Simple Plans

Overview

Employers with 100 or fewer employees, each of whom received at least $5,000 in compensation for the preceding year, and with no other employer-sponsored retirement plans may adopt savings incentive match plans for employees (SIMPLE). A SIMPLE retirement account may take the form of an IRA or may be part of a §401(k) plan.

-

Maximum employee elective contribution under age 50 (2024): $16,000

-

Maximum employee elective contribution age 50 and over (2024): $19,500

-

Required employer matching contribution:

-

3% of employee compensation or

-

2% of employee compensation $345,000 cap (2024)

-

-

Two-year rollover waiting period

Related IRC and IRS Publications and Forms

-

Form 5305-SIMPLE - With a Designated Financial Institution

-

Form 5304-SIMPLE - No designated financial institution

-

Form 5305-SA - SIMPLE Individual Retirement Custodial Account

-

Form 5305-S - SIMPLE Individual Retirement Trust Account

-

Form 8881 – Credit for Small Employer Pension Plan Startup Costs

-

Pub 560 - Retirement Plans for Small Business (SEP, SIMPLE and Qualified Plans)

-

Pub 4284 - Simple IRA Retirement Plan Checklist

-

Pub 4334 - SIMPLE IRA Plans for Small Businesses

-

IRC Sec 408(p)

Employers with 100 or fewer employees, each of whom received at least $5,000 in compensation for the preceding year, and with no other employer-sponsored retirement plans, may adopt savings incentive match plans for employees (SIMPLE). A SIMPLE retirement account may take the form of an IRA (not a Roth) or may be part of a §401(k) plan.

