Non-Qualified Distribution Penalty

If a taxpayer approves a non-qualified distribution from a Roth IRA, he or she may face a tax penalty. Find full details below.

If, within the 5-year period starting with the year of a conversion contribution, any part of a withdrawal from a Roth IRA that is from the taxable part of an amount converted, may be subject to the 10% additional tax on premature distributions, unless one of the Sec. 72(t) exceptions applies. The 10% penalty applies only to the part of the conversion contribution that is included in income. Moreover, it applies as though the amount is includible in gross income in the year of the withdrawal, even if no conversion income is includible. Unless an exception applies, the taxable part of other Roth IRA distributions that are not qualified distributions is subject to the 10% penalty on premature distributions. The following early withdrawal exceptions apply to IRAs (codes refer to Form 5329, line 2, identifiers):

-

Unreimbursed Medical Expenses (in excess of 7.5% of AGI whether or not itemizing) (Code 05)

-

Permanent Disability (Code 03) or Death (Code 04)

-

Beneficiary Exception (Code 04 – “Death”)

-

Annuity or "Substantially Equal Payments" Exception (Code 02)

-

Distribution as result of an IRS Levy (Code 10)

-

Qualified Reservist Distributions – At Least 180 Days on Active Duty (Code 11)

-

Contributions Returned Before the Due Date (Code 12 – “Other”)

-

Medical Insurance – Receiving Unemployment Benefits (Code 07)

-

Higher Education Expense (Code 08)

-

First-time Homebuyer – Maximum $10,000 per taxpayer from their respective accounts (Code 09)

-

Qualified birth or adoption distributions – attach statement with child’s name, age and TIN (Code 12)

-

Rollover to Health Savings Account

Note

Where an IRA account contains both Roth contributions and conversion amounts, the early withdrawal penalty can be avoided if the distributions are limited to an amount equal to the Roth contributions or less. That is because the distribution ordering rules (discussed later) specify that the distribution amounts are first allocated to Roth Contributions and then followed by conversion contributions.

| Example: A Roth IRA contains $21,000 attributable as follows: | |

| Roth contribution for 2020 | $5,000 |

| Roth contribution for 2021 | $5,000 |

| Traditional IRA converted to a Roth IRA in 2020 | $3,000 |

| Traditional IRA converted to a Roth IRA in 2021 | $7,000 |

| Earnings | $1,000 |

-

Scenario #1 – In 2024, the taxpayer, age 50, withdraws $10,000 from the Roth IRA., The distribution is tax- and penalty-free since, per the withdrawal ordering rules, the distribution comes first from Roth contributions.

-

Scenario #2 – In 2024, the taxpayer, age 50, withdraws $15,000 from the Roth IRA., The $15,000 is allocated first to the Roth contributions, making the first $10,000 tax- and penalty-free., The remaining $5,000 is attributable to the conversion and, although it is not taxable (because it was already taxed when converted), the $5,000 is subject to the 10% early distribution penalty because it had not been in the IRA for the required five years, resulting in a $500 penalty tax., No penalty exceptions apply!

-

Scenario #3 – In 2024, the taxpayer, age 50, withdraws the entire balance of $21,000 from the Roth IRA. As with the previous examples, the first $10,000 is tax- and penalty-free. The next $10,000 is attributable to the conversion and is tax-free but subject to the 10% early withdrawal penalty because it had not been in the IRA for the required five years, resulting in a penalty tax of $1,000. The remaining $1,000 is attributable to earnings; since it had not met the 5-year aging requirement, it is subject to taxation and the 10% penalty, resulting in a $100 tax penalty plus the tax on the $1,000. No penalty exceptions apply!

-

Scenario #4 – In 2024, the taxpayer, age 51, withdraws the entire account balance. Let’s assume the earnings amount is unchanged. The taxpayer’s first conversion ($3,000) has now met its 5-year aging requirement so that the first $13,000 withdrawn is not subject to tax or penalty. However, the next $7,000 of converted funds has not met the 5-year aging requirement and, although it is tax-free, it is subject to the 10% penalty. Although the Roth account has met the 5-year aging requirement, it is still not a qualified distribution because the taxpayer is under the age of 59½ and, as a result, the $1,000 earnings are subject to both tax and the 10% penalty. No penalty exceptions apply!

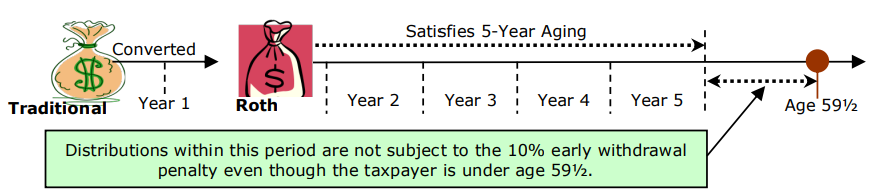

Converted Amounts After 5 Years But Before Age 59½

An individual who would not reach age 59½ (or satisfy any other exception to the 10% early withdrawal tax) in five years, can nonetheless convert a traditional IRA to a Roth IRA, and receive distribution of the contribution after five tax years, without being subject to the 10% tax, even though the same distribution from the unconverted IRA would have been subject to the 10% tax.