Ordering Rules for Withdrawals

Below, you will find comprehensive information about the rules for withdrawing funds from a Roth IRA retirement account.

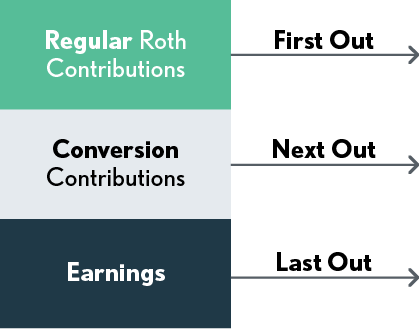

In determining the taxable amount of Roth IRA distributions that are not qualified distributions, distributions are treated as made in the following order (determined as of the end of the tax year and exhausting each category before moving on to the following category):

(1) From contributions and qualified rollover contributions other than from a traditional IRA. Thus, this category includes:

-

Regular Roth IRA contributions,

-

Rollover contributions from other Roth IRAs (not from traditional IRAs), and

-

Rollover contributions from a designated Roth account (Code Sec. 408A(d)(4)(B)(ii)(I)).

(2) From “conversion contributions,” i.e., qualified rollover contributions other than from a Roth IRA or a designated Roth account, starting with the amounts first converted, on a first-in, first-out basis. (Code Sec. 408A(d)(4)(B)(ii)(II)) Distributions allocated to a conversion contribution are treated as coming first from the taxable portion of the contribution (Code Sec. 408A(d)(4)(B)); and

(3) From earnings. (Reg § 1.408A-6, Q&A 8(a)(3))

Aggregation Rules (grouping and adding rules)

To determine the taxable amounts distributed, distributions, and contributions by grouping and adding them together as follows.

-

All withdrawals from all the taxpayer’s Roth IRAs during the year are added together.

-

All regular contributions made during and for the tax year are added together (including those made by the April 15 due date of the return).

-

All conversion contributions made during the year are added together.