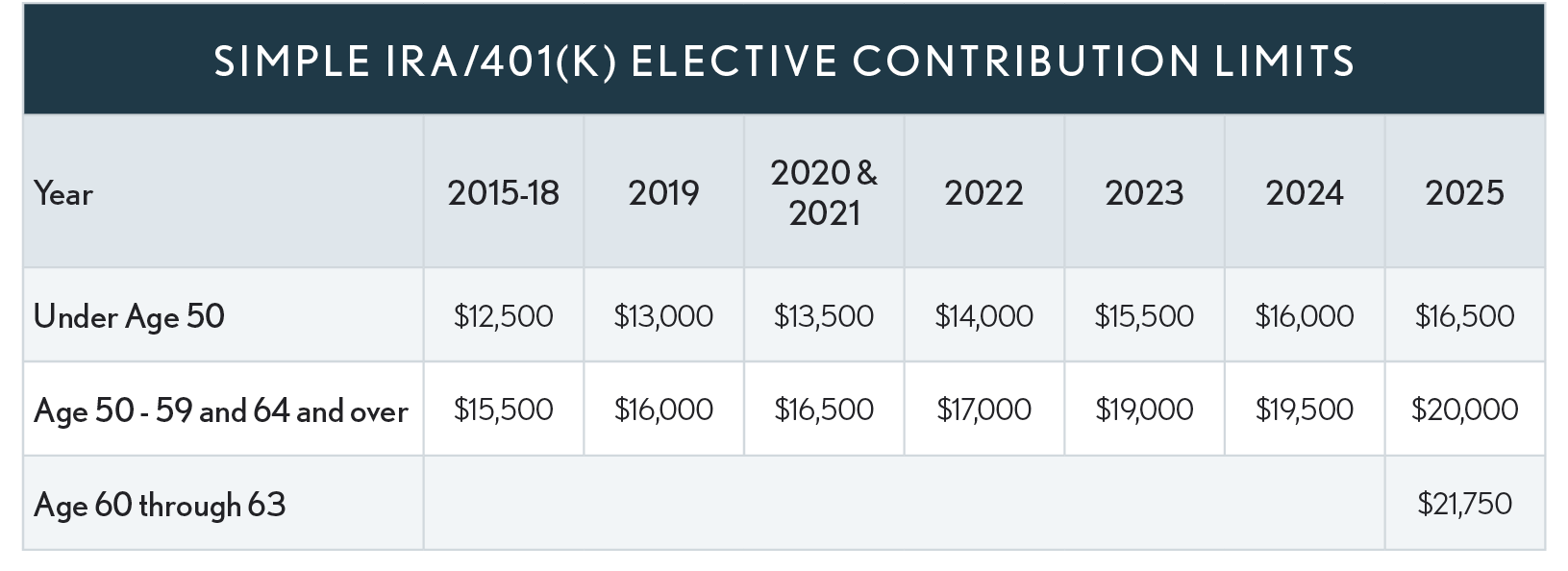

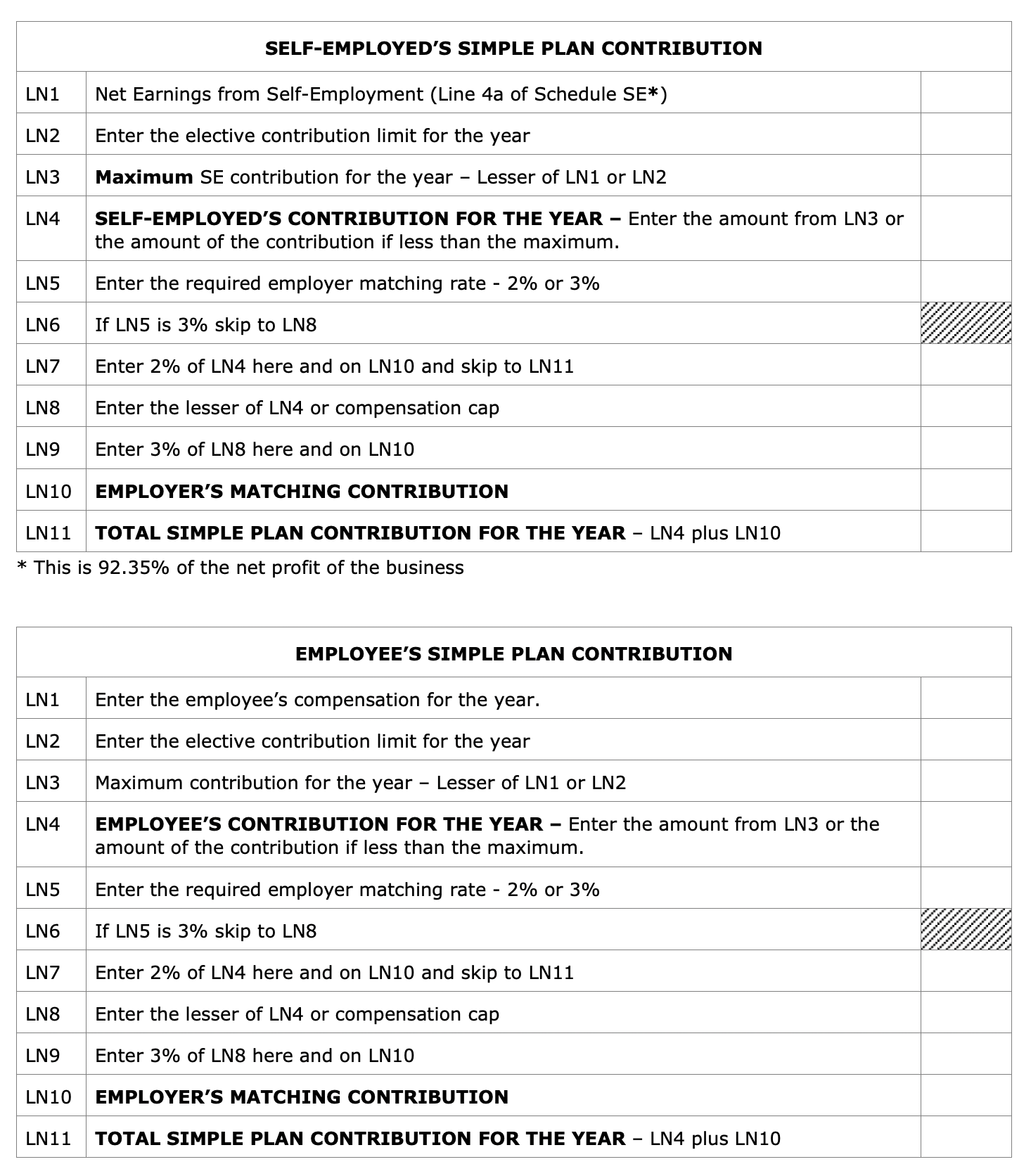

As an IRA or as part of a 401(k) plan, SIMPLE retirement plans allow employees to make elective contributions up to the annual limit (see table below). Employers must match the contributions dollar-for dollar up to 3% of the employee's compensation. The 3% may be lowered to not less than 1% for two out of every five plan years. Alternatively, for an IRA SIMPLE plan, an employer may make a 2% non-elective contribution for each eligible employee, considering no more than $345,000 for 2024 ($350,000in 2025) in compensation for each employee.

