IRAs. For tax years beginning on or after January 1, 2010, California DOES conform to the federal modified AGI indexed amounts.

CA Basis May Have Been Created

If the deductible amount for California was less than it was for federal because of the phase-out difference, basis was created for California, so when distributions are made in the future, part of each one will be nontaxable for California. It is important that the nondeductible amount be tracked so that tax isn’t paid on the basis portion of distributions.

Age Limitation for Contributions

California DOES NOT conform to the federal SECURE Act provision that removes the age cap of 70-1/2 for making traditional IRA contributions starting with tax year 2020. The Schedule CA instructions for 2020 did not deal with this adjustment. In fact, the columns for IRA adjustments on line 19 were greyed out. An obvious oversight on the part of the FTB. The FTB advised taxpayers to make the adjustment on line 22 instead.

For 2021 and 2022, if a taxpayer made an IRA contribution after becoming 70-1/2, the amount of that contribution that is deducted for federal should be entered on Schedule CA, Section C, line 20 in column B.

Since the contribution to a traditional IRA by a taxpayer over age 70-1/2 won’t be deductible for California, the undeducted contribution amount will increase the IRA’s basis for California purposes, resulting in the taxable distribution amounts being different for federal and California.

Excess Contribution Penalty

California does not have taxes like the federal tax on excess contributions to traditional IRAs, Roth IRAs, Coverdell ESAs, ABLE accounts, Archer MSAs, or tax on excess accumulation in qualified retirement plans.

Coronavirus-Related 2020 Distributions

The federal CARES Act included a provision allowing an eligible taxpayer to withdraw up to $100,000 from an IRA in 2020 that would be penalty free (for those underage 59½) and the income would be spread over three tax years, 2020, 2021 and 2022. The taxpayer could elect to have all of the distribution taxed on the federal return for 2020. Further, the taxpayer could redeposit up to the amount of the distribution during 2020-2022 and the recontribution would be treated as a rollover, making the distribution non-taxable, up to the amount redeposited. California conforms to these provisions, but the taxpayer could make a different election for federal and California.

What is the treatment if the taxpayer’s residency changes during the 3-year period? The income is to be allocated to California based on the residency period. Thus, in the year residency changes, a part-year California return is filed, and the IRA income to report will be based on the number of days spent in California that year divided by the total number of days in the year. The portion of the distribution attributable to the non-residency period is not taxable by California.

Example: Jack was a California resident all of his life until February 15, 2021, when he became a non-resident after a move to Texas. During 2020, he qualified to take a coronavirus-related distribution from his Traditional IRA and withdrew $90,000 from the IRA. He used the 3-year spread of the income for both federal and California and has not redeposited any of the distribution. So, in 2020 he reported $30,000 of IRA income to both the IRS and FTB. In 2021, he included $30,000 of IRA income on his federal return but only $3,780 is taxable by California since he was a resident for only 46 days ($30,000 x 46/365). For 2022, he’ll report $30,000 of IRA income on his federal return but nothing to California because he is a non-resident all year.

-

A taxpayer who becomes a California resident in 2021 or 2022, and who had no 2020 filing requirement for California, must follow the federal method of reporting for California.

Example: Gloria was a Nevada resident in 2020 when she qualified for and took a $60,000 corona virus related distributed from her IRA. For federal she used the 3-year spread method for taxing the distribution, reporting $20,000 on her 2020 return. Gloria became a California resident on August 1, 2021. She made no recontributions. On her 2021 returns, she included $20,000 of coronavirus-related IRA distribution for federal, and on her part-year California return, she included $8,328 ($20,000 x 152/365), where 152 is the number of days she was a resident (August 1 through the end of the year). For 2022, if she doesn’t make any recontributions, she’ll include $20,000 on both her federal and California returns.

-