Simplified Employee Pension Plan Contribution Limits

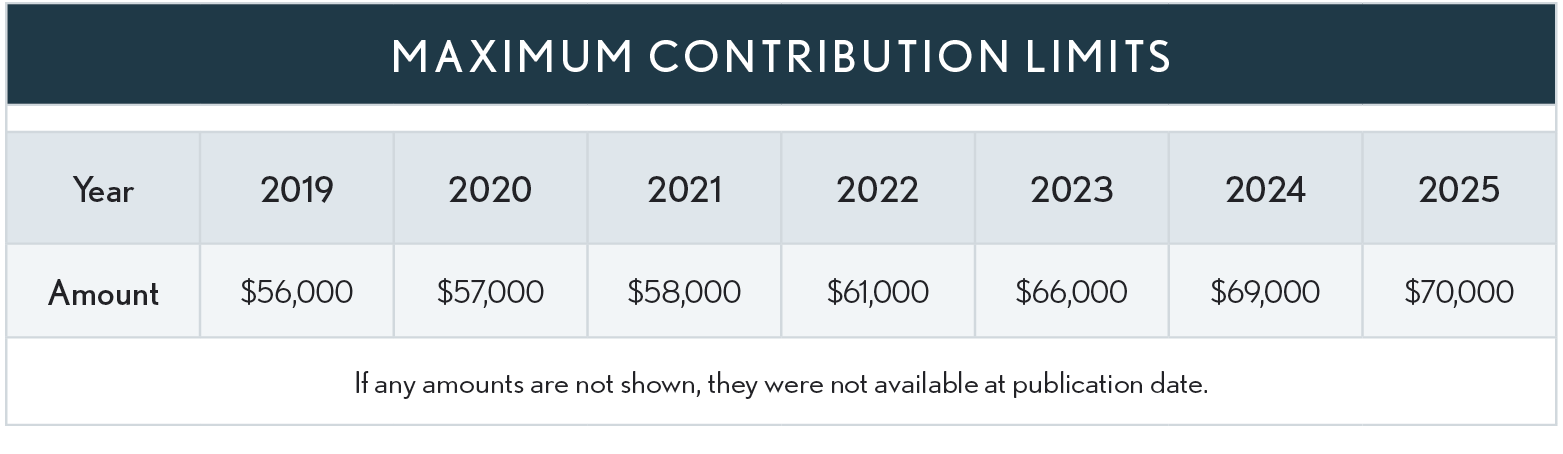

The maximum annual contribution to a SEP plan is the lesser of “25% of compensation” (20% of net profit after deducting the SEP contribution for the self-employed proprietor’s contribution) or:

SEP contributions on behalf of an owner-employee are computed in the same manner as for a profit-sharing Keogh.

Computing the Maximum Contribution

The maximum contribution for a self-employed individual is determined in the same manner as a SE Retirement (Keogh) plan.

No Catch-Up Contribution

The catch-up contribution allowed for age 50 and over participants of Traditional and Roth IRAs is not allowed for SEP-IRAs.