Post-2023 Increased Contribution Limits

-

25 or Fewer Employees - Section 117 of the SECURE 2.0 Act increases the annual deferral limit and the catch-up contribution at age 50 by 10%, as compared to the limit that would otherwise apply in the first year this change is effective. The 10% is included in contribution limits in the table above.

-

26 to 100 Employees - An employer with 26 to 100 employees would be permitted to provide higher deferral limits, but only if the employer either provides a:

-

4% matching contribution or

-

3% employer contribution.

-

Section 117 makes similar changes to the contribution limits for SIMPLE 401(k) plans.

Effective Date: Years beginning after December 31, 2023.

Age 60 through 63 Higher Catch-Up Limits -Effective after 2024

SECURE 2.0 Act Section 109 increases the catch-up contribution limits to the greater of $5,000 or 50 percent more than the regular catch-up amount beginning in 2025 for individuals who have attained ages 60, 61, 62 and 63. The increased amounts are indexed for inflation after 2025.

Thus beginning in 2025 SIMPLE plan catch-up amount for individuals aged 60 though 63 will be the greater of $5,000 or 150% of the regular inflation adjusted catch-up amount.

Catch-Up Contributions Required To Be Roth Contributions

SECURE 2.0 Act Section 603 (amending IRC Sec 414) provides that effective January 1, 2023, all catch-up contributions to qualified retirement plans would be subject to Roth tax treatment. An exception is provided for employees with compensation of $145,000 or less (indexed) whose catch-up contributions can be made on a pre-tax or Roth basis.

Combination Plans Limitations

A SIMPLE Plan is classified a qualified employer salary reduction plan which has the following impact on other retirement plans:

-

Overall, Salary Reduction Plan Limits – If the employee participates in any other salary reduction contributions (elective deferrals) the salary reduction contributions under a SIMPLE IRA plan also count towards the overall annual limit of $20,500 for 2022 ($22,500 for 2023).

Caution – Aggregate Contribution Limits

The contribution limits to 403(b) TSA plans, 408(p)(2) SIMPLE plans, 408(k) SEP IRAs and 401(k) plans apply on an aggregate basis. That is, the total contributed to all four plans cannot exceed the annual limit. See the guide 401(k) Plans for corrective distributions.

-

IRA Limits – Since a SIMPLE plan is an employer plan, the contribution to the SIMPLE plan does not reduce the amount that can be contributed to an IRA.

-

Traditional IRA Contributions – SIMPLE plans are employer plans and thus trigger the AGI limitation for Traditional IRA contributions by plan participants.

-

SEP Limits – If the employee who participates in a SIMPLE plan is also self-employed in his or her own business, contributions the individual makes to his or her own SEP plan (that is not a SARSEP) are not reduced by the contributions made to the employer’s SIMPLE IRA plan by either the employee or the employer.

Employer Mandatory Matching Contributions

The employer must make either:

-

A matching contribution equal to the amount the employee contributes, up to 3% of the employee's compensation for the year (Code Sec. 408(p)(2)(C)(ii)(I)), OR, electively, as little as 1% in no more than two out of the previous five years, if the employer timely notifies the employees of the lower percentage (Code Sec. 408(p)(2)(C)(ii)(II)), or

-

A non-elective contribution of 2% of compensation for each employee eligible to participate who has at least $5,000 of compensation from the employer for the year and taking into consideration no more than $330,000 of compensation for 2023 ($305,000 for 2022). See table below for other years. (Code Sec. 408(p)(2)(B)(i)) Caution: The elective reduced employer contribution does not apply to SIMPLE plans that are part of a 401(k) plan.

-

For years after December 31,2023, SECURE 2.0 Section 116 permits an employer to make additional contributions to each employee of the plan in a uniform manner, provided that the contribution may not exceed the lesser of:

-

Up to 10% of compensation or

-

$5,000 (indexed after 2024).

No other contribution can be made. Employer contributions must be made no more than 30 days after the month for which the contributions are to be made. Compensation is the same as wages for income tax withholding plus the amount of the employee’s elective deferrals. For self-employed individuals, compensation is net self-employed earnings without regard to the SIMPLE plan provisions. The definition of compensation includes wages paid to domestic workers, even though those amounts are not subject to income tax withholding.

Employer Matching Contributions

The employer is generally required to match each employee’s salary reduction contributions on a dollar-for-dollar basis up to 3% of the employee’s compensation. This requirement does not apply if the employer makes non-elective contributions.

Example: Employee, John, earns $25,000 and chooses to defer 5% of his salary. Dave, the employer, has net earnings from self-employment of $40,000, and chooses to contribute 10% of his earnings to the SIMPLE IRA. The employer makes 3% matching contributions.

