Roth IRA Distributions

Below, find a complete guide to Roth IRA distributions. Learn everything you need to know about receiving distributions from this type of retirement account.

Qualified Distribution

Distributions from a Roth are non-taxable only if they are “qualified distributions.”

Qualified Distribution Definition

A qualified distribution is generally any payment or distribution from a Roth IRA:

1. That meets the five-year aging requirement discussed below (Sec 408(d)(2)(B)), AND

2. That meets one of the following conditions (Sec 408(d)(2)(A)):

-

The distribution is made after the IRA owner reaches the age of 59-1/2

-

The distribution is made after death of the individual

-

The distribution is made on account of the owner becoming disabled, OR

-

The distribution is for first-time homebuyer expenses, as detailed in chapter 4.10 on Early Withdrawal Penalty Exceptions.

Other distributions are non-qualifying, and earnings on the IRA are taxed when distributed.

Five-Year Qualifying Period

The five-tax-year period (that determines whether a Roth distribution is a “qualified distribution”) begins with the first tax year for which the individual made a contribution to a Roth IRA established for the individual (Code Sec 408A(d)(2)(B)). That is, the five-tax-year holding period:

-

Begins on the earlier of:

-

The first day of the individual's tax year for which the first regular (i.e., non-rollover) contribution is made to any of the individual's Roth IRAs, or

-

The first day of the individual's tax year in which the first conversion contribution is made to any of the individual's Roth IRAs; and

-

-

Ends on the last day of the individual's fifth consecutive tax year beginning with the tax year described above (Reg§ 1.408A-6, Q&A 2).

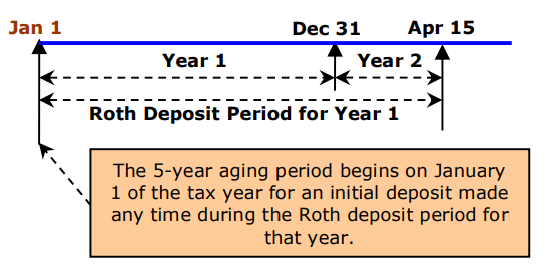

Thus, if an individual whose tax year is the calendar year makes a first-time regular Roth IRA contribution for Year 1 any time between Jan. 1 of Year 1 and the April due date in Year 2, the five-tax-year period begins on Jan. 1 of Year 1. See illustration above.

Converted IRAs

A conversion of a regular IRA into a Roth IRA after the five-tax-year period has begun will not start the running of a new five-year period. (S Rept No. 105-174 (PL 105-206) p. 144)

Initial Deposit Starts Five-Tax-Year Holding Period for All Subsequent Deposits

-

Thus, once the five-tax-year holding period has been met, any distribution from the Roth IRA, even one allocable to contributions made within five years before the distribution, may be excludable as a qualified distribution except as noted below for:

o Corrective distributions

o Rollovers from a “Designated Roth Account”

o Beneficiaries.

Corrective Distribution Exceptions

The initial contribution to a Roth IRA does not start the five-tax-year holding period if that initial contribution is:

-

Distributed as a corrective distribution., Any amount distributed as a corrective distribution is treated as if it was never contributed (Reg § 1.408A-6, Q&A 2);

-

Revoked within seven days under Reg § 1.408-6(d)(4)(ii)(A), or

-

Recharacterized (Preamble to TD 8816, 2/3/1999).

Beneficiaries

The following special rules apply to inherited Roth IRAs:

-

General Rule - The five-tax-year holding period for a Roth IRA held by an individual as a beneficiary of a deceased Roth IRA owner is determined independently of the five-tax-year period for the beneficiary's own Roth IRA. (Reg § 1.408A-6, Q&A 7(b))

-

Surviving Spouse - if a surviving spouse treats the Roth IRA that was owned by the decedent spouse as his or her own, the five-tax-year period for any of the surviving spouse's Roth IRAs (including the one that the surviving spouse treats as his or her own) ends at the earlier of the end of either (Reg § 1.408A-6, Ex 7(b)):

-

The five-tax-year period for the decedent's Roth IRA, or

-

The five-tax-year period for the spouse's own Roth IRAs.

-

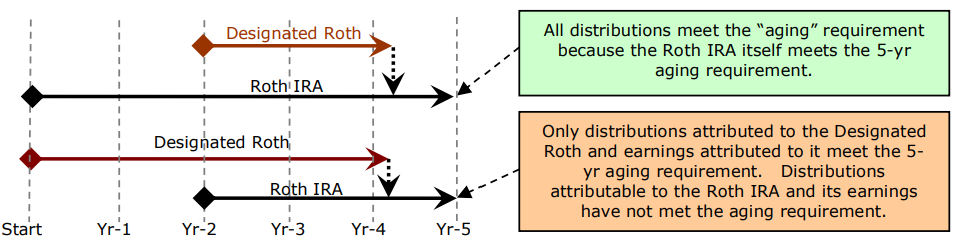

Designated Roth Account

The five-tax-year holding period for determining a qualified distribution from a Roth IRA is determined independently of the five-tax-year holding period for determining a qualified distribution from a “Designated Roth account” (discussed later in this chapter). Thus, an individual cannot count the tax years that he has had a designated Roth account towards the five-tax-year holding period for Roth IRAs, even if he rolls over an amount from the designated Roth account to the Roth IRA (Preamble to TD 9324, 4/27/2007).