John's (the employee) contributions are determined as follows:

| Salary reduction contributions ($25,000 x .05) | $1,250 |

| Employer matching contribution ($25,000 x .03) | 750 |

| Total contributions | $2,000 |

Dave's (the employer) contributions are determined as follows:

| Salary reduction contributions ($40,000 x .10) | $4,000 |

| Employer matching contribution ($40,000 x .03) | 1,200 |

| Total contributions | $5,200 |

Student Loan Payments as Elective Deferrals for Matching Contributions

SECURE 2.0 Act Sec 110 is intended to assist employees who may not be able to save for retirement because they are overwhelmed with student debt, and thus are missing out on available employer matching contributions for retirement plans.

Section 110 allows such employees to receive those matching contributions by reason of repaying their student loans by permitting an employer to make matching contributions under a 401(k) plan, 403(b) plan, SIMPLE IRA or 457(b) government plan with respect to “qualified student loan payments.”

A qualified student loan payment is broadly defined as any indebtedness incurred by the employee solely to pay qualified higher education expenses of the employee.

For purposes of the non-discrimination test applicable to elective contributions, Section 110 permits a plan to test separately the employees who receive matching contributions on student loan repayments.

Employer may rely upon the employee certification of student loan payment.

Effective Date: Applies to contributions made for plan years beginning after December 31, 2023.

Withdrawals for Certain Emergency Expenses

Generally, an additional 10% tax applies to early distributions from tax-preferred retirement accounts unless an exception applies.

SECURE 2.0 Act Sec 115 adds new IRC Sec 72(t)(2)(I) that provides an exception for certain distributions used for emergency expenses, which are unforeseeable or immediate financial needs relating to personal or family emergency expenses.

Only one distribution is permissible per year of up to $1,000, and a taxpayer has the option to repay the distribution within 3 years.

No further emergency distributions are permissible during the 3-year repayment period unless repayment occurs.

Effective Date: Applies to distributions made after December 31, 2023.

Employee Election

Each employee eligible to participate must be given the right to elect for a calendar year to (a) participate in the arrangement, or (b) modify the amounts subject to the arrangement:

-

During the 60-day period immediately preceding the beginning of a calendar year (i.e., Nov. 2 through Dec. 31 of the preceding calendar year); or

-

For the year during which an employee becomes eligible to elect to have salary reduction contributions made, the 60-day period that includes either the date the employee becomes eligible, or the day before that date.

A SIMPLE plan may provide additional or longer election periods for employees to enter into salary reduction agreements or modify prior agreements. For example, a SIMPLE plan can provide a 90-day election period instead of the 60-day period. Also, a SIMPLE plan can provide quarterly election periods during the 30 days before each calendar quarter, in addition to the 60-day period.

Plan Adoption

An existing employer may establish a SIMPLE IRA Plan effective on any date between January 1 and October 1 of a year, provided that the employer (or any predecessor employer) did not previously maintain a SIMPLE IRA Plan. A new employer that comes into existence after October 1 of the year may establish a SIMPLE IRA plan if the employer establishes the plan as soon as administratively feasible after the employer comes into existence. If an employer (or predecessor employer) previously maintained a SIMPLE IRA Plan, the employer may establish a SIMPLE IRA Plan effective only on January 1 of a year. (Notice 98-4, Q&A K-1)

Contribution Timing

Employer contributions to SIMPLE accounts are deductible in the employer's tax year in the calendar year for which the contribution applies but can be made up to the extended due date of the employer’s tax return.

Participation Termination

An employee must be able to elect to terminate participation in the arrangement at any time during the year (Code Sec. 408(p)(5)(B)).

Cash Election

An employee eligible to participate in a SIMPLE IRA plan is required to make an election between his employer paying him cash or making a contribution to a SIMPLE IRA on his behalf (Code Sec. 408(p)).

Employee Contributions

Salary reduction contributions for regular employees must generally be deposited not later than the close of the 30-day period following the last day of the month in which amounts otherwise would have been payable to the employee in cash.

Employer Subsequently Fails Qualifications

A qualifying employer that maintains a SIMPLE plan but later fails to qualify may continue to maintain the plan for two years after its last year of eligibility, subject to certain restrictions for acquisitions, dispositions and similar transactions.

Automatic Enrolment

SIMPLE plans may also incorporate an automatic contribution arrangement which permits an employer to make contributions to an employee's SIMPLE IRA without the employee having made an affirmative election to participate in the plan. The code does not require that the employee receive cash where he doesn't make an affirmative election to have that amount contributed to the SIMPLE IRA.

Employee’s Age

Prior to 2020, elective contributions could be made to SIMPLE IRAs by employees who had reached age 70½ even though IRA contributions were otherwise not permitted by individuals once they turned 70½. With the SECURE Act’s elimination of an age cap for making traditional IRA contributions beginning with 2020, this should no longer be an issue.

Two-Year Period for Rollovers

Unlike participants in qualified plans, which are not allowed to take in service distributions, participants in a SIMPLE are allowed to receive distributions subject to certain restrictions. Participants in a SIMPLE plan can transfer (trustee-to-trustee) the IRA to another SIMPLE plan in a tax and penalty free transfer. However, no other transfers are allowed within the two-year period beginning with the date of participation in the SIMPLE plan without being taxable and subject to a 25% penalty.

One IRA Rollover Per 12 Months Limitation

An individual receiving an IRA distribution on or after January 1, 2015, cannot roll over any portion of the distribution into an IRA if the individual has received a distribution from any IRA, including a SIMPLE IRA, in the preceding 1-year period that was rolled over into an IRA. This rule does not apply to trustee-to-trustee transfers. (IRS Announcement 2014-32) See the guide Retirement Rollovers Overview for additional information.

FICA & FUTA

Matching and non-elective contributions to a SIMPLE account are excludable from an employee’s income for FITW, FICA and FUTA purposes. But salary reduction contributions to a SIMPLE plan, while excludable from income and for income tax withholding, are subject to FICA (Social Security/Medicare) withholding and for FUTA purposes.

Saver’s Credit

Contributions to SIMPLE plans qualify for the saver’s credit that benefits lower-income taxpayers. See the guide Saver's Credit for more details.

Small Business Start-up Credit

A SIMPLE plan qualifies for the Small Business Start-Up Credit (use Form 8881).

“Only Plan” Limitation

The SIMPLE plan can be the only plan offered by a qualified employer.

100-Employee Limitation

For purposes of applying the “100-employee limitation” and in determining whether an employee is eligible to participate in a SIMPLE IRA plan (i.e., whether the employee had $5,000 in compensation for any two preceding years), an employee's income includes the employee's elective deferrals under a 401(k) plan, a salary reduction SEP, and a 403(b) annuity contract.

401(k) Non-Discrimination Test

A 401(k) plan that meets the SIMPLE 401(k) plan requirements for the year is treated as meeting the non-discrimination test applicable to employee elective deferrals.

Top Heavy Rules

A SIMPLE 401(k) plan is not subject to the top-heavy rules for any year for which the SIMPLE 401(k) rules are met, if the plan allows only the contributions allowed under the SIMPLE 401(k) rules.

Rollovers into Simple Plans

For contributions made after December 18, 2015, SIMPLE IRA owners may, after the plan has existed for two years, roll over amounts from a traditional IRA, SEP plan, 401(k) plan, 403-b plan, 457(b) plan and other qualified plans into their SIMPLE IRA. (IRC Sec 408(p)(1) as amended by the PATH Act of 2015, Division Q, Act §306(a))

Plan Loans

IRAs and IRA-based plans (SEP, SIMPLE IRA and SARSEP plans) cannot offer loans to participants. A loan from an IRA or IRA-based plan would result in a prohibited transaction.

Special Rules Federally Declared Disasters

See the guide IRS Form 5500-EZ Filing Requirement.

Unrelated Business Income

See the guide Traditional IRA.

Age for Required Minimum Distributions (RMDs)

Under the SECURE Act, effective for 2020 and subsequent years, the age at which RMDs must begin is 72. See the guide Required Minimum Distributions for details.

Replace Simple Retirement Accounts With Safe Harbor 401(k)

Effective after 2023, SECURE 2.0 Act Section 332 allows an employer to replace a SIMPLE IRA plan with a SIMPLE 401(k) plan or other 401(k) plan that requires mandatory employer contributions during a plan year.

Early Withdrawal Penalty

Generally, if a taxpayer is under age 59-1/2 and withdraws assets (money or other property) from a qualified plan including Traditional IRAs, the taxpayer must pay a 10% additional tax, commonly referred to as a penalty (IRC Sec. 72(t)). This tax is 10% of the part of the distribution that the taxpayer was required to include in gross income for the year of the distribution. Several exceptions provide relief from the early withdrawal penalty; see the guide IRA Early Withdrawal Exemption.

California Differences

California conforms to SIMPLE